OPEN-SOURCE SCRIPT

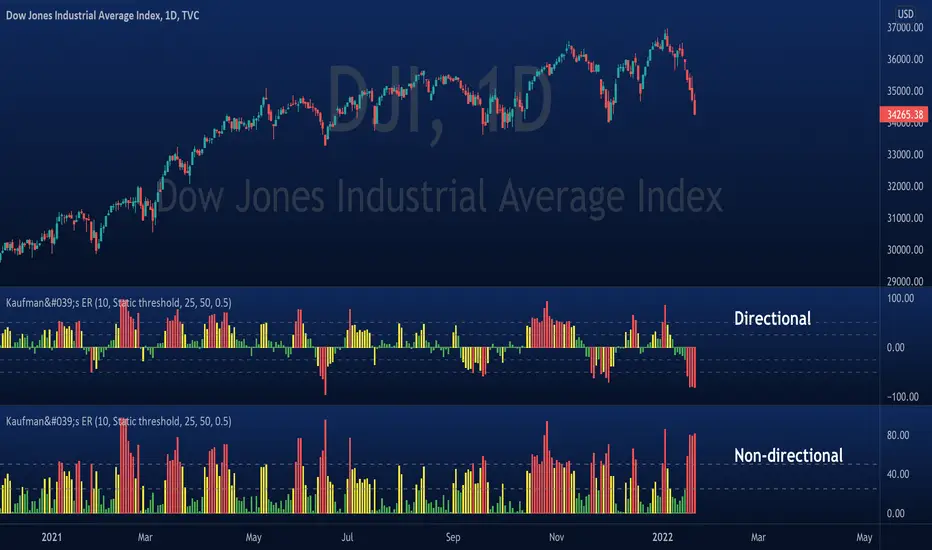

업데이트됨 Kaufman's Efficiency Ratio Indicator

Kaufman Efficiency Ratio ("ER")

This ratio was developed by a systematic trader by the name of Perry J. Kaufman.

Formula

The formula is:

= A divided by B,

where:

Under default settings, closing price is used as source data, and the ER value is expressed in +ve/-ve signs (non-absolute), representing whether price had moved upward/downward over the period.

What this script does:

This script plots out ER and fills in the area beneath the curve with colors according to whether ER is classified as low/medium/high. There are two modes:

- Dynamic mode: low/medium/high is determined by ER value relative to it's mean +/- 'multiple' of standard deviation

- Static mode: low/medium/high is based on user defined thresholds

Applications:

- Can be used for identifying bullish moves in instances where price had already gone up steeply, but rests. If speculating that price will continually rise, then can enter during resting phase.

- Can be used to filter out choppy entry signals produced by existing trade strategies. If trying to enter during periods of consolidation, then ER should ideally be low. On the other hand, for mean reversion strategies, ER should be expected high.

This ratio was developed by a systematic trader by the name of Perry J. Kaufman.

Formula

The formula is:

= A divided by B,

where:

- A = Current closing price minus the closing price at the start of the lookback period

- B = Sum of differences between closing prices (in absolute terms) of consecutive bars over the lookback period

Under default settings, closing price is used as source data, and the ER value is expressed in +ve/-ve signs (non-absolute), representing whether price had moved upward/downward over the period.

What this script does:

This script plots out ER and fills in the area beneath the curve with colors according to whether ER is classified as low/medium/high. There are two modes:

- Dynamic mode: low/medium/high is determined by ER value relative to it's mean +/- 'multiple' of standard deviation

- Static mode: low/medium/high is based on user defined thresholds

Applications:

- Can be used for identifying bullish moves in instances where price had already gone up steeply, but rests. If speculating that price will continually rise, then can enter during resting phase.

- Can be used to filter out choppy entry signals produced by existing trade strategies. If trying to enter during periods of consolidation, then ER should ideally be low. On the other hand, for mean reversion strategies, ER should be expected high.

릴리즈 노트

Can choose between three color modes: (1) Static, (2) Dynamic, and (3) No colorClarification: In Kaufman's book "Trading Systems and Methods", he compares price movements in a high noise market to the analogy of a "drunken sailor trying to walk a straight line". On the other hand, if a market displays no noise, price should be nicely trending straight. Following is an illustration of what this all means:

릴리즈 노트

- switched to using histogram- added horizontal dash lines

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Read Faster & Learn Anything with Coral AI! getcoralai.com//?ref=dojiemoji

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.