OPEN-SOURCE SCRIPT

업데이트됨 Spread Trading Z-Score

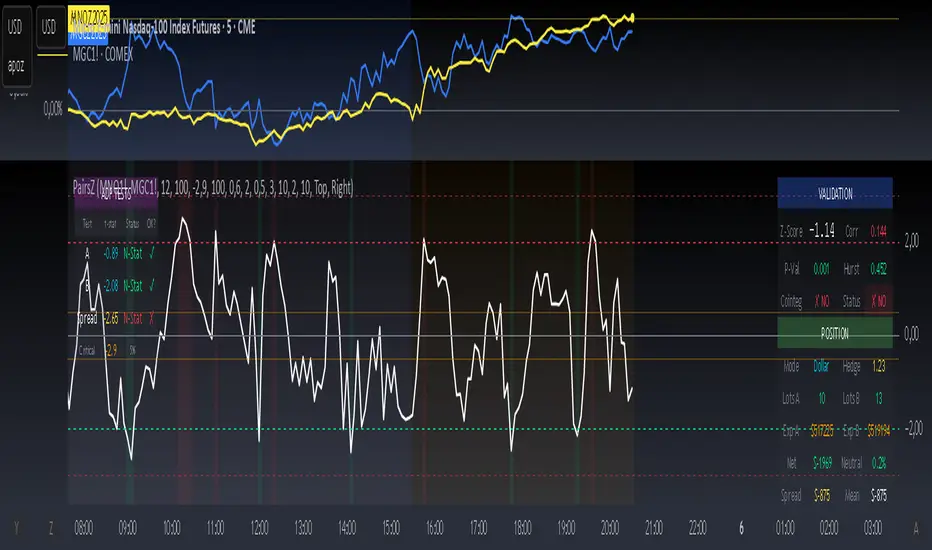

Indicator: Z-Score Spread Indicator

Description

The "Z-Score Spread Indicator" is a powerful tool for traders employing mean-reversion strategies on the spread between two financial assets (e.g., futures contracts like MNQ and MES). This indicator calculates and plots the Z-score of the price spread, indicating how far the current spread deviates from its historical mean. It features customizable entry and exit thresholds with adjustable offsets, along with an estimated p-value displayed in a table to assess statistical significance.

Key Features

Asset Selection: Allows users to select two asset symbols (e.g., CME_MINI:MNQ1! and CME_MINI:MES1!) via customizable inputs.

Z-Score Calculation: Computes the Z-score based on the spread’s simple moving average and standard deviation over a user-defined lookback period.

Customizable Thresholds with Offset: Offers adjustable base entry and exit thresholds, with an optional offset to fine-tune trading levels, plotted as horizontal lines.

P-Value Estimation: Provides an approximate p-value to evaluate the statistical significance of the Z-score, displayed in a table anchored to the top-left corner.

Visual Representation: Plots the Z-score with a zero line and threshold lines for intuitive interpretation.

Adjustable Parameters

Asset A Symbol: Symbol for Asset A (default: CME_MINI:MNQ1!).

Asset B Symbol: Symbol for Asset B (default: CME_MINI:MES1!).

Z-Score Lookback: Lookback period for Z-score calculation (default: 40, minimum 2).

Base Entry Threshold: Threshold for entry signals (default: 1.8, adjustable with a step of 0.1).

Base Exit Threshold: Threshold for exit signals (default: 0.5, adjustable with a step of 0.1).

Threshold Offset (+/-): Offset to adjust entry and exit thresholds symmetrically (default: 0.0, range -5.0 to 5.0, step 0.1).

Usage

Add the indicator to your chart via the "Indicators" tab.

Customize the parameters based on your preferred assets and trading strategy (lookback period, thresholds, offset).

Observe the Z-score plot and threshold lines (red for short entry, green for long entry, orange dotted for exits) to identify potential trade setups.

Check the p-value table in the top-left corner to assess the statistical significance of the current Z-score.

Use this data to inform mean-reversion trading decisions, ideally in conjunction with other indicators.

Notes

A Z-score above the entry threshold (positive) or below the negative entry threshold suggests a potential short or long entry, respectively. Exits are signaled when the Z-score crosses the exit thresholds.

