OPEN-SOURCE SCRIPT

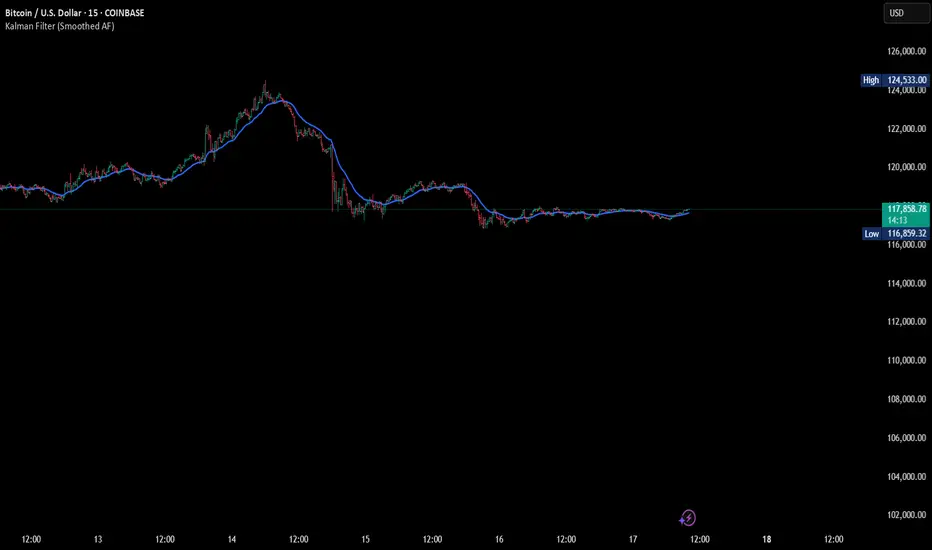

Kalman Filter (Smoothed)

The Kalman Filter is a recursive statistical algorithm that smooths noisy price data while adapting dynamically to new information. Unlike simple moving averages or EMAs, it minimizes lag by balancing measurement noise (R) and process noise (Q), giving traders a clean, adaptive estimate of true price action.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.