OPEN-SOURCE SCRIPT

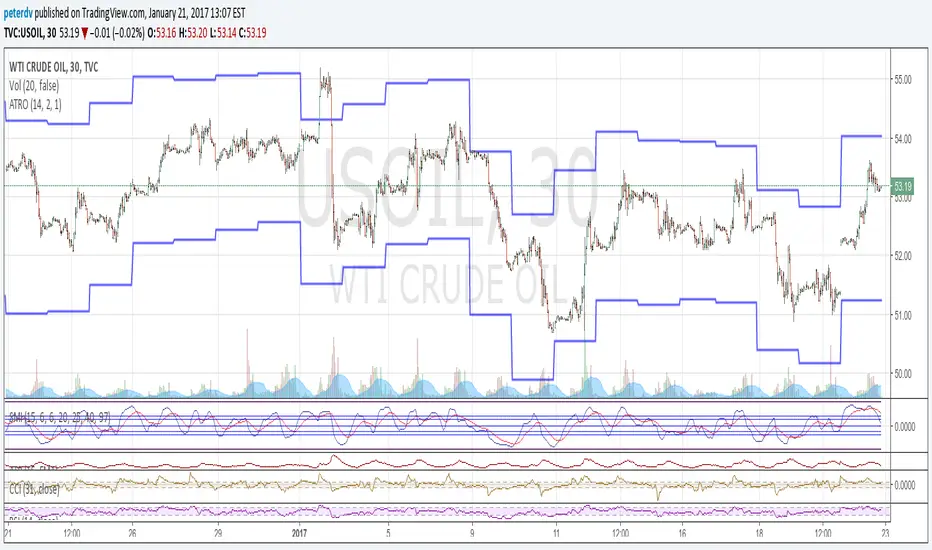

Average True Range Overlay

Plots ATR calculated on a daily basis as an overlay on the current chart.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.