The p-value is an approximation based on the normal distribution; a value below 0.05 typically indicates statistical significance, but further validation is recommended.

The indicator uses a simple spread (Asset A - Asset B) without volatility adjustments; consider pairing it with a lots calculator for hedging.

Limitations

The p-value is an approximation and may not reflect advanced statistical tests (e.g., ADF) due to Pine Script constraints.

No automatic trading signals are generated; it provides data for manual analysis.

Author

Developed by grogusama, October 15, 2025, 07:29 PM CEST.

Description

The "Z-Score Spread Indicator" is a powerful tool for traders employing mean-reversion strategies on the spread between two financial assets (e.g., futures contracts like MNQ and MES). This indicator calculates and plots the Z-score of the price spread, indicating how far the current spread deviates from its historical mean. It features customizable entry and exit thresholds with adjustable offsets, along with an estimated p-value displayed in a table to assess statistical significance.

Key Features

Asset Selection: Allows users to select two asset symbols (e.g., CME_MINI:MNQ1! and CME_MINI:MES1!) via customizable inputs.

Z-Score Calculation: Computes the Z-score based on the spread’s simple moving average and standard deviation over a user-defined lookback period.

Customizable Thresholds with Offset: Offers adjustable base entry and exit thresholds, with an optional offset to fine-tune trading levels, plotted as horizontal lines.

P-Value Estimation: Provides an approximate p-value to evaluate the statistical significance of the Z-score, displayed in a table anchored to the top-left corner.

Visual Representation: Plots the Z-score with a zero line and threshold lines for intuitive interpretation.

Adjustable Parameters

Asset A Symbol: Symbol for Asset A (default: CME_MINI:MNQ1!).

Asset B Symbol: Symbol for Asset B (default: CME_MINI:MES1!).

Z-Score Lookback: Lookback period for Z-score calculation (default: 40, minimum 2).

Base Entry Threshold: Threshold for entry signals (default: 1.8, adjustable with a step of 0.1).

Base Exit Threshold: Threshold for exit signals (default: 0.5, adjustable with a step of 0.1).

Threshold Offset (+/-): Offset to adjust entry and exit thresholds symmetrically (default: 0.0, range -5.0 to 5.0, step 0.1).

Usage

Add the indicator to your chart via the "Indicators" tab.

Customize the parameters based on your preferred assets and trading strategy (lookback period, thresholds, offset).

Observe the Z-score plot and threshold lines (red for short entry, green for long entry, orange dotted for exits) to identify potential trade setups.

Check the p-value table in the top-left corner to assess the statistical significance of the current Z-score.

Use this data to inform mean-reversion trading decisions, ideally in conjunction with other indicators.

Notes

A Z-score above the entry threshold (positive) or below the negative entry threshold suggests a potential short or long entry, respectively. Exits are signaled when the Z-score crosses the exit thresholds.

The p-value is an approximation based on the normal distribution; a value below 0.05 typically indicates statistical significance, but further validation is recommended.

The indicator uses a simple spread (Asset A - Asset B) without volatility adjustments; consider pairing it with a lots calculator for hedging.

Limitations

The p-value is an approximation and may not reflect advanced statistical tests (e.g., ADF) due to Pine Script constraints.

No automatic trading signals are generated; it provides data for manual analysis.

Author

Developed by grogusama, October 15, 2025, 07:29 PM CEST.

릴리즈 노트

Update of spread calculation 릴리즈 노트

Update of spread calculation 릴리즈 노트

Update beta calculation릴리즈 노트

Update : Hurst exposent added릴리즈 노트

Update of the calculation method릴리즈 노트

Reduction of the table size릴리즈 노트

Update of information for a trade validation릴리즈 노트

update of the calculation method릴리즈 노트

Update of the calculation method릴리즈 노트

Update of the visuals and the final calculation method 릴리즈 노트

Garch implementation릴리즈 노트

Lot size adjusted릴리즈 노트

Update calculation method 릴리즈 노트

Added a kalman filter 릴리즈 노트

Update of the calculation and visuals 릴리즈 노트

Update of the calculation method 오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.