OPEN-SOURCE SCRIPT

Investing Performance with vs without fees

Hello traders,

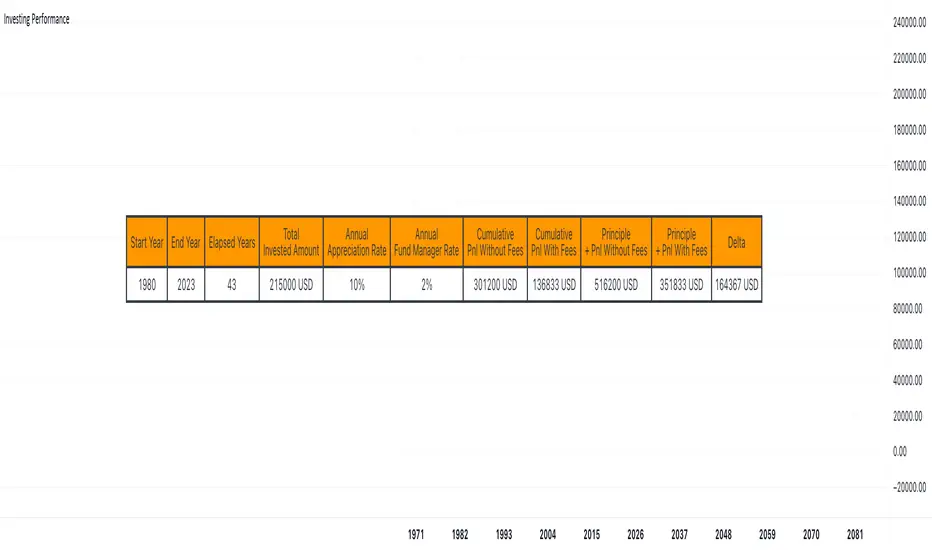

I had a chat with a friend recently who's using a fund manager services to invest for him in some US-based ETFs tracking the US indices.

I showed him using an online tool that those 2% annual fees he's paying to his fund manager are eating a lot of his profit overtime.

As I had some time, I decided to code this simulator in Pinescript because .... why not :)

RicardoSantos already did that Compound Interest function (tradingview.com/script/woq6TTda-FunctionCompoundInterest/)

I added the n parameter being the number of times the interest is compounded per unit of time

Compound interest is calculated using the following formula

CI = P*(1 + R/n) (n*t) – P

Here,

For now, the script only works on a yearly chart - I might update it later making it compatible with other chart timeframes - assuming there is some demand for it

If there is, let me know in the comments down below

All the best

Dave

I had a chat with a friend recently who's using a fund manager services to invest for him in some US-based ETFs tracking the US indices.

I showed him using an online tool that those 2% annual fees he's paying to his fund manager are eating a lot of his profit overtime.

As I had some time, I decided to code this simulator in Pinescript because .... why not :)

RicardoSantos already did that Compound Interest function (tradingview.com/script/woq6TTda-FunctionCompoundInterest/)

I added the n parameter being the number of times the interest is compounded per unit of time

Compound interest is calculated using the following formula

CI = P*(1 + R/n) (n*t) – P

Here,

- P is the principal amount.

- R is the annual interest rate.

- t is the time the money is invested or borrowed for.

- n is the number of times that interest is compounded per unit t, for example if interest is compounded monthly and t is in years then the value of n would be 12.

If interest is compounded quarterly and t is in years then the value of n would be 4.

For now, the script only works on a yearly chart - I might update it later making it compatible with other chart timeframes - assuming there is some demand for it

If there is, let me know in the comments down below

All the best

Dave

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

⭐️ I'm looking to sell Best Trading Indicator. DM me if interested

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

⭐️ Listed as an Official TradingView Trusted TOP Pine Programmer

📧 Coding/Consulting Inquiries: dave@best-trading-indicator.com

⏩ Course: best-trading-indicator.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.