INVITE-ONLY SCRIPT

업데이트됨 RunRox - Backtesting System (SM)

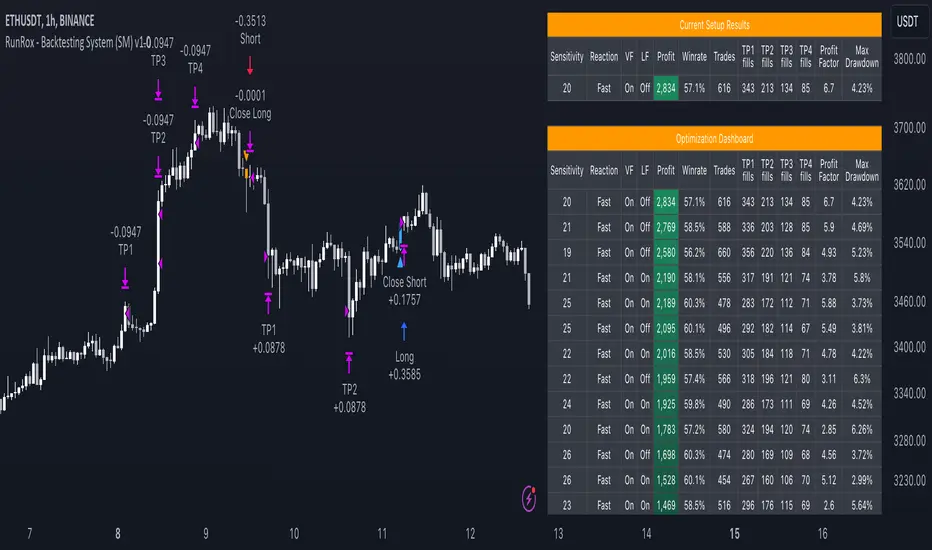

RunRox - Backtesting System (SM) is designed for flexible and comprehensive testing of trading strategies, closely integrated with our RunRox - Signals Master indicator. This combination enhances your ability to refine strategies efficiently, providing you with insights to adapt and optimize your trading tactics seamlessly.

The Backtesting System (SM) excels in pinpointing the optimal settings for the RunRox - Signals Master indicator, efficiently highlighting the most effective configurations.

Capabilities of the Backtesting System (SM)

Trading Flexibility Across Three Modes:

Dual-Direction Trading: Engage in both buying and selling with this mode. Our dashboard optimizes and identifies the best settings for trading in two directions, streamlining the process to maximize effectiveness for both buy and sell orders.

Buy-Only Mode: Tailored for traders focusing exclusively on purchasing assets. In this mode, our backtester pinpoints the most advantageous sensitivity, speed reaction, and filter settings specifically for buying. Optimal settings in this mode may differ from those used in dual-direction trading, providing a customized approach to single-direction strategies.

Sell-Only Mode: Perfect for strategies primarily based on selling. This setting allows you to discover the ideal configurations for asset sales, which can be particularly useful if you are looking for optimal exit points in long-term transactions or under specific market conditions.

Here's an example of how profits can differ on the same asset when trading using two distinct strategies: exclusively buying or trading in both directions.

Above in the image, you can see how one-directional trading influences the results of backtests on historical data. While this does not guarantee future outcomes, it provides insight into how the strategy's performance can vary with different trading directions.

As you can also see from the image, one-directional trading has affected the optimal combination of settings for Sensitivity, Speed Reaction, and Filters.

Stop Loss and Take Profit

Our backtesting system, as you might have gathered, includes flexible settings for take profits and stop losses. Here are the main features:

These settings offer extensive flexibility and can be customized according to your preferences and trading style. They are suitable for both novice and professional traders looking to test their trading strategies on historical data.

As illustrated in the image above, we have implemented money management by setting fixed take profits and stop losses. Utilizing money management has improved indicators such as profit, maximum drawdown, and profit factor, turning even historically unprofitable strategies into profitable ones. Although this does not guarantee future results, it serves as a valuable tool for understanding the effectiveness of money management.

Additionally, as you can see, the optimal settings for Signals Master have been adjusted, highlighting the best configurations for the most favorable outcomes.

Disclaimer:

Historical data is not indicative of future results. All indicators and strategies provided by RunRox are intended for integration with traders' strategies and should be used as tools for analysis rather than standalone solutions. Traders should use their own discretion and understand that all trading involves risk.

The Backtesting System (SM) excels in pinpointing the optimal settings for the RunRox - Signals Master indicator, efficiently highlighting the most effective configurations.

Capabilities of the Backtesting System (SM)

- Optimal Settings Determination: Identifies the best configurations for the Signals Master indicator to enhance its effectiveness.

- Timeframe-Specific Strategy Testing: Allows strategies to be tested over specific historical time periods to assess their viability.

- Customizable Initial Conditions: Enables setting of initial deposit, risk per trade, and commission rates to mirror real-world trading conditions.

- Flexible Money Management: Provides options to set take profits and stop losses, optimizing potential returns and risk management.

- Intuitive Dashboard: Features a user-friendly dashboard that visually displays all pertinent information, making it easy to analyze and adjust strategies.

Trading Flexibility Across Three Modes:

Dual-Direction Trading: Engage in both buying and selling with this mode. Our dashboard optimizes and identifies the best settings for trading in two directions, streamlining the process to maximize effectiveness for both buy and sell orders.

