OPEN-SOURCE SCRIPT

업데이트됨 COT Index by Niels

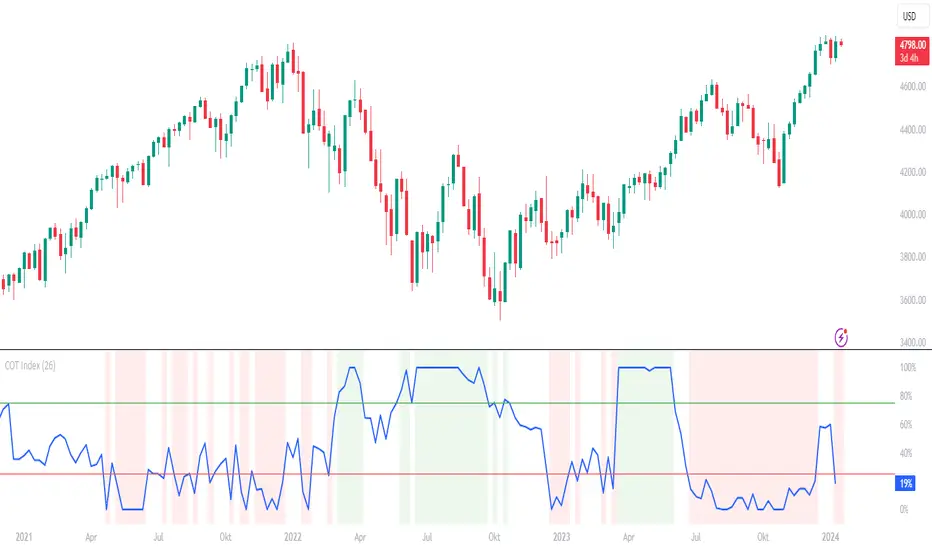

The COT index is an indicator for determining trend reversals based on the net positions of commercials from the CFTC COT report.

A time frame of 26 weeks is selected as the basis. If the value is greater than or equal to 75, this is a bullish sign; if it is less than or equal to 25, this is a bearish sign.

You can select the number of weeks to be used for the calculation.

As the CFTC data is only published on Fridays at 21:30, the value of the current week is hidden until the market closes.

In addition, the background changes color when the index reaches an extreme range.

Both functions can be deactivated in the settings.

A time frame of 26 weeks is selected as the basis. If the value is greater than or equal to 75, this is a bullish sign; if it is less than or equal to 25, this is a bearish sign.

You can select the number of weeks to be used for the calculation.

As the CFTC data is only published on Fridays at 21:30, the value of the current week is hidden until the market closes.

In addition, the background changes color when the index reaches an extreme range.

Both functions can be deactivated in the settings.

릴리즈 노트

Added correction for the copper futures to show the correct value.릴리즈 노트

Two functions have been added:1. A COT proxy function has been added, which calculates COT data using the price range without the CFTC report. This is enabled by default for the DAX future and can be applied to all other futures through the options if needed. The formula was developed by Larry Williams.

2. It is now also possible to view the change of the COT index compared to the previous week. This can also be activated in the options.

릴리즈 노트

Added "Hide Until New Data" (default enabled):The COT Index is now only displayed if the data for the current week differs from the previous week. Prevents showing unchanged or outdated data.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.