OPEN-SOURCE SCRIPT

COIN/BTC Trend Oscillator

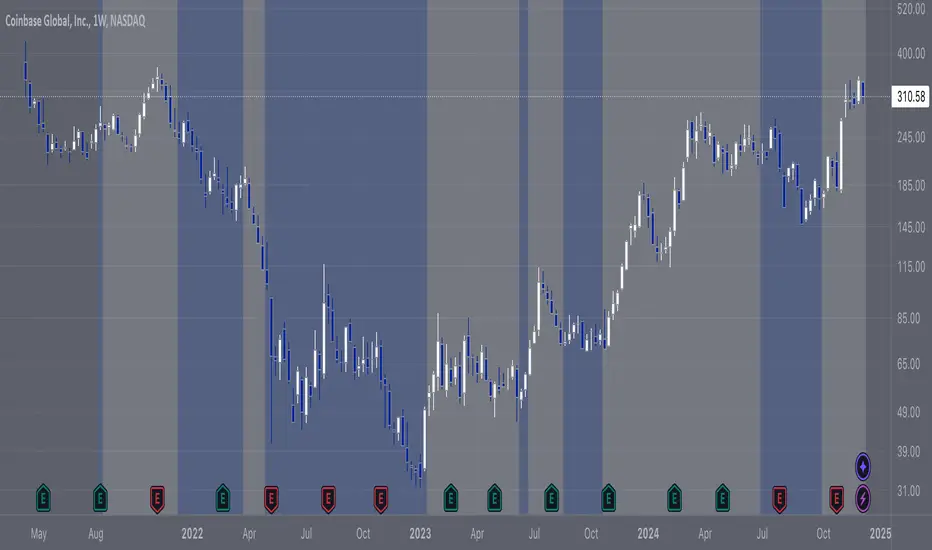

The COIN/BTC Trend Oscillator is a versatile tool designed to measure and visualize momentum divergences between Coinbase stock ( COIN) and Bitcoin (

COIN) and Bitcoin ( BTC). It helps identify overbought and oversold conditions, while also highlighting potential trend reversals.

BTC). It helps identify overbought and oversold conditions, while also highlighting potential trend reversals.

Key Features:

Use Case:

This indicator is ideal for trading Coinbase stock relative to Bitcoin’s momentum. It’s especially useful during strong market trends, helping traders time entries and exits based on extremes in relative performance.

Limitations:

• Performance may degrade in choppy or sideways markets.

• Assumes a strong correlation between COIN and

COIN and  BTC, which may not hold during independent events.

BTC, which may not hold during independent events.

Pro Tip: Use this oscillator with broader trend confirmation tools like moving averages or RSI to improve reliability. For macro strategies, consider combining with higher timeframes for alignment.

Key Features:

- VWAP-Based Divergence Analysis:

• Tracks the difference betweenCOIN and

BTC relative to their respective VWAPs.

• Highlights shifts in momentum between the two assets. - Normalized Oscillator:

• Uses ATR normalization to adapt to different volatility conditions.

• Displays momentum shifts on a standardized scale for better comparability. - Overbought and Oversold Conditions:

• Identifies extremes using customizable thresholds (default: ±80).

• Dynamic background colors for quick visual identification:

• Blue for overbought zones (potential sell).

• White for oversold zones (potential buy). - Rolling Highs and Lows Detection:

• Tracks turning points in the oscillator to identify possible trend reversals.

• Useful for spotting exhaustion or accumulation phases.

Use Case:

This indicator is ideal for trading Coinbase stock relative to Bitcoin’s momentum. It’s especially useful during strong market trends, helping traders time entries and exits based on extremes in relative performance.

Limitations:

• Performance may degrade in choppy or sideways markets.

• Assumes a strong correlation between

Pro Tip: Use this oscillator with broader trend confirmation tools like moving averages or RSI to improve reliability. For macro strategies, consider combining with higher timeframes for alignment.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.