Buy-Only Mode: Tailored for traders focusing exclusively on purchasing assets. In this mode, our backtester pinpoints the most advantageous sensitivity, speed reaction, and filter settings specifically for buying. Optimal settings in this mode may differ from those used in dual-direction trading, providing a customized approach to single-direction strategies.

Sell-Only Mode: Perfect for strategies primarily based on selling. This setting allows you to discover the ideal configurations for asset sales, which can be particularly useful if you are looking for optimal exit points in long-term transactions or under specific market conditions.

Here's an example of how profits can differ on the same asset when trading using two distinct strategies: exclusively buying or trading in both directions.

Above in the image, you can see how one-directional trading influences the results of backtests on historical data. While this does not guarantee future outcomes, it provides insight into how the strategy's performance can vary with different trading directions.

As you can also see from the image, one-directional trading has affected the optimal combination of settings for Sensitivity, Speed Reaction, and Filters.

Stop Loss and Take Profit

Our backtesting system, as you might have gathered, includes flexible settings for take profits and stop losses. Here are the main features:

- Multiple Take Profits: Ability to set from 1 to 4 take profit levels.

- Fixed Percentage: Option to assign a fixed percentage for each take profit.

- Trade Proportion Fixation: Ability to set a fixed size from the trade for securing profits.

- Stop Loss Installation: Option to establish a stop loss.

- Break-Even Stop Loss: Ability to move the stop loss to a break-even point upon reaching a specified take profit level.

These settings offer extensive flexibility and can be customized according to your preferences and trading style. They are suitable for both novice and professional traders looking to test their trading strategies on historical data.

As illustrated in the image above, we have implemented money management by setting fixed take profits and stop losses. Utilizing money management has improved indicators such as profit, maximum drawdown, and profit factor, turning even historically unprofitable strategies into profitable ones. Although this does not guarantee future results, it serves as a valuable tool for understanding the effectiveness of money management.

Additionally, as you can see, the optimal settings for Signals Master have been adjusted, highlighting the best configurations for the most favorable outcomes.

Disclaimer:

Historical data is not indicative of future results. All indicators and strategies provided by RunRox are intended for integration with traders' strategies and should be used as tools for analysis rather than standalone solutions. Traders should use their own discretion and understand that all trading involves risk.

릴리즈 노트

Added:Optimization Mode - We have added the option to optimize the parameters you need: Signals, Inverse Signals, Labels, Inverse Labels, StopLoss, TakeProfit.

Ability to set parameters from and to, which will be used for optimizing StopLoss and TakeProfit parameters.

Update:

Dashboard - Updated the dashboard, allowing customization of the text color on the panel.

릴리즈 노트

Changed- Minor changes

릴리즈 노트

Fixed:- Fixed a problem with incorrect WinRate %

릴리즈 노트

We’ve updated our indicator with new features:- Ability to set TakeProfit and StopLoss in ticks and pips for Forex traders.

- Option to set leverage

릴리즈 노트

Bug fixes for displaying StopLoss in the table릴리즈 노트

The Major Backtesting System (SM) Update is Here!We’ve made a big upgrade to the backtester, allowing you to achieve even better results. New features improve optimization and help you find the most effective settings for your strategy.

New Features:

Entry Filter

We’ve added 8 possible condition sets that must be met before a trade entry is confirmed. This lets you combine multiple conditions for more accurate backtest results.

- Trend Assistance (Bullish/Bearish)

- Trend Catcher (Bullish/Bearish)

- Neo Cloud (Bullish/Bearish)

+5 custom filters with the following options: Neo Cloud, Trend Assistance Cloud, Reversal Zone Above, Reversal Zone Below.

We’ve also separated the settings for additional visual assistants, so you can fine-tune each one individually.

You can also set a Lookback Period for each condition.

What does this mean? If the condition was true within the last N candles (that you specify), then the filter confirms the entry.

Example: If price was inside Neo Cloud within the last 50 candles and then a signal appears, we take it into the calculation. If price was not in Neo Cloud during that period, the signal is ignored.

External Entry Filter

We’ve added 5 custom external filters with the ability to connect any external indicator for signal filtering. You can link any external indicator and set the conditions you want.

Example: Add RSI to your chart together with Backtesting System (SM). In the strategy settings, select RSI as an external filter and set the condition < 30. In this case, signals will only be counted when RSI is below 30 (oversold zone).

External filters let you integrate any indicator into Backtesting System (SM) and filter signals your way. This opens massive possibilities for testing and building unique strategies.

Custom Expression – An advanced formula field for combining filters.

Example: (f1 or f2) and (f3 or f4)

Meaning: if Filter 1 OR 2 are true, and Filter 3 OR 4 are also true, then the entry is confirmed.

And on top of that, this update includes lots of optimizations and performance improvements, so the backtester now runs even faster!

릴리즈 노트

Fix Minor Bug릴리즈 노트

Bug Fixed with Text초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 RunRox에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Get instant access here: https://RunRox.com/tv

Access RunRox premium indicators: RunRox.com/tv

Join our FREE Discord for Strategy, Live Translation and more: discord.gg/RunRox

Join our FREE Discord for Strategy, Live Translation and more: discord.gg/RunRox

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 RunRox에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Get instant access here: https://RunRox.com/tv

Access RunRox premium indicators: RunRox.com/tv

Join our FREE Discord for Strategy, Live Translation and more: discord.gg/RunRox

Join our FREE Discord for Strategy, Live Translation and more: discord.gg/RunRox

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.