OPEN-SOURCE SCRIPT

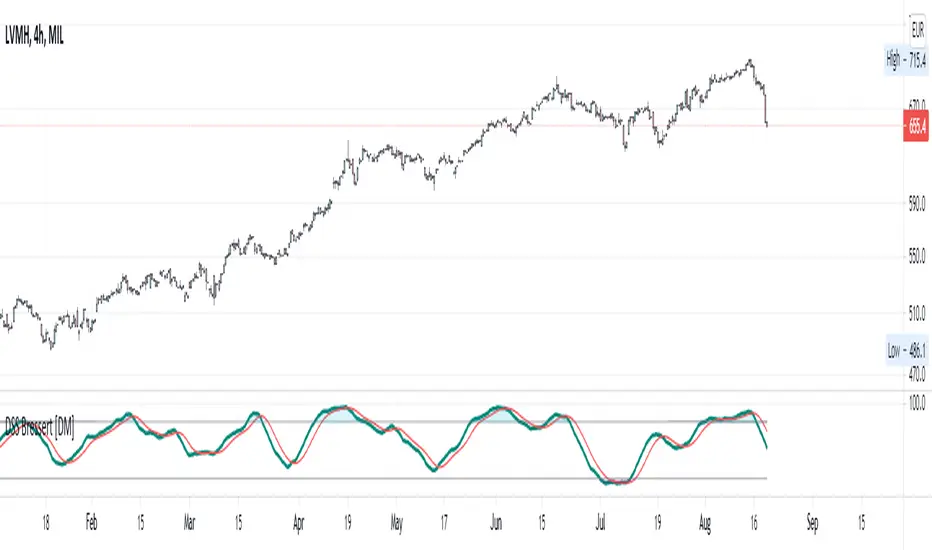

"DSS" Bessert Double Smooth Stochastic Alma Variant

Hi colleagues I share this time DSS bressert.

As usual they have all the adjustable colors and signals. I hope you enjoy them and leave here below the length of signals that best suit your needs so that we can continue sharing content

Description

One after the other, William Blau and Walter Bressert each presented a version of the Double Smoothed Stochastics. Two exponentially smoothed MAs are used to even out the input values (H, L and C), in a similar way to the well-known stochastic formula.

Parameters

The adjustable period length can be chosen from 2 to 500. The most common settings will have a period length ranging from 5 to 30. In addition, the indicator can be smoothed in the interval from 1 to 50. Meaningful smoothing values lie in the short-term range.

Interpretation

The application of the DSS is comparable with that of the stochastic method. Accordingly, values above 70 or 80 must be regarded as overbought and values below 20 or 30 as oversold. A rise of the DSS above its center line should be viewed as bullish, and a fall of the DSS below its center line as bearish.

/// Quick Explained ALMA ///

//Window size: The window size is the look-back period and it is a basic setting of ALMA.

//Experienced traders can change this setting according to their preference.

//But if you are using this indicator for the first time, it is recommended to go with the default setting.

//Offset: The offset value is used to tweak the ALMA so that it will be more inclined

//towards responsiveness or smoothness. You can set the offset in decimals between the 0 to1.

//The value of 0.01 makes it smoother, while a setting of 0.99 makes the indicator more responsive.

//Sigma: The sigma is used for the filter. Any value less than 6 makes the indicator

//more focused, whereas the setting of 6 makes the filter large. According to Mr Arnaud,

//a sigma value of 6 is offer good performance.

/// Explain DSS ///

//Parameters

//The adjustable period length can be chosen from 2 to 500.

//The most common settings will have a period length ranging from 5 to 30.

//In addition, the indicator can be smoothed in the interval from 1 to 50.

//Meaningful smoothing values lie in the short-term range.

//Interpretation

//The application of the DSS is comparable with that of the stochastic method.

//Accordingly, values above 70 or 80 must be regarded as overbought and values below 20 or 30 as oversold.

//A rise of the DSS above its center line should be viewed as bullish,

//and a fall of the DSS below its center line as bearish

/// End Of The Code///

As usual they have all the adjustable colors and signals. I hope you enjoy them and leave here below the length of signals that best suit your needs so that we can continue sharing content

Description

One after the other, William Blau and Walter Bressert each presented a version of the Double Smoothed Stochastics. Two exponentially smoothed MAs are used to even out the input values (H, L and C), in a similar way to the well-known stochastic formula.

Parameters

The adjustable period length can be chosen from 2 to 500. The most common settings will have a period length ranging from 5 to 30. In addition, the indicator can be smoothed in the interval from 1 to 50. Meaningful smoothing values lie in the short-term range.

Interpretation

The application of the DSS is comparable with that of the stochastic method. Accordingly, values above 70 or 80 must be regarded as overbought and values below 20 or 30 as oversold. A rise of the DSS above its center line should be viewed as bullish, and a fall of the DSS below its center line as bearish.

/// Quick Explained ALMA ///

//Window size: The window size is the look-back period and it is a basic setting of ALMA.

//Experienced traders can change this setting according to their preference.

//But if you are using this indicator for the first time, it is recommended to go with the default setting.

//Offset: The offset value is used to tweak the ALMA so that it will be more inclined

//towards responsiveness or smoothness. You can set the offset in decimals between the 0 to1.

//The value of 0.01 makes it smoother, while a setting of 0.99 makes the indicator more responsive.

//Sigma: The sigma is used for the filter. Any value less than 6 makes the indicator

//more focused, whereas the setting of 6 makes the filter large. According to Mr Arnaud,

//a sigma value of 6 is offer good performance.

/// Explain DSS ///

//Parameters

//The adjustable period length can be chosen from 2 to 500.

//The most common settings will have a period length ranging from 5 to 30.

//In addition, the indicator can be smoothed in the interval from 1 to 50.

//Meaningful smoothing values lie in the short-term range.

//Interpretation

//The application of the DSS is comparable with that of the stochastic method.

//Accordingly, values above 70 or 80 must be regarded as overbought and values below 20 or 30 as oversold.

//A rise of the DSS above its center line should be viewed as bullish,

//and a fall of the DSS below its center line as bearish

/// End Of The Code///

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.