PROTECTED SOURCE SCRIPT

Hassi XAUUSD 15TF BUY/SELL (Anchored, Non-Repainting)

What this does

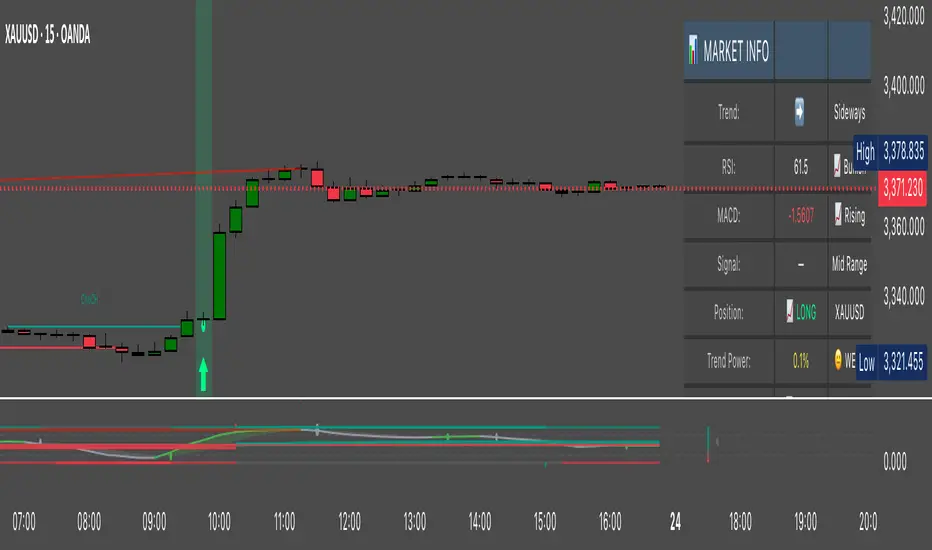

Hassi XAUUSD 15TF BUY/SELL is a non-repainting signal indicator designed for XAUUSD (Gold) on the 15-minute timeframe (also works on BTCUSD). It blends EMA crossover + RSI + MACD with optional volume & volatility filters, and prints anchored BUY/SELL arrows that stay glued to their candle (no visual drifting on zoom/scale/replay). Optional confidence% labels help you judge signal quality at a glance.

Why it’s stable (no repaint)

Signals confirm only on bar close (barstate.isconfirmed).

Arrows/X marks are placed with label.new(x=bar_index, y=high/low, xloc.bar_index, yloc.abovebar/belowbar) so they remain exactly above/below the triggering candle.

No request.security for higher-TF lookaheads; no negative offsets.

How signals are generated

Core trigger: EMA(9) crosses EMA(21)

RSI filter (opt): RSI ≥ RSI Buy Min (default 50) for buys; ≤ RSI Sell Max (default 50) for sells

MACD filter (opt): MACD line crosses its signal or histogram sign matches direction

Volume/ATR filters (opt): require a basic volume spike and above-average ATR volatility (toggleable)

Divergence (opt): lightweight RSI divergence hints (diamond marks)

Anchored markers

BUY: triangle below the signal candle

SELL: triangle above the signal candle

EXIT (❌): small x above (long exit) / below (short exit) when the opposite signal confirms

Nudges: fine-tune vertical placement with tick offsets (inputs) without breaking anchoring

Inputs (defaults)

Fast EMA: 9

Slow EMA: 21

RSI Length: 14

MACD Fast/Slow/Signal: 12 / 26 / 9

Require RSI filter (50 line): ✅

Require MACD cross filter: ✅

RSI Buy Min / RSI Sell Max: 50 / 50

Buy/Sell/Exit Offset (ticks): 0 / 0 / 0

Advanced toggles: Trend Strength ✅, Dynamic Sizing (visual) ✅, Volume Filter ⛔, Volatility Filter ⛔, RSI Divergence ⛔, Show Confidence ✅

Status line/table: ✅

Alerts

Add any of these in Add Alert → Condition: this indicator

Buy Signal → {{ticker}} BUY @ {{close}} - ANCHORED SIGNAL

Sell Signal → {{ticker}} SELL @ {{close}} - ANCHORED SIGNAL

Exit Mark → {{ticker}} EXIT @ {{close}} - ANCHORED EXIT

Recommended use (15-minute XAUUSD)

Use during active sessions (London/NY overlaps).

Keep defaults; enable Volume & Volatility filters in high-noise conditions.

Add confluence (S/R, structure/BOS, session highs/lows, FVG or HTF bias).

Manage risk with structure-based SL or ATR x 1.0–1.5, and partial TP at 1:1–1.5R.

Note: You mentioned it has ~80% win rate on 15TF in your testing. Performance varies by broker feed, session, spread, and risk management. Treat results as educational, not a guarantee.

