OPEN-SOURCE SCRIPT

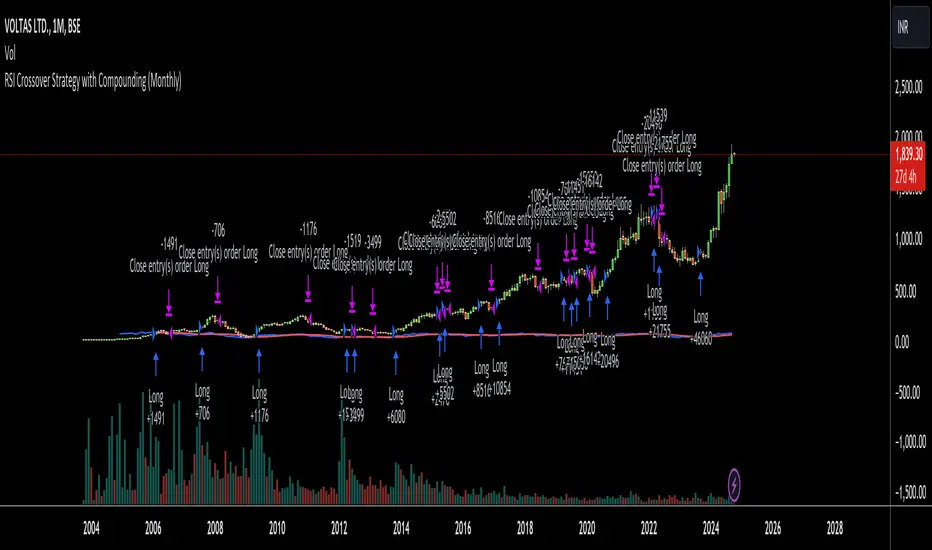

RSI Crossover Strategy with Compounding (Monthly)

Explanation of the Code:

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.