OPEN-SOURCE SCRIPT

업데이트됨 X PD&FV

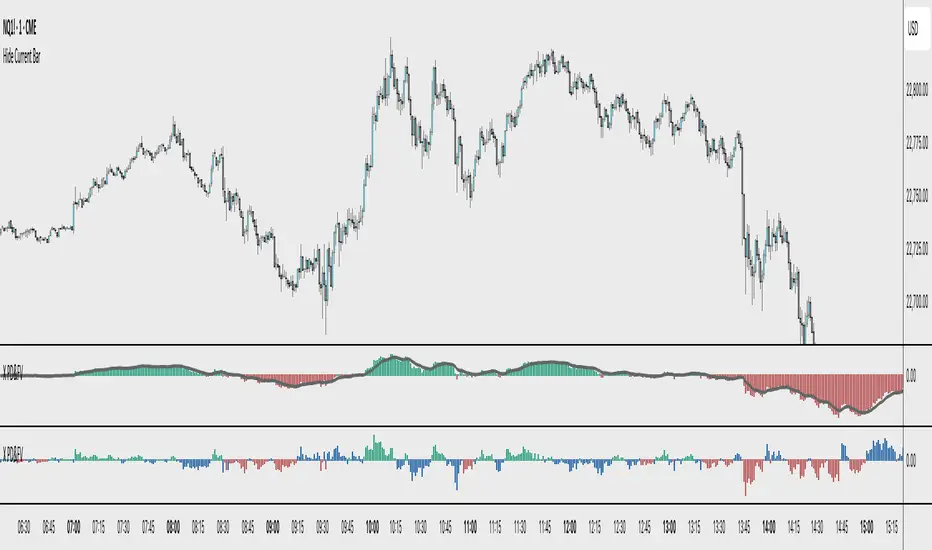

Visualizes the price's premium or discount relative to a moving average benchmark, highlighting mean-reversion and trend-continuation opportunities. While the underlying math is simple, the application is nuanced and can enhance decision-making in both trending and ranging market conditions.

Core Logic:

This tool calculates a custom **spread value**, defined as the distance between the current price and a chosen exponential moving average (EMA). Specifically:

This approach creates a dynamic spread that reflects deviation from the EMA, with histogram bars:

A secondary EMA (default 9-period) is applied to the spread itself, plotted as a smoother line over the histogram. This "EMA of spread" line can be interpreted as a moving reference level for detecting directional shifts in momentum.

Interpretation:

Zero Line = Fair Value: The horizontal zero axis represents equilibrium relative to the moving average. Movement toward or away from this line signals potential shifts in market bias.

Trend Following Use: In trending markets, traders can:

Mean Reversion Use: A return to the zero line (fair value) often acts as an **inflection point**, which traders can monitor for either:

Customization:

EMA length (default 50) is adjustable to fit different timeframes or asset volatility.

Core Logic:

This tool calculates a custom **spread value**, defined as the distance between the current price and a chosen exponential moving average (EMA). Specifically:

- When the current price is **above** the EMA, the spread is calculated as `low - EMA`.

- When the price is **below** the EMA, the spread is calculated as `high - EMA`.

This approach creates a dynamic spread that reflects deviation from the EMA, with histogram bars:

- Green when the spread is positive (suggesting a price premium),

- Red when the spread is negative (suggesting a discount).

A secondary EMA (default 9-period) is applied to the spread itself, plotted as a smoother line over the histogram. This "EMA of spread" line can be interpreted as a moving reference level for detecting directional shifts in momentum.

Interpretation:

Zero Line = Fair Value: The horizontal zero axis represents equilibrium relative to the moving average. Movement toward or away from this line signals potential shifts in market bias.

Trend Following Use: In trending markets, traders can:

- Buy when the spread dips below its EMA (discount within uptrend),

- Sell when the spread rises above its EMA (premium within downtrend).

Mean Reversion Use: A return to the zero line (fair value) often acts as an **inflection point**, which traders can monitor for either:

- Trend continuation (bounce away from zero), or

- Reversal (cross through zero).

Customization:

EMA length (default 50) is adjustable to fit different timeframes or asset volatility.

릴리즈 노트

Supplemental Feature: Trade Timing Zones with Momentum ConfirmationThe latest enhancement introduces a second histogram that measures the deviation of the spread from its own EMA (ema01_spread - ema01_of_ema01). This creates a higher-order view of momentum within the price deviation signal itself.

Key Interpretive Layer:

The bars are colored green or red depending on whether the deviation is positive or negative, indicating momentum direction of the spread relative to its own average.

A third color (blue) is introduced based on slope logic of the base EMA:

When price deviation is rising against the slope of the underlying EMA, or falling with it, bars are blue.

These blue bars highlight key decision zones where price behavior becomes more ambiguous or transitional.

Strategic Use:

Blue zones mark moments where the current move conflicts with or resets against the trend. These are optimal areas to:

Initiate a new position (long or short), with the intent to confirm direction.

Wait for follow-through before scaling in, allowing the market to show continuation.

Fade the prevailing move if blue resolves counter to the trend.

Practical Guideline:

Only initiate trades during blue bar periods, and only commit/add once your directional bias is confirmed by follow-through in spread direction and EMA slope alignment.

This feature provides a structured framework for disciplined entries, reducing the risk of chasing noise and improving alignment with broader directional bias.

best is to have same indicator twice to see both setting options at same time

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.