OPEN-SOURCE SCRIPT

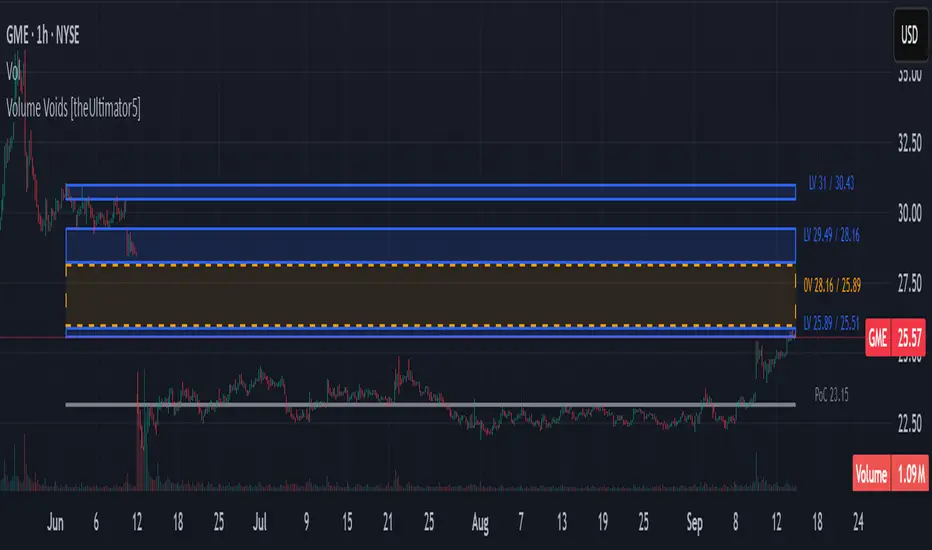

Volume Voids [theUltimator5]

Volume Voids highlights price regions with no or unusually thin participation over a chosen lookback. It bins the lookback’s full price range into equal steps, assigns each bar’s close to a bin, and accumulates volume per bin. Contiguous runs of zero-volume bins are shown as “voids,” while low-volume runs (below a dynamic threshold) mark thin-liquidity “corridors” where price often traverses quickly when revisited.

An optional PoC (Point of Control) line marks the mid-price of the highest-volume bin—commonly treated as a recent “value” area that price may revisit.

What it draws on your chart

How it works

Note: This is a lightweight, chart-native approximation of a volume profile. Volume is binned by bar close (not by tick-level prints or intrabar distribution), so “voids”/“thin” areas reflect this approximation.

Key inputs

How to use (educational, not signals)

Limitations & performance

Bins use closing price only; intrabar distribution is not modeled.

Detections refresh on the live bar; visuals can be heavy on large lookbacks/high bin counts—reduce bins/lookback or hide labels if needed.

An optional PoC (Point of Control) line marks the mid-price of the highest-volume bin—commonly treated as a recent “value” area that price may revisit.

What it draws on your chart

- Histogram (optional): Right-anchored horizontal volume-by-price bars built from your lookback and bin count. Bars tint green→red via a simple delta proxy (up-bar volume minus down-bar volume) to hint at directional participation inside each price band.

- Point of Control (optional): A horizontal line at the highest-volume bin’s mid-price (the PoC).

- Zero-Volume Voids: Translucent boxes where no bin volume printed within the window (detected between the first and last non-empty bins).

- Low-Volume Zones: Translucent boxes where bin volume is below a dynamic threshold (see formula below), often acting like low-friction corridors.

How it works

- Slice the lookback’s high→low into N equal price bins.

- Assign each bar’s closing price to a bin and add that bar’s volume to the bin total. A simple up/down-bar delta proxy drives the histogram’s tinting.

- PoC = bin with the maximum accumulated volume.

- Zero-Volume Voids = contiguous runs of bins with exactly zero volume (bounded by the first/last occupied bins).

- Low-Volume Zones = contiguous runs of bins with volume below:

threshold = total_window_volume ÷ (divisor × number_of_bins)Lower divisor → more LV boxes; higher divisor → stricter/fewer boxes.

Note: This is a lightweight, chart-native approximation of a volume profile. Volume is binned by bar close (not by tick-level prints or intrabar distribution), so “voids”/“thin” areas reflect this approximation.

Key inputs

- Lookback Period: Window for calculations.

- Number of Volume Boxes (bins): Histogram resolution.

- PoC / Show Histogram / Anchor to Right Side: Visibility and layout controls.

- Low-Volume Threshold Divisor: Sensitivity for LV detection.

- Colors & Labels: Customize zero-volume / low-volume box colors and optional labels with offsets.

How to use (educational, not signals)

- Context: High-volume = acceptance; thin/zero-volume = inefficiency. Price often rotates near acceptance and moves faster through thin areas.

- Revisits: On returns to prior voids/LV zones, watch for accelerated moves or fills; PoC can serve as a balance reference.

- Confluence: Pair with trend tools (e.g., ADX), VWAP/session markers, or structure levels for timing and risk.

Limitations & performance

Bins use closing price only; intrabar distribution is not modeled.

Detections refresh on the live bar; visuals can be heavy on large lookbacks/high bin counts—reduce bins/lookback or hide labels if needed.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.