OPEN-SOURCE SCRIPT

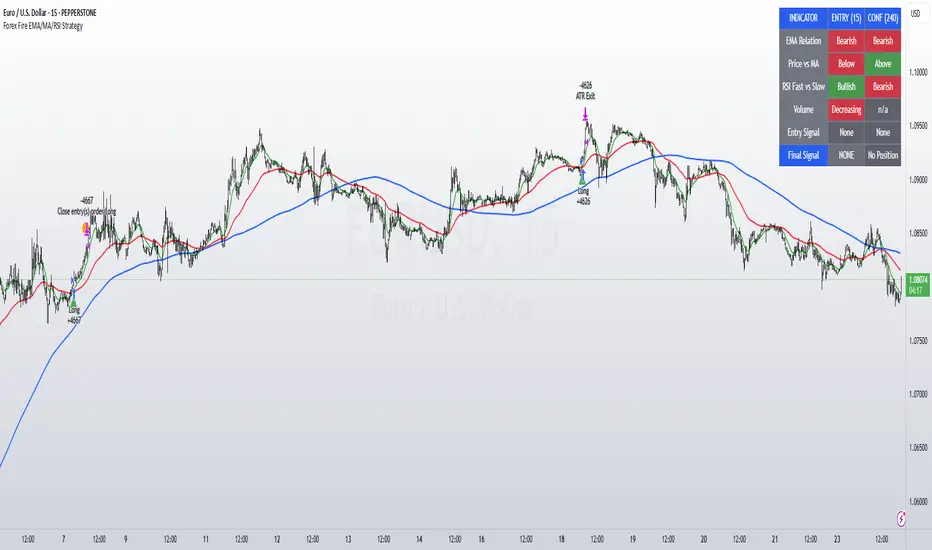

Forex Fire EMA/MA/RSI Strategy

EURUSD

The entry method in the Forex Fire EMA/MA/RSI Strategy combines several conditions across two timeframes. Here's a breakdown of how entries are determined:

Long Entry Conditions:

15-Minute Timeframe Conditions:

EMA 13 > EMA 62 (short-term momentum is bullish)

Price > MA 200 (trading above the major trend indicator)

Fast RSI (7) > Slow RSI (28) (momentum is increasing)

Fast RSI > 50 (showing bullish momentum)

Volume is increasing compared to 20-period average

4-Hour Timeframe Confluence:

EMA 13 > EMA 62 (larger timeframe confirms bullish trend)

Price > MA 200 (confirming overall uptrend)

Slow RSI (28) > 40 (showing bullish bias)

Fast RSI > Slow RSI (momentum is supporting the move)

Additional Precision Requirement:

Either EMA 13 has just crossed above EMA 62 (crossover)

OR price has just crossed above MA 200

Short Entry Conditions:

15-Minute Timeframe Conditions:

EMA 13 < EMA 62 (short-term momentum is bearish)

Price < MA 200 (trading below the major trend indicator)

Fast RSI (7) < Slow RSI (28) (momentum is decreasing)

Fast RSI < 50 (showing bearish momentum)

Volume is increasing compared to 20-period average

4-Hour Timeframe Confluence:

EMA 13 < EMA 62 (larger timeframe confirms bearish trend)

Price < MA 200 (confirming overall downtrend)

Slow RSI (28) < 60 (showing bearish bias)

Fast RSI < Slow RSI (momentum is supporting the move)

Additional Precision Requirement:

Either EMA 13 has just crossed under EMA 62 (crossunder)

OR price has just crossed under MA 200

The key aspect of this strategy is that it requires alignment between the shorter timeframe (15m) and the larger timeframe (4h), which helps filter out false signals and focuses on trades that have strong multi-timeframe support. The crossover/crossunder requirement further refines entries by looking for actual changes in direction rather than just conditions that might have been in place for a long time.

The entry method in the Forex Fire EMA/MA/RSI Strategy combines several conditions across two timeframes. Here's a breakdown of how entries are determined:

Long Entry Conditions:

15-Minute Timeframe Conditions:

EMA 13 > EMA 62 (short-term momentum is bullish)

Price > MA 200 (trading above the major trend indicator)

Fast RSI (7) > Slow RSI (28) (momentum is increasing)

Fast RSI > 50 (showing bullish momentum)

Volume is increasing compared to 20-period average

4-Hour Timeframe Confluence:

EMA 13 > EMA 62 (larger timeframe confirms bullish trend)

Price > MA 200 (confirming overall uptrend)

Slow RSI (28) > 40 (showing bullish bias)

Fast RSI > Slow RSI (momentum is supporting the move)

Additional Precision Requirement:

Either EMA 13 has just crossed above EMA 62 (crossover)

OR price has just crossed above MA 200

Short Entry Conditions:

15-Minute Timeframe Conditions:

EMA 13 < EMA 62 (short-term momentum is bearish)

Price < MA 200 (trading below the major trend indicator)

Fast RSI (7) < Slow RSI (28) (momentum is decreasing)

Fast RSI < 50 (showing bearish momentum)

Volume is increasing compared to 20-period average

4-Hour Timeframe Confluence:

EMA 13 < EMA 62 (larger timeframe confirms bearish trend)

Price < MA 200 (confirming overall downtrend)

Slow RSI (28) < 60 (showing bearish bias)

Fast RSI < Slow RSI (momentum is supporting the move)

Additional Precision Requirement:

Either EMA 13 has just crossed under EMA 62 (crossunder)

OR price has just crossed under MA 200

The key aspect of this strategy is that it requires alignment between the shorter timeframe (15m) and the larger timeframe (4h), which helps filter out false signals and focuses on trades that have strong multi-timeframe support. The crossover/crossunder requirement further refines entries by looking for actual changes in direction rather than just conditions that might have been in place for a long time.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.