INVITE-ONLY SCRIPT

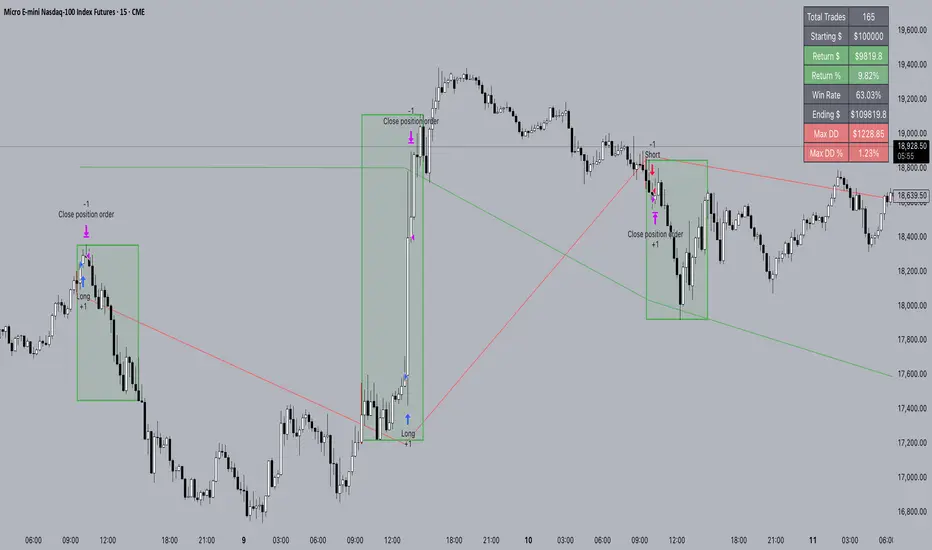

업데이트됨 FXC NQ Opening Range Breakout Strategy V2.4

Mechanical Strategy that trades breakouts on NQ futures on the 15min timeframe during the NYSE session. It's designed to manage Apex and Top Step accounts with the lowest risk possible.

Risk Disclaimer:

Past results as well as strategy tester reports do not indicate future performance. Guarantees do not exist in trading. By using this strategy you risk losing all your money.

Important:

How it works:

Every selected trading day it measures the range of the first 15min candle after the NYSE open. As soon as price closes above on the 15min timeframe, it will trade the breakout targeting a set risk to reward ratio. SL on the opposite side of the range. It will trail the SL after a set amount of points and uses a buffer of the set amount of points to trail it.

Settings:

Backtest Settings:

For the backtest the commissions ere set to 0.35 USD per mini contract which is the highest amount Tradeovate charges. Margin was not accounted for because typically on Apex accounts you can use way more contracts than you need for the extremely low max drawdown. Margin would be important on personal accounts but even there typically it's not an issue at all especially because this strategy runs on the 15min timeframe so it won't use a lot of contracts anyways.

What makes it unique:

This script is unique because it's designed to be used on Apex and Top Step accounts with extremely strict drawdown rules.

The strategy is optimised to be traded with a fixed contract size instead of using % risk. The reason for that is that the drawdown rules of these Futures Prop Accounts are very strict and the fact that the smallest trade-able contract size is 1.

Why the source code is hidden:

The source code is hidden because I invested a lot of time and money into developing this strategy and optimising it with paid 3rd party software. Also since I use it myself on my Apex accounts and prop firms don't allow copy trading I don't want it to be used by too many traders.

Risk Disclaimer:

Past results as well as strategy tester reports do not indicate future performance. Guarantees do not exist in trading. By using this strategy you risk losing all your money.

Important:

- It only trades on Monday, Wednesday and Friday and takes usually only 1 trade per trading day.

- It works on the 15min timeframe only.

- The settings are optimised already for NQ but feel free to change them.

How it works:

Every selected trading day it measures the range of the first 15min candle after the NYSE open. As soon as price closes above on the 15min timeframe, it will trade the breakout targeting a set risk to reward ratio. SL on the opposite side of the range. It will trail the SL after a set amount of points and uses a buffer of the set amount of points to trail it.

Settings:

- Opening Range Time : This is the time of the day in hours and minutes when the strategy starts looking for trades. It's in the EST/ NY Timezone and set to 9:30-09:45 by default

because that's the NYSE open. - Session Time : This is the time of the day in hours and minutes until the strategy trades. It's in the EST/ NY Timezone and set to 09:45-14:45 by default.

because that's what gave the best results in backtesting. Open trades will get closed automatically once the end of the session is reached. No matter if win or loss. This is just to prevent holding positions over night. - Session Border This setting is to select the border color in which the session box will be plotted.

