PROTECTED SOURCE SCRIPT

Student Wyckoff Effort Result Time

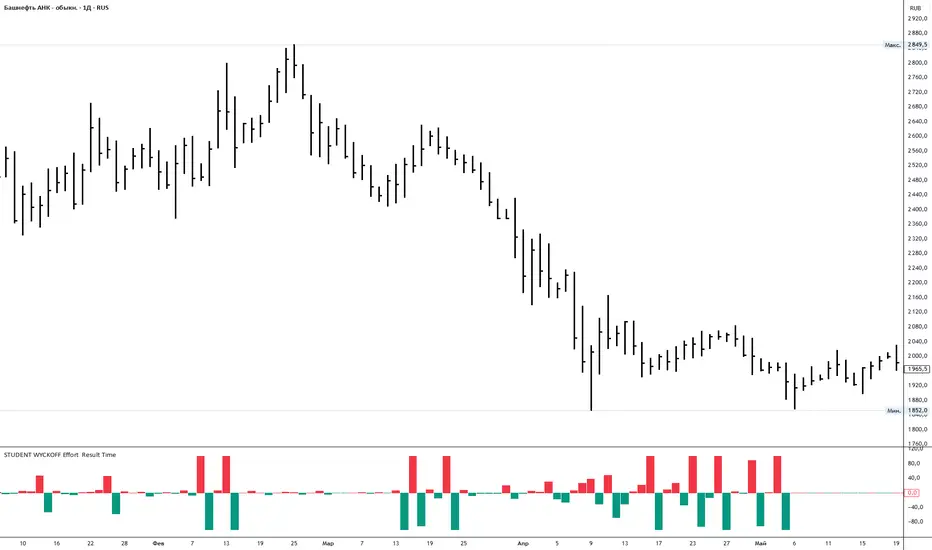

**STUDENT WYCKOFF Effort vs Result**

This tool measures how *hard* the market is working on every bar and compares the current effort with the previous one. It is built in the spirit of Wyckoff: first we look at the effort (volume), then at the result (price progress), and only after that compare them.

---

### Calculation (logic in simple terms)

For each bar the script:

1. Takes an **ERT window (N bars)** – by default 2 bars:

* **Effort (E)** = sum of volume over the last N bars.

* **Time (T)** = number of bars in the window = N.

* **Result (R)** = absolute % price change from the first bar in the window to the last bar.

2. Computes **ERT** as the “effort per unit of result”:

* More volume and smaller price move → higher ERT (movement is heavy).

* Less volume and bigger price move → lower ERT (movement is easy).

3. Plots a **histogram of ΔERT** – the difference between the current ERT and the previous ERT:

* **Red bar above 0** – current ERT > previous ERT →

*the last N bars were heavier than the previous N bars*.

* **Teal bar below 0** – current ERT < previous ERT →

*the last N bars were easier than the previous N bars*.

4. Optional **normalization window** rescales ΔERT over the last M bars, so extreme spikes do not destroy the readability of the whole histogram. It does not change the logic, only the visual scale.

---

### How to use

* Look for **clusters of high red bars** – segments where price needs noticeably more effort than before to make progress. On up-moves this often appears before slowing, churning or topping; on down-moves it often appears near potential stopping zones.

* Look for **deep teal bars** – segments where price moves easier than before. On rallies this can confirm a strong trend; on declines it can confirm strong selling pressure.

* Divergences between price and the pattern of heavy/light ΔERT can highlight zones where the balance between effort and result is shifting.

Inputs:

* **ERT window (bars)** – how many bars are used to measure effort and result (N).

* **Normalize ΔERT for readability** – on/off for visual normalization.

* **Normalization window (bars)** – how many last bars are used to adapt the scale.

* Colors for “current ERT heavier than previous” and “current ERT lighter than previous”.

This tool measures how *hard* the market is working on every bar and compares the current effort with the previous one. It is built in the spirit of Wyckoff: first we look at the effort (volume), then at the result (price progress), and only after that compare them.

---

### Calculation (logic in simple terms)

For each bar the script:

1. Takes an **ERT window (N bars)** – by default 2 bars:

* **Effort (E)** = sum of volume over the last N bars.

* **Time (T)** = number of bars in the window = N.

* **Result (R)** = absolute % price change from the first bar in the window to the last bar.

2. Computes **ERT** as the “effort per unit of result”:

* More volume and smaller price move → higher ERT (movement is heavy).

* Less volume and bigger price move → lower ERT (movement is easy).

3. Plots a **histogram of ΔERT** – the difference between the current ERT and the previous ERT:

* **Red bar above 0** – current ERT > previous ERT →

*the last N bars were heavier than the previous N bars*.

* **Teal bar below 0** – current ERT < previous ERT →

*the last N bars were easier than the previous N bars*.

4. Optional **normalization window** rescales ΔERT over the last M bars, so extreme spikes do not destroy the readability of the whole histogram. It does not change the logic, only the visual scale.

---

### How to use

* Look for **clusters of high red bars** – segments where price needs noticeably more effort than before to make progress. On up-moves this often appears before slowing, churning or topping; on down-moves it often appears near potential stopping zones.

* Look for **deep teal bars** – segments where price moves easier than before. On rallies this can confirm a strong trend; on declines it can confirm strong selling pressure.

* Divergences between price and the pattern of heavy/light ΔERT can highlight zones where the balance between effort and result is shifting.

Inputs:

* **ERT window (bars)** – how many bars are used to measure effort and result (N).

* **Normalize ΔERT for readability** – on/off for visual normalization.

* **Normalization window (bars)** – how many last bars are used to adapt the scale.

* Colors for “current ERT heavier than previous” and “current ERT lighter than previous”.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Уже 18 лет я торгую на рынках

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

Уже 18 лет я торгую на рынках

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.