OPEN-SOURCE SCRIPT

Fisher Volume Transform | AlphaNatt

Fisher Volume Transform | AlphaNatt

