INVITE-ONLY SCRIPT

STATEMAP | QuantEdgeB

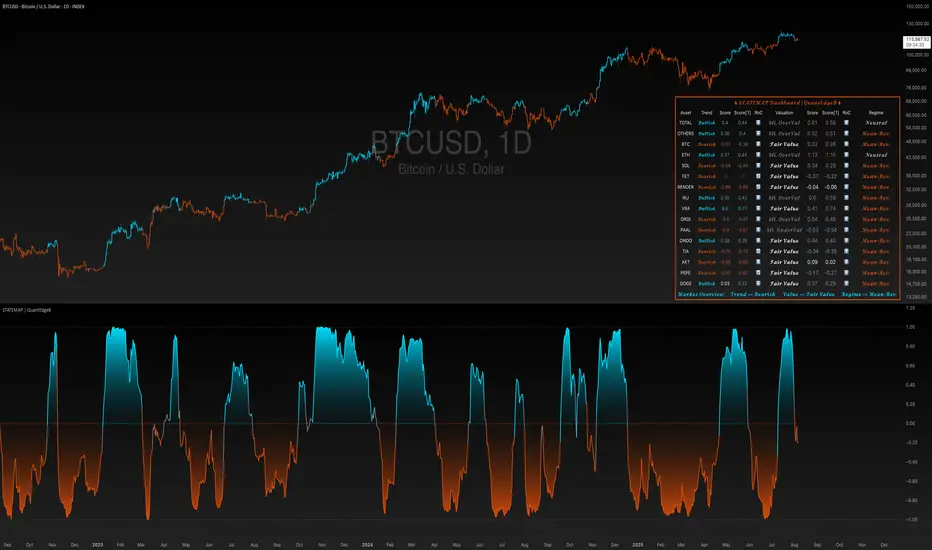

Introducing STATEMAP by QuantEdgeB

🔍 Overview

STATEMAP | QuantEdgeB is a holistic Trend & Valuation dashboard for 16 key crypto and index assets. It distills each asset’s momentum regime and valuation state into two live averages—trend average and valuation average—and presents them via color-coded candles, dynamic plots, and a comprehensive bottom-right table. Switch effortlessly between Trend and Valuation views to spot regime shifts across the market.

✨ Key Features

• 🧭 Trend vs. Valuation Toggle

Flip between viewing the overall market’s trend average or its valuation average with a single input.

• 📊 Trend Average

Aggregates each asset’s directional bias (bullish vs. bearish) into one composite gauge that flags risk-on vs. risk-off regimes.

• 💎 Valuation Average

Blends each asset’s statistical valuation score to highlight extreme under-/over-valued conditions.

• 🎨 Color-Coded Visualization

Candles turn blue for bullish, red for bearish, and gray for neutral; fills and horizontal bands reinforce regime thresholds.

• 🗺️ Live Asset Matrix

A 16×8 table shows for each symbol:

• Current Trend (Bullish/Bearish)

• Score & Prior Score with direction arrows (⬆️/⬇️/🔄)

• RoC (momentum change)

• Valuation State label (e.g. “Strong UnderValued”)

• Valuation value & prior value with change indicator

• 🚦 Market Stage Banner

A top-row line combines both averages into a concise “Market Stage” message (e.g. “Trend ⟹ Bullish Value ⟹ Sli. OverValued”).

⚙️ How It Works

• Universal Trend Assessment

Uses a library of trend-following logic to classify each asset as bullish or bearish, then averages those signals into the trend average.

• Adaptive Valuation Mapping

Evaluates each asset’s statistical valuation band, maps it into intuitive labels (under-/fair-/over-valued), and averages into the valuation average.

• Regime Thresholds

• Trend average above +0.1 ⇒ risk-on (bullish); below –0.1 ⇒ risk-off (bearish); otherwise neutral.

• Valuation average buckets assign six states from “Strong UnderValued” to “Strong OverValued.”

• Dynamic Visualization

Color-coded candlesticks and filled plot areas highlight when the market crosses key levels, making regime changes immediately apparent.