Non-repainting notes

Signals lock on close; historical arrows are final.

Labels are bar/price anchored (no drift when you zoom or change scale).

Arrays trim old labels automatically to avoid drawing limits.

FAQ

Q: Why don’t past arrows move when I resize the chart?

A: They’re label.new() anchored to bar_index and bar high/low with xloc/yloc, so they stay with the candle.

Q: Can I turn it into a strategy/backtest?

A: Yes—wrap the same signals into strategy.entry/exit, but this release is an indicator by design.

Q: Will it work on BTC or other pairs/timeframes?

A: Yes, but it’s tuned for XAUUSD M15. Adapt filters for other markets.

Changelog

v1.0 — Initial public release: anchored non-repainting arrows, optional RSI/MACD filters, volume/ATR filter, divergence hints, confidence labels, status panel, alerts.

Disclaimer

This tool is for education and analysis only. It is not financial advice. Trading involves risk; do your own research and manage risk responsibly.

Hassi XAUUSD 15TF BUY/SELL is a non-repainting signal indicator designed for XAUUSD (Gold) on the 15-minute timeframe (also works on BTCUSD). It blends EMA crossover + RSI + MACD with optional volume & volatility filters, and prints anchored BUY/SELL arrows that stay glued to their candle (no visual drifting on zoom/scale/replay). Optional confidence% labels help you judge signal quality at a glance.

Why it’s stable (no repaint)

Signals confirm only on bar close (barstate.isconfirmed).

Arrows/X marks are placed with label.new(x=bar_index, y=high/low, xloc.bar_index, yloc.abovebar/belowbar) so they remain exactly above/below the triggering candle.

No request.security for higher-TF lookaheads; no negative offsets.

How signals are generated

Core trigger: EMA(9) crosses EMA(21)

RSI filter (opt): RSI ≥ RSI Buy Min (default 50) for buys; ≤ RSI Sell Max (default 50) for sells

MACD filter (opt): MACD line crosses its signal or histogram sign matches direction

Volume/ATR filters (opt): require a basic volume spike and above-average ATR volatility (toggleable)

Divergence (opt): lightweight RSI divergence hints (diamond marks)

Anchored markers

BUY: triangle below the signal candle

SELL: triangle above the signal candle

EXIT (❌): small x above (long exit) / below (short exit) when the opposite signal confirms

Nudges: fine-tune vertical placement with tick offsets (inputs) without breaking anchoring

Inputs (defaults)

Fast EMA: 9

Slow EMA: 21

RSI Length: 14

MACD Fast/Slow/Signal: 12 / 26 / 9

Require RSI filter (50 line): ✅

Require MACD cross filter: ✅

RSI Buy Min / RSI Sell Max: 50 / 50

Buy/Sell/Exit Offset (ticks): 0 / 0 / 0

Advanced toggles: Trend Strength ✅, Dynamic Sizing (visual) ✅, Volume Filter ⛔, Volatility Filter ⛔, RSI Divergence ⛔, Show Confidence ✅

Status line/table: ✅

Alerts

Add any of these in Add Alert → Condition: this indicator

Buy Signal → {{ticker}} BUY @ {{close}} - ANCHORED SIGNAL

Sell Signal → {{ticker}} SELL @ {{close}} - ANCHORED SIGNAL

Exit Mark → {{ticker}} EXIT @ {{close}} - ANCHORED EXIT

Recommended use (15-minute XAUUSD)

Use during active sessions (London/NY overlaps).

Keep defaults; enable Volume & Volatility filters in high-noise conditions.

Add confluence (S/R, structure/BOS, session highs/lows, FVG or HTF bias).

Manage risk with structure-based SL or ATR x 1.0–1.5, and partial TP at 1:1–1.5R.

Note: You mentioned it has ~80% win rate on 15TF in your testing. Performance varies by broker feed, session, spread, and risk management. Treat results as educational, not a guarantee.

Non-repainting notes

Signals lock on close; historical arrows are final.

Labels are bar/price anchored (no drift when you zoom or change scale).

Arrays trim old labels automatically to avoid drawing limits.

FAQ

Q: Why don’t past arrows move when I resize the chart?

A: They’re label.new() anchored to bar_index and bar high/low with xloc/yloc, so they stay with the candle.

Q: Can I turn it into a strategy/backtest?

A: Yes—wrap the same signals into strategy.entry/exit, but this release is an indicator by design.

Q: Will it work on BTC or other pairs/timeframes?

A: Yes, but it’s tuned for XAUUSD M15. Adapt filters for other markets.

Changelog

v1.0 — Initial public release: anchored non-repainting arrows, optional RSI/MACD filters, volume/ATR filter, divergence hints, confidence labels, status panel, alerts.

Disclaimer

This tool is for education and analysis only. It is not financial advice. Trading involves risk; do your own research and manage risk responsibly.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.