OPEN-SOURCE SCRIPT

업데이트됨 Renko Chart

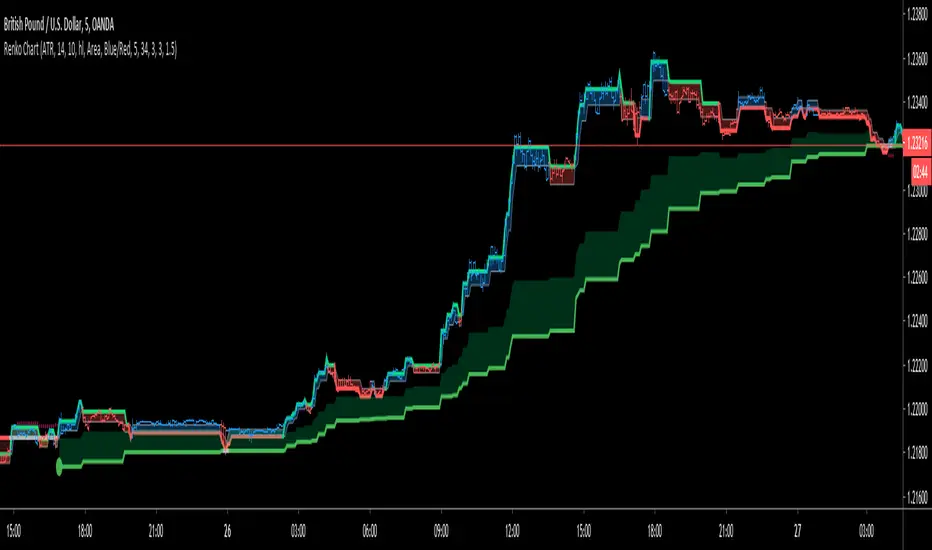

Hello All. This is live and non-repainting Renko Charting tool. The tool has it’s own engine and not using integrated function of Trading View.

Renko charts ignore time and focus solely on price changes that meet a minimum requirement. Time is not a factor on Renko chart but as you can see with this script Renko chart created on time chart.

Renko chart provide several advantages, some of them are filtering insignificant price movements and noise, focusing on important price movements and making support/resistance levels much easier to identify.

in the script Renko Trend Line with threshold area is included. and also there is protection from whipsaws, so you can catch big waves with very good entry points. Trend line is calculated by EMA of Renko closing price.

As source Closing price or High/Low can be used. Traditional or ATR can be used for scaling. If ATR is chosen then there is rounding algorithm according to mintick value of the security. For example if mintick value is 0.001 and brick size (ATR/Percentage) is 0.00124 then box size becomes 0.001. And also while using dynamic brick size (ATR), box size changes only when Renko closing price changed.

Renko bar can be seen as area or candle and also optionally bar color changes when Renko trend changed.

Soon other Renko scripts (Renko RSI, Renko Weis Wave, Renko MACD etc) are coming ;)

ENJOY!

Renko charts ignore time and focus solely on price changes that meet a minimum requirement. Time is not a factor on Renko chart but as you can see with this script Renko chart created on time chart.

Renko chart provide several advantages, some of them are filtering insignificant price movements and noise, focusing on important price movements and making support/resistance levels much easier to identify.

in the script Renko Trend Line with threshold area is included. and also there is protection from whipsaws, so you can catch big waves with very good entry points. Trend line is calculated by EMA of Renko closing price.

As source Closing price or High/Low can be used. Traditional or ATR can be used for scaling. If ATR is chosen then there is rounding algorithm according to mintick value of the security. For example if mintick value is 0.001 and brick size (ATR/Percentage) is 0.00124 then box size becomes 0.001. And also while using dynamic brick size (ATR), box size changes only when Renko closing price changed.

Renko bar can be seen as area or candle and also optionally bar color changes when Renko trend changed.

Soon other Renko scripts (Renko RSI, Renko Weis Wave, Renko MACD etc) are coming ;)

ENJOY!

릴리즈 노트

Updated.릴리즈 노트

Updated릴리즈 노트

Added Breakout Strategy by request by user namsuc_aTwo option for it:

"Length for Breakout" is the length to check breakout. I recommend using 2 or more. it's 1 by default.

"Show Breakout Trend" is the option to show breakout trend, lime and red lines on bricks. lime line means uptrend, red line means downtrend.

An example:

Enjoy!

릴리즈 노트

Fix.릴리즈 노트

improvement in breakout strategy.릴리즈 노트

breakout strategy fixed.릴리즈 노트

Functions that are used in Breakout Strategy was fixed.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🤝 LonesomeTheBlue community

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🤝 LonesomeTheBlue community

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

t.me/LonesomeTheBlue_Official

🎦 YouTube Channel

Youtube.com/@lonesometheblue/videos

💰 Subscription to Pro indicators

Tradingview.com/spaces/LonesomeTheBlue/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.