INVITE-ONLY SCRIPT

Macro S&D Alpha

Macro S&D Suite: Part 1 — Alpha Zones (Macro Structure S&D)

Title: Macro S&D Suite: Part 1 — Alpha Zones (Macro Structure S&D)

Description:

Overview

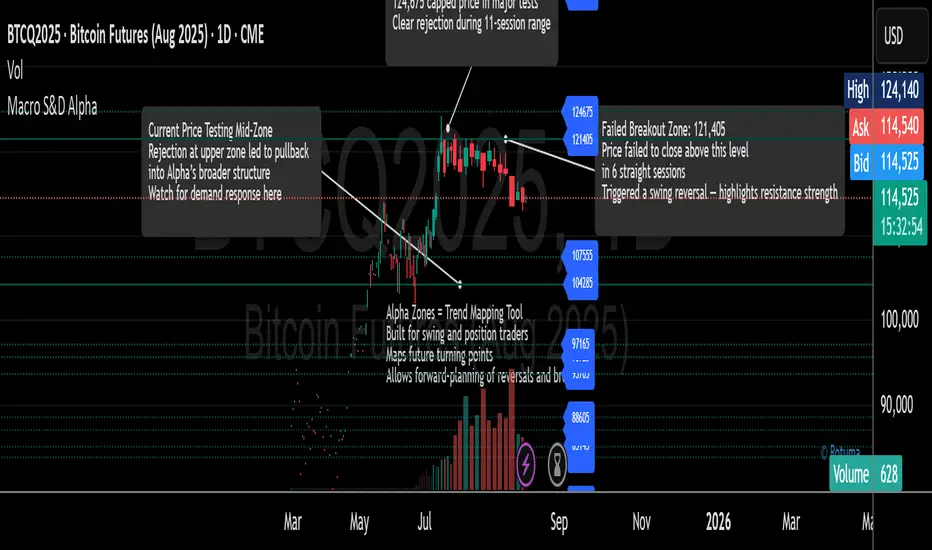

Macro S&D Alpha is the foundational component of our system, designed to identify institutional-level supply and demand zones across Weekly, Daily, and 4H timeframes. It captures the structural blueprint of the market by filtering out weak swings and highlighting zones that historically attract major liquidity.

How It Works

• Volatility-Weighted Swings: Detects key pivot points using swing duration, price rejection intensity, and volatility scores

• Auto-Zone Drawing: Plots supply (resistance) and demand (support) zones from validated macro pivots

• Dynamic Updates: Zones extend and adjust only when the structure confirms a significant change

• Noise Reduction: Filters minor or untested pivots to highlight meaningful levels with proven historical relevance

Use Case

Add Alpha to your higher-timeframe charts (Daily/4H) to define your structural market bias. These zones help identify potential reversals, trend continuations, and breakout regions. Alpha serves as the macro map for directional decision-making.

How It Integrates with Beta

Alpha defines where the market is most likely to respond — at key macro structural zones.

Beta sharpens the focus with precise entry and exit zones on lower timeframes.

When the two align — for example, a Micro 1 or 5 rejection within an Alpha zone — this often marks a high-probability reversal, breakout, or pullback setup with reduced risk and increased conviction.

What Makes It Unique

Alpha is not a standard support/resistance or swing high/low script. It uses a proprietary multi-factor scoring model to determine which historical pivots carry institutional weight. This allows traders to focus only on the most reliable structural zones over multi-week horizons.

Technical Note

This script is Part 1 of the Macro S&D Suite. Due to TradingView's line and object limits, the suite is divided into modular tools:

• Part 1 – Alpha: Macro structure zones (this script)

• Part 2 – Beta: Intraday tactical zones (published separately)

Educational Support & System Guide

This script is accompanied by a 25-page Trading Rules Guide, outlining how to apply our zone logic, entry/exit rules, and execution structure.

All approved users receive daily support and real-time guidance, applying the exact identical setups we use in live trading — across indices, FX, crypto, and commodities.