🎯 Who Should Use It

• Systematic Traders looking for a unified regime filter across multiple assets

• Portfolio Managers wanting a pulse on market momentum vs. valuation before reallocations

• Swing & Position Traders confirming cross-asset alignment or spotting divergences

• Risk Managers monitoring broad contractions (trend bearish) vs. expansions (trend bullish) alongside valuation extremes

🧬 Default Settings

• View Mode: Trend

• Bar color: Yes

• Assets Covered: TOTAL market cap, TOTAL OTHERS, BTC, ETH, SOL, FET, RNDR, INJ, VRA, ORDI, PAAL, ONDO, TIA, AKT, PEPE, DOGE

📌 Conclusion

STATEMAP | QuantEdgeB delivers a clear, emoji-tagged map of where the crypto market stands in both momentum and valuation space. With an easy toggle and a rich dashboard, it empowers you to make regime-aware trading and allocation decisions at a glance.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

🔍 Overview

STATEMAP | QuantEdgeB is a holistic Trend & Valuation dashboard for 16 key crypto and index assets. It distills each asset’s momentum regime and valuation state into two live averages—trend average and valuation average—and presents them via color-coded candles, dynamic plots, and a comprehensive bottom-right table. Switch effortlessly between Trend and Valuation views to spot regime shifts across the market.

✨ Key Features

• 🧭 Trend vs. Valuation Toggle

Flip between viewing the overall market’s trend average or its valuation average with a single input.

• 📊 Trend Average

Aggregates each asset’s directional bias (bullish vs. bearish) into one composite gauge that flags risk-on vs. risk-off regimes.

• 💎 Valuation Average

Blends each asset’s statistical valuation score to highlight extreme under-/over-valued conditions.

• 🎨 Color-Coded Visualization

Candles turn blue for bullish, red for bearish, and gray for neutral; fills and horizontal bands reinforce regime thresholds.

• 🗺️ Live Asset Matrix

A 16×8 table shows for each symbol:

• Current Trend (Bullish/Bearish)

• Score & Prior Score with direction arrows (⬆️/⬇️/🔄)

• RoC (momentum change)

• Valuation State label (e.g. “Strong UnderValued”)

• Valuation value & prior value with change indicator

• 🚦 Market Stage Banner

A top-row line combines both averages into a concise “Market Stage” message (e.g. “Trend ⟹ Bullish Value ⟹ Sli. OverValued”).

⚙️ How It Works

• Universal Trend Assessment

Uses a library of trend-following logic to classify each asset as bullish or bearish, then averages those signals into the trend average.

• Adaptive Valuation Mapping

Evaluates each asset’s statistical valuation band, maps it into intuitive labels (under-/fair-/over-valued), and averages into the valuation average.

• Regime Thresholds

• Trend average above +0.1 ⇒ risk-on (bullish); below –0.1 ⇒ risk-off (bearish); otherwise neutral.

• Valuation average buckets assign six states from “Strong UnderValued” to “Strong OverValued.”

• Dynamic Visualization

Color-coded candlesticks and filled plot areas highlight when the market crosses key levels, making regime changes immediately apparent.

🎯 Who Should Use It

• Systematic Traders looking for a unified regime filter across multiple assets

• Portfolio Managers wanting a pulse on market momentum vs. valuation before reallocations

• Swing & Position Traders confirming cross-asset alignment or spotting divergences

• Risk Managers monitoring broad contractions (trend bearish) vs. expansions (trend bullish) alongside valuation extremes

🧬 Default Settings

• View Mode: Trend

• Bar color: Yes

• Assets Covered: TOTAL market cap, TOTAL OTHERS, BTC, ETH, SOL, FET, RNDR, INJ, VRA, ORDI, PAAL, ONDO, TIA, AKT, PEPE, DOGE

📌 Conclusion

STATEMAP | QuantEdgeB delivers a clear, emoji-tagged map of where the crypto market stands in both momentum and valuation space. With an easy toggle and a rich dashboard, it empowers you to make regime-aware trading and allocation decisions at a glance.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantEdgeB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please check out our Whop page for access!!

https://whop.com/quantedgeb/?a=quantedge17

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 QuantEdgeB에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please check out our Whop page for access!!

https://whop.com/quantedgeb/?a=quantedge17

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.