OPEN-SOURCE SCRIPT

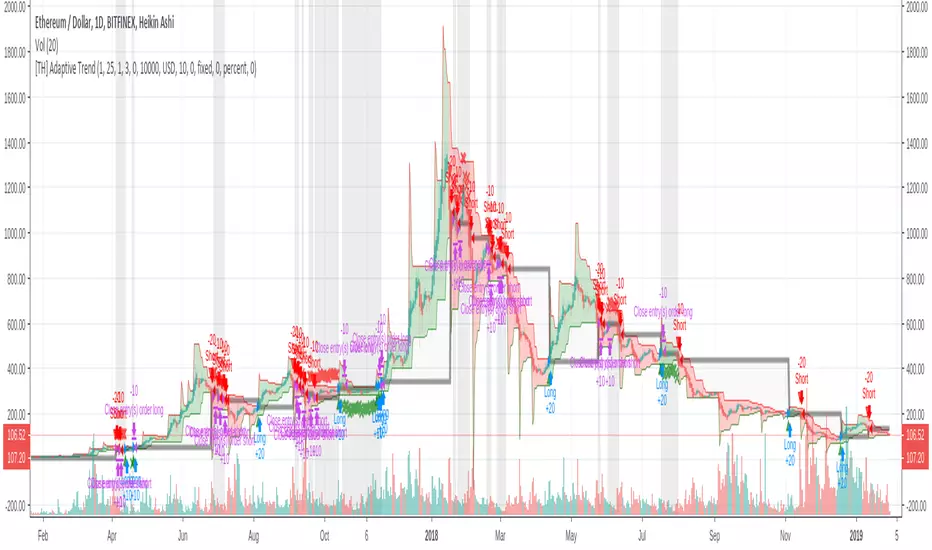

[TH] Adaptive Trend : Strategy

Adaptive Trend : Strategy

*** It should be used with 'heikin ashi' chart ***

*** It should be used with 'heikin ashi' chart ***

- Super Trend

Basically, it is super trend strategy ( Rajandran R Supertrend )

- My idea is,

1. (scale) Factor of super trend is related with sensitivity of Up/Down trend change

2. Constant Factor cause failure of super trend strategy when market prices variance is low ( ie. high Factor ==> miss short trend )

3. By using variance measure ( like BollingerBand ) as a varying Factor, maybe we can catch short trend and long trend together - Loss Cut

The silver thick line is loss cut line & silver background means exit position status

I found that silver background is appear usually when price moves horizontally

1. It is set to open price of actual position entry ( heikin ashi chart's open price = loss cut line = (open + close)/2 )

2. If position is long

==> loss cut is executed when low price is lower than loss cut line

==> re-entry when low price is higher than loss cut line

3. If Position is short

==> loss cut is executed when high price is higher than loss cut line

==> re-entry when high price is lower than loss cut lin

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.