Compatibility Note

Alpha is primarily designed for structure-based price action trading, but it also works well in conjunction with external tools such as VWAP, volume profile, or basic trend overlays.

Traders can keep their workflow clean or layer additional confluence to suit their strategy.

Invite-Only Access

Access to this script is reserved for active members of our MacroStructure community.

If you're interested in exploring the system, we offer a 14-day no-obligation trial — no signup, no credit card, and no risk.

Send us your TradingView username via direct message, and we'll activate full access so you can test the tool in live market conditions.

We also provide a daily playbook and real-time guidance during the London and New York sessions to help you apply the system the same way we do in our trades.

If it fits your workflow and improves your consistency, you're welcome to continue with a monthly subscription after the trial.

Title: Macro S&D Suite: Part 1 — Alpha Zones (Macro Structure S&D)

Description:

Overview

Macro S&D Alpha is the foundational component of our system, designed to identify institutional-level supply and demand zones across Weekly, Daily, and 4H timeframes. It captures the structural blueprint of the market by filtering out weak swings and highlighting zones that historically attract major liquidity.

How It Works

• Volatility-Weighted Swings: Detects key pivot points using swing duration, price rejection intensity, and volatility scores

• Auto-Zone Drawing: Plots supply (resistance) and demand (support) zones from validated macro pivots

• Dynamic Updates: Zones extend and adjust only when the structure confirms a significant change

• Noise Reduction: Filters minor or untested pivots to highlight meaningful levels with proven historical relevance

Use Case

Add Alpha to your higher-timeframe charts (Daily/4H) to define your structural market bias. These zones help identify potential reversals, trend continuations, and breakout regions. Alpha serves as the macro map for directional decision-making.

How It Integrates with Beta

Alpha defines where the market is most likely to respond — at key macro structural zones.

Beta sharpens the focus with precise entry and exit zones on lower timeframes.

When the two align — for example, a Micro 1 or 5 rejection within an Alpha zone — this often marks a high-probability reversal, breakout, or pullback setup with reduced risk and increased conviction.

What Makes It Unique

Alpha is not a standard support/resistance or swing high/low script. It uses a proprietary multi-factor scoring model to determine which historical pivots carry institutional weight. This allows traders to focus only on the most reliable structural zones over multi-week horizons.

Technical Note

This script is Part 1 of the Macro S&D Suite. Due to TradingView's line and object limits, the suite is divided into modular tools:

• Part 1 – Alpha: Macro structure zones (this script)

• Part 2 – Beta: Intraday tactical zones (published separately)

Educational Support & System Guide

This script is accompanied by a 25-page Trading Rules Guide, outlining how to apply our zone logic, entry/exit rules, and execution structure.

All approved users receive daily support and real-time guidance, applying the exact identical setups we use in live trading — across indices, FX, crypto, and commodities.

Compatibility Note

Alpha is primarily designed for structure-based price action trading, but it also works well in conjunction with external tools such as VWAP, volume profile, or basic trend overlays.

Traders can keep their workflow clean or layer additional confluence to suit their strategy.

Invite-Only Access

Access to this script is reserved for active members of our MacroStructure community.

If you're interested in exploring the system, we offer a 14-day no-obligation trial — no signup, no credit card, and no risk.

Send us your TradingView username via direct message, and we'll activate full access so you can test the tool in live market conditions.

We also provide a daily playbook and real-time guidance during the London and New York sessions to help you apply the system the same way we do in our trades.

If it fits your workflow and improves your consistency, you're welcome to continue with a monthly subscription after the trial.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Rotuma에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access to this script is reserved for active members of our MacroStructure community.

If you're interested in exploring the system, we offer a 14-day no-obligation trial. Message @rotuma with your TradingView username to begin your 14-day free

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 Rotuma에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access to this script is reserved for active members of our MacroStructure community.

If you're interested in exploring the system, we offer a 14-day no-obligation trial. Message @rotuma with your TradingView username to begin your 14-day free

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.