OPEN-SOURCE SCRIPT

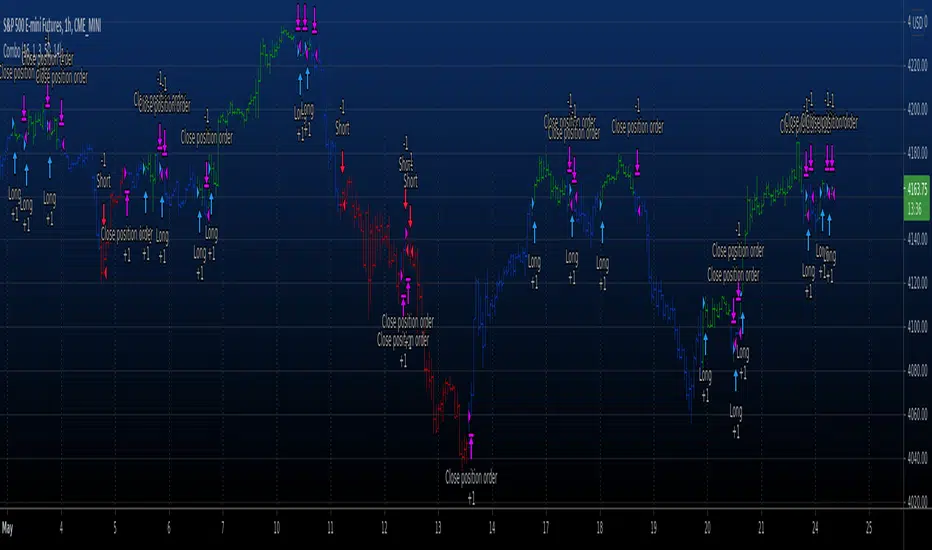

Combo Backtest 123 Reversal & Qstick Indicator

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

A technical indicator developed by Tushar Chande to numerically identify

trends in candlestick charting. It is calculated by taking an 'n' period

moving average of the difference between the open and closing prices. A

Qstick value greater than zero means that the majority of the last 'n' days

have been up, indicating that buying pressure has been increasing.

Transaction signals come from when the Qstick indicator crosses through the

zero line. Crossing above zero is used as the entry signal because it is indicating

that buying pressure is increasing, while sell signals come from the indicator

crossing down through zero. In addition, an 'n' period moving average of the Qstick

values can be drawn to act as a signal line. Transaction signals are then generated

when the Qstick value crosses through the trigger line.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

A technical indicator developed by Tushar Chande to numerically identify

trends in candlestick charting. It is calculated by taking an 'n' period

moving average of the difference between the open and closing prices. A

Qstick value greater than zero means that the majority of the last 'n' days

have been up, indicating that buying pressure has been increasing.

Transaction signals come from when the Qstick indicator crosses through the

zero line. Crossing above zero is used as the entry signal because it is indicating

that buying pressure is increasing, while sell signals come from the indicator

crossing down through zero. In addition, an 'n' period moving average of the Qstick

values can be drawn to act as a signal line. Transaction signals are then generated

when the Qstick value crosses through the trigger line.

WARNING:

- For purpose educate only

- This script to change bars colors.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.