INVITE-ONLY SCRIPT

업데이트됨 Momentum Oscillator

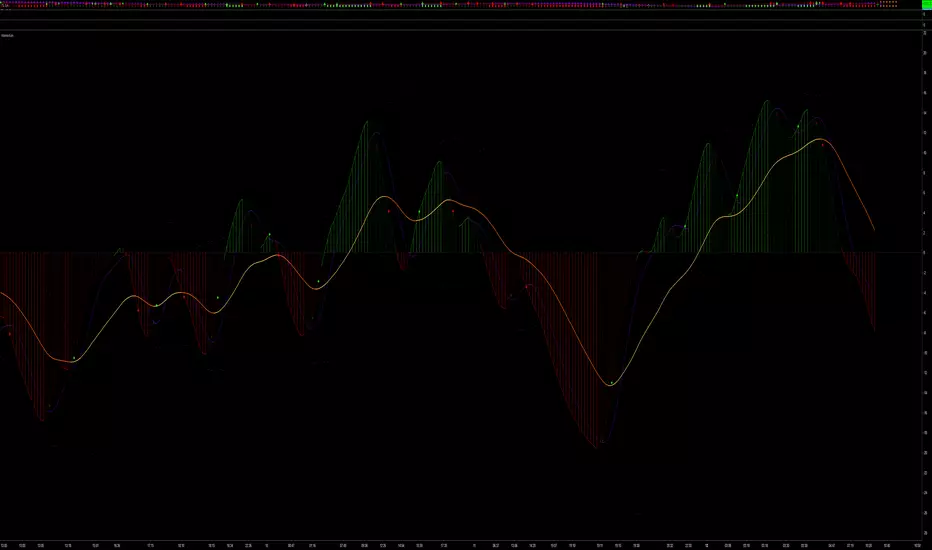

This is a heavily modified MACD to show the momentum of the market. There is a bollinger band with the source being set to MACD line to show the volatility of the momentum. The concept and settings came from Barry Burn's foundation course but I discovered that adding a bollinger band to macd line can show the squeeze and expansion of the momentum and that can be very helpful in conjunction with the whole system. If you switch to weekly chart and above, the settings automatically switches to those that Barry uses for none 1 to 3 ratio so you won't need to worry about it.

릴리즈 노트

Added the ability to switch between standard MACD formula with what Bill Williams suggests in his speeches and books. Switching to Williams formula (set to true by default) reduces the noise in the indicator and most of the time the average line (DAD) turns the color few bars earlier compared to what was before on the other hand, sometimes the crossing of the momentum line with the average line happens sooner in standard formula and sometimes later, because this one is not a consistent appearance, you can't say what formula works better in that regard.릴리즈 노트

Another slight change in the formula, switched from using close as input value to hlc3, slightly less noisy and even better calculations in regard to price changes.릴리즈 노트

changed the way momentum line is drawn, previously, it was easy to miss if the momentum is bellow zero line or not, now, it will draw as histogram easily identifying if the momentum is bellow zero or above it, also, for being able to easily see the momentum line, it will be redrawn as the line itself on top of histogram.there is added options to draw the histogram or not, same for drawing the line or not indivitually

릴리즈 노트

added an option to switch the input used for mom formula, the default is using (high + low + close) / 3 in other words using hlc3 but bill williams uses another formula (high + low) / volume, if you check mark the input option for bill williams, you get totally different results shown in the copy bellow the original, witch ever you want to use, you have the option now.릴리즈 노트

Added an option to switch the average calculation bar numbers from what Barry Burn suggests to what Bill Williams suggest.Thiis oscillator is almost finished with every chance and system you can put on it.

The top instance is what you would get by default, HLC3 as input and the number settings based on Barry's suggestions but uses SMA instead of EMA in macd calculations.

The second one is still using SMA and HLC3, but instead of Barry's suggested numbers for bar calculations, it's using Williams suggested numbers. As you see, the cross between MOM and DAD is happening much faster in time but there are instances of them going back and forth in crossing when the top one is not doing it.

The third instance is using Barry's suggested numbers, with SMA but uses MFI from Williams book.

The last instance is what you would get if you completely go with Bill Williams, the suggested bar calcultions, with MFI as input and SMA in calculations.

릴리즈 노트

Changed the default state of the momentum oscillator to mimic barry burn's formulaAdded a 7 SMA for MOM

Added color signals for when MOM moves above / bellow 7 SMA and DAD

Moved plots around for better order on what draws on top of what

릴리즈 노트

- Changed the histogram color to mimic what we have in my methodology and Uni Renko toolset- Removed the cloud drawing between momentum and DAD, would make the chart look too busy

- Changed the way signals are being drawn from background bars to crosses on the oscillator itself

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 CAB_Member에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 CAB_Member에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.