- Opening Range Box This setting is to select the fill color of the opening range box.

- Opening Range Border This setting is to select the border color of the session box.

- Trade Timeframe This setting determines on which timeframe candle has to close outside the opening range box in order to take a trade. It's set to 15min by default because this is what worked by far the best in backtests and live trading.

- Stop Loss Buffer in Points: This is simply the buffer in points that is added to the SL for safety reasons. If you have it on 0, the SL will be at the exact price of the opposite side of the range. By default it's set to 0 pips because this is what delivered the best results in backtests.

- Profit Target Factor: This is simply the total SL size in points multiplied by x.

Example: If you put 2, you get a 1:2 Risk to Reward Ratio. By Default it's set to 4 because this gave the best results in backtests, because trades always get closed either by trailing SL or because the end of the session is reached. - Use Trailing Stop Loss: This setting is to enable/ disable the trailing stop loss. It's enabled by default because this is a fundamental part of the strategy.

- Trailing Stop Buffer: This setting determines after how many points in profit the trailing SL will be activated.

- Risk Type: You can chose either between Fixed USD Amount, Risk per Trade in % or Fixed Contract Size. By default it's set to fixed contract size.

- Risk Amount (USD or Contracts): This setting is to set how many USD or how many contracts you want to risk per trade. Make sure to check which risk type you have selected before you chose the risk amount.

- Use Limit Orders If enabled, the strategy will place a pending order x points from the current price, instead of a market order. Limit orders are enabled by default for a better performance. Important: It doesn't actually place a limit order. The strategy will just wait for a pullback and then enter with a market order. It's more like a hidden limit order.

- Limit Order Distance (points): If you have limit orders enabled, this setting determines how many points from the current price the limit order will be placed.

- Trading Days: These checkboxes are to select on which week days the strategy has to trade. Thursday is disabled by default because backtests have shown that Thursday is the least profitable day

Backtest Settings:

For the backtest the commissions ere set to 0.35 USD per mini contract which is the highest amount Tradeovate charges. Margin was not accounted for because typically on Apex accounts you can use way more contracts than you need for the extremely low max drawdown. Margin would be important on personal accounts but even there typically it's not an issue at all especially because this strategy runs on the 15min timeframe so it won't use a lot of contracts anyways.

What makes it unique:

This script is unique because it's designed to be used on Apex and Top Step accounts with extremely strict drawdown rules.

The strategy is optimised to be traded with a fixed contract size instead of using % risk. The reason for that is that the drawdown rules of these Futures Prop Accounts are very strict and the fact that the smallest trade-able contract size is 1.

Why the source code is hidden:

The source code is hidden because I invested a lot of time and money into developing this strategy and optimising it with paid 3rd party software. Also since I use it myself on my Apex accounts and prop firms don't allow copy trading I don't want it to be used by too many traders.

릴리즈 노트

Change log:- Ticker hard coded to ''MNQ1!'' to prevent wrong use of the script.

- Limit order default distance adjusted.

릴리즈 노트

Change log:- Ticker hard coded to ''MNQ1!'' to prevent wrong use of the script.

- Limit order default distance adjusted.

릴리즈 노트

Change Log:- Daylight saving problem fixed. The strategy will now automatically adjust for daylight saving.

- Parameters optimised for more trades and better performance. (Past performance is no indication for future returns)

- Default settings updated.

릴리즈 노트

Change Log:Maximum SL size setting added (SL Threshold). This feature has been requested by users to prevent big losses due to extreme volatility.

릴리즈 노트

Change Log V2.9:- Added Setting Called ''Exit Trigger Method'' --> You can now choose if the exit (SL, Trailing SL or TP) is triggered when price touches the level or if a candle has to close outside the level.

By Default it's set to ''Candle Close'' - Slightly Adjusted Trading Session Time (until 2pm instead of 2:45pm)

- Adjusted Limit Order Distance to 8 Points

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 timhutter에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

If you want access to the strategy please send me a DM on Tradingview or contact me via the live chat on my website. Link is in my Tradingview profile.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 timhutter에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

If you want access to the strategy please send me a DM on Tradingview or contact me via the live chat on my website. Link is in my Tradingview profile.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.