OPEN-SOURCE SCRIPT

업데이트됨 Triple EMA Crossover Strategy

Triple EMA Crossover Strategy

Overview

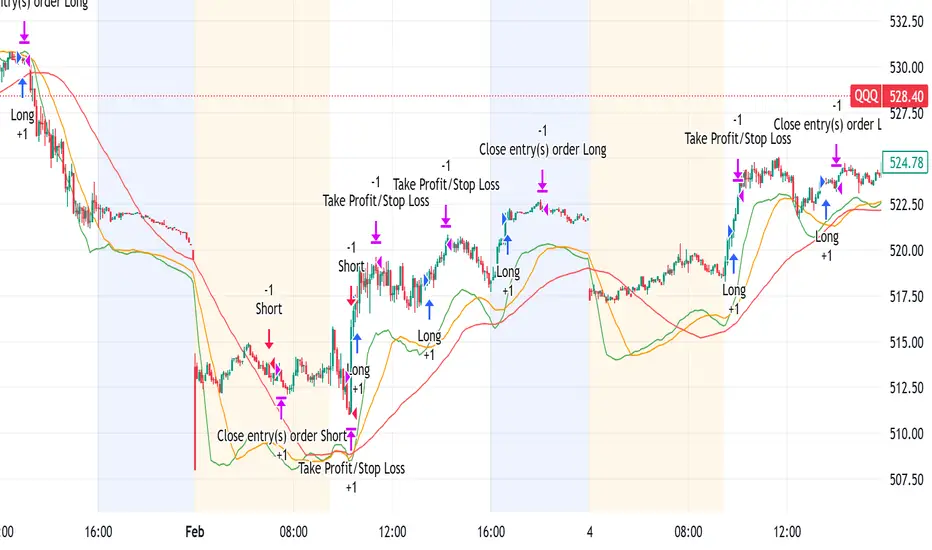

The Triple EMA Crossover Strategy is a trend-following trading system that utilizes three Exponential Moving Averages (EMAs) to identify potential entry and exit points in the market. This strategy is based on the principle that when shorter-term prices cross above longer-term prices, it can indicate a bullish trend, and conversely when they cross below, it can signal a bearish trend.

Components

Exponential Moving Averages (EMAs):

Short EMA: A fast-moving average that reacts quickly to price changes (commonly set to 9 periods).

Medium EMA: A medium-term average that smooths out price data and helps confirm trends (commonly set to 21 periods).

Long EMA: A slow-moving average that helps identify the overall trend direction (commonly set to 55 periods).

Trading Signals:

Buy Signal: A long entry is triggered when:

The Short EMA (9) crosses above the Medium EMA (21).

The Medium EMA (21) is above the Long EMA (55).

Sell Signal: A short entry is signaled when:

The Short EMA (9) crosses below the Medium EMA (21).

The Medium EMA (21) is below the Long EMA (55).

Stop Loss and Take Profit:

Stop Loss: Implement a predefined percentage or ATR-based stop loss to limit potential losses.

Take Profit: Set a target based on a risk-to-reward ratio that reflects your trading strategy's goals.

Advantages

Trend Identification: The EMA crossover system allows traders to identify the current trend dynamically, focusing on upward or downward price movements.

Simplicity: The strategy is straightforward, making it accessible for both new and experienced traders.

Flexibility: This method can be applied across multiple timeframes and asset classes, making it versatile for various trading styles.

Disadvantages

Lagging Indicator: Moving averages are lagging indicators, meaning signals may come later than the actual price movement, which can lead to missed opportunities.

Whipsaw Effect: In ranging markets, the strategy may produce false signals leading to potential losses.

Overview

The Triple EMA Crossover Strategy is a trend-following trading system that utilizes three Exponential Moving Averages (EMAs) to identify potential entry and exit points in the market. This strategy is based on the principle that when shorter-term prices cross above longer-term prices, it can indicate a bullish trend, and conversely when they cross below, it can signal a bearish trend.

Components

Exponential Moving Averages (EMAs):

Short EMA: A fast-moving average that reacts quickly to price changes (commonly set to 9 periods).

Medium EMA: A medium-term average that smooths out price data and helps confirm trends (commonly set to 21 periods).

Long EMA: A slow-moving average that helps identify the overall trend direction (commonly set to 55 periods).

Trading Signals:

Buy Signal: A long entry is triggered when:

The Short EMA (9) crosses above the Medium EMA (21).

The Medium EMA (21) is above the Long EMA (55).

Sell Signal: A short entry is signaled when:

The Short EMA (9) crosses below the Medium EMA (21).

The Medium EMA (21) is below the Long EMA (55).

Stop Loss and Take Profit:

Stop Loss: Implement a predefined percentage or ATR-based stop loss to limit potential losses.

Take Profit: Set a target based on a risk-to-reward ratio that reflects your trading strategy's goals.

Advantages

Trend Identification: The EMA crossover system allows traders to identify the current trend dynamically, focusing on upward or downward price movements.

Simplicity: The strategy is straightforward, making it accessible for both new and experienced traders.

Flexibility: This method can be applied across multiple timeframes and asset classes, making it versatile for various trading styles.

Disadvantages

Lagging Indicator: Moving averages are lagging indicators, meaning signals may come later than the actual price movement, which can lead to missed opportunities.

Whipsaw Effect: In ranging markets, the strategy may produce false signals leading to potential losses.

릴리즈 노트

The Triple EMA Crossover Strategy is a trend-following indicator designed to identify high-probability trade opportunities by leveraging three Exponential Moving Averages (EMAs) of different periods. This strategy aims to capture momentum in trending markets while filtering out false signals in choppy conditions.Key Features:

✅ Three EMAs for Trend Confirmation – Uses short-, medium-, and long-term EMAs to identify strong uptrends and downtrends.

✅ ADX Filter for Trend Strength – Avoids trades in weak or ranging markets by ensuring trend strength meets a predefined threshold.

✅ Automatic Trade Execution – Includes built-in long and short entries with stop-loss and take-profit levels.

✅ Visual Aids – Plots EMAs, ADX, and trend-based bar coloring to make trend recognition intuitive.

How It Works:

A bullish signal occurs when the shortest EMA crosses above the medium EMA while both remain above the longest EMA, with ADX confirming a strong trend.

A bearish signal occurs when the shortest EMA crosses below the medium EMA while both remain below the longest EMA, with ADX confirming downward momentum.

The strategy implements a dynamic stop-loss and take-profit system based on tick values to manage risk effectively.

This indicator is ideal for traders looking to capitalize on strong trends while minimizing exposure to weak, sideways markets. Perfect for swing traders and intraday traders alike! 🚀

Let me know if you’d like any modifications! 📈

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.