OPEN-SOURCE SCRIPT

Price vs VWAP Performance

Price vs VWAP Performance (PvVWAP)

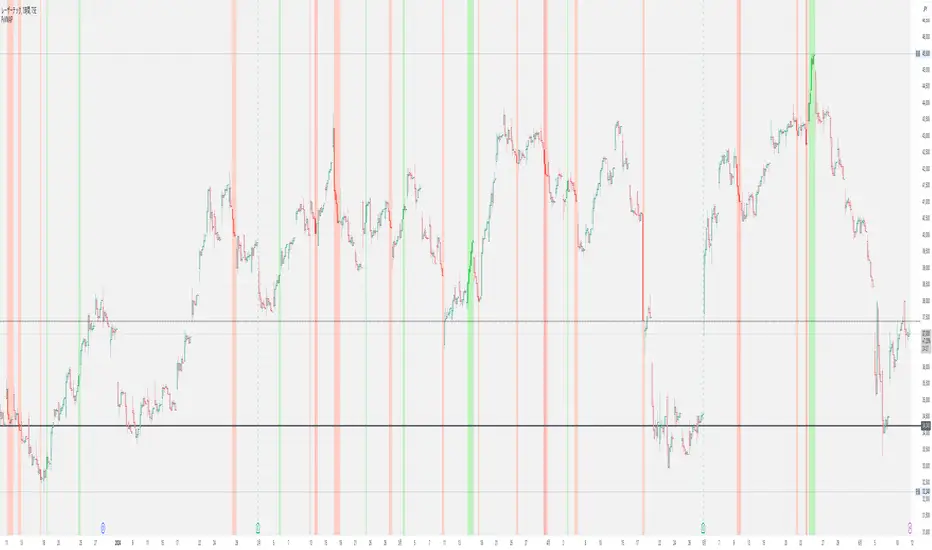

This indicator visually displays the deviation between the current price and VWAP (Volume Weighted Average Price), helping you to determine the strength of a trend.

How it Works

VWAP Calculation: Calculates the Volume Weighted Average Price (VWAP) over a specified period.

Standard Deviation Calculation: Calculates the standard deviation of closing prices over the past 20 periods.

Deviation Calculation: Calculates the difference between the current price and VWAP, expressed as a multiple of the standard deviation.

Color Assignment: Changes the color of bars and background based on the magnitude of the deviation.

Green: Very strong uptrend

Light Green: Strong uptrend

Light Gray: No trend

Pinkish Red: Weak downtrend

Red: Very strong downtrend

How to Use

Trend Strength Assessment:

The greater the deviation of the price from VWAP, the stronger the trend is considered to be.

The color of the bars and background provides a visual indication of trend strength.

Entry/Exit Point Reference:

You can enter/exit by aiming for the movement of the price returning to VWAP after a large deviation from VWAP.

Notes

Parameter Settings:

The standard deviation period is 20 periods by default, but can be adjusted as needed.

Avoid Using Alone:

It is recommended to use this indicator in combination with other technical indicators.

This indicator visually displays the deviation between the current price and VWAP (Volume Weighted Average Price), helping you to determine the strength of a trend.

How it Works

VWAP Calculation: Calculates the Volume Weighted Average Price (VWAP) over a specified period.

Standard Deviation Calculation: Calculates the standard deviation of closing prices over the past 20 periods.

Deviation Calculation: Calculates the difference between the current price and VWAP, expressed as a multiple of the standard deviation.

Color Assignment: Changes the color of bars and background based on the magnitude of the deviation.

Green: Very strong uptrend

Light Green: Strong uptrend

Light Gray: No trend

Pinkish Red: Weak downtrend

Red: Very strong downtrend

How to Use

Trend Strength Assessment:

The greater the deviation of the price from VWAP, the stronger the trend is considered to be.

The color of the bars and background provides a visual indication of trend strength.

Entry/Exit Point Reference:

You can enter/exit by aiming for the movement of the price returning to VWAP after a large deviation from VWAP.

Notes

Parameter Settings:

The standard deviation period is 20 periods by default, but can be adjusted as needed.

Avoid Using Alone:

It is recommended to use this indicator in combination with other technical indicators.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.