INVITE-ONLY SCRIPT

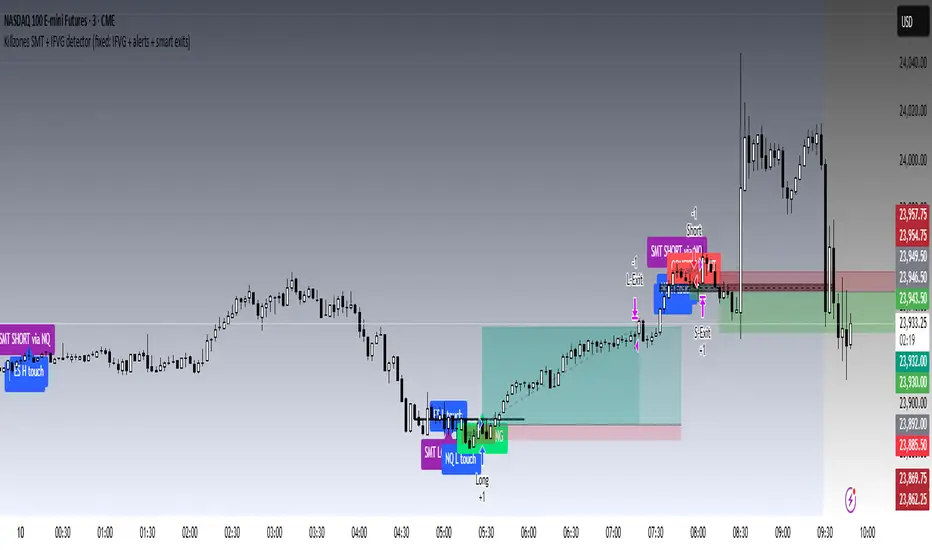

업데이트됨 Killzones SMT + IFVG detector

Summary

Killzones SMT + IFVG detector is a rules-based tool for intraday setups inside defined “killzone” windows. It combines SMT (cross-market divergence between NQ and ES) with strict ICT-style IFVG confirmation (3-bar imbalance), plus safety gates and optional stop/target management.

Design rationale — how the pieces work together

How it works (high level)

Killzones (what they are + default times)

Times are interpreted in the chart’s timezone. The logic stores extremes made inside these windows and monitors them forward.

How to use

What the alerts mean

Limitations

Signals depend on data quality, feeds, and timeframe. Divergence and confirmations can fail. Designed primarily for the NQ/ES pair. Past performance is not indicative of future results; use prudent risk controls.

Disclaimer

Educational tool only; not financial advice. Trade at your own risk.

Killzones SMT + IFVG detector is a rules-based tool for intraday setups inside defined “killzone” windows. It combines SMT (cross-market divergence between NQ and ES) with strict ICT-style IFVG confirmation (3-bar imbalance), plus safety gates and optional stop/target management.

Design rationale — how the pieces work together

- []Context first: time-boxed killzones + recorded session extremes (H/L) focus the search on likely liquidity areas.

[]Selective divergence: signals require exclusive SMT sweeps (one index takes the level while the other does not), which filters noise.

[]Strict confirmation: only confirms when price closes beyond the IFVG boundary in the candle’s direction (bull close above upper gap for longs; bear close below lower gap for shorts).

[]Safety gating: same-bar H&L sweep on the same symbol pauses until the next killzone; weekend lockout; cooldown; and a max initial-stop gate that skips oversized setups.

How it works (high level)

- []Session extremes inside killzones: during each window, the script stores NQ/ES highs/lows and keeps a limited number of untouched levels.

[]SMT (exclusive sweep): a candidate forms when, on the same bar, only one index sweeps its stored H/L while the other does not.

• Bullish SMT: one index sweeps the low while the other remains above its session low.

• Bearish SMT: one index sweeps the high while the other remains below its session high.

Detection supports Sweep (Cross) with minimum-tick penetration or Exact Tick equality.

[]IFVG lock & confirmation: after an SMT candidate, the script locks a qualifying 3-bar IFVG on the chosen confirmation symbol (NQ or ES). Confirmation requires a close through the gap boundary in the candle’s direction. Optional “re-lock” keeps tracking the newest valid IFVG until confirmation/expiry.

[](Strategy option) Exits: initial stop from last opposite-candle wick (+ buffer), fixed TP in points, and step-ups to BE → 50% → 80% of target as progress thresholds are reached.

Killzones (what they are + default times)

Times are interpreted in the chart’s timezone. The logic stores extremes made inside these windows and monitors them forward.

- []19:00–23:00 — Early overnight liquidity formation.

[]01:00–04:00 — London/European activity window.

[]08:30–10:00 — U.S. morning discovery (major data at :30).

[]11:00–12:00 — Midday probe/pause; thinner liquidity. - 12:30–15:00 — U.S. afternoon continuation/unwind into close.

How to use

- []Apply on a chart with NQ and ES data (e.g., continuous futures). Choose killzone windows and detection mode (Cross vs Exact Tick).

[]Select the confirmation symbol (NQ or ES) and optionally enable IFVG re-lock until confirmation/expiry. - set realistic Properties and run on “Once per bar close.”

*

Alerts: enable SMT Bullish/Bearish and/or Confirm LONG/SHORT; “Once per bar close” is generally recommended.

What the alerts mean

- []SMT Bullish/Bearish: an exclusive sweep + divergence printed this bar.

[]Confirm LONG/SHORT: the close crossed the IFVG boundary in the candle’s direction per the rules.

Limitations

Signals depend on data quality, feeds, and timeframe. Divergence and confirmations can fail. Designed primarily for the NQ/ES pair. Past performance is not indicative of future results; use prudent risk controls.

Disclaimer

Educational tool only; not financial advice. Trade at your own risk.

릴리즈 노트

Fixed a bug where confirming Long/short with pre-SMT IFVG초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 eliran5060에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Access is invite-only and granted manually on TradingView. For contact details, see my Signature.

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

Access & support: whop.com/killzones-smt-ifvg-detector/smt-killzone-divergence-ifvg-ee/

Feel free to contact me via: eliran5060@gmail.com

Feel free to contact me via: eliran5060@gmail.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 eliran5060에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Access is invite-only and granted manually on TradingView. For contact details, see my Signature.

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

Access & support: whop.com/killzones-smt-ifvg-detector/smt-killzone-divergence-ifvg-ee/

Feel free to contact me via: eliran5060@gmail.com

Feel free to contact me via: eliran5060@gmail.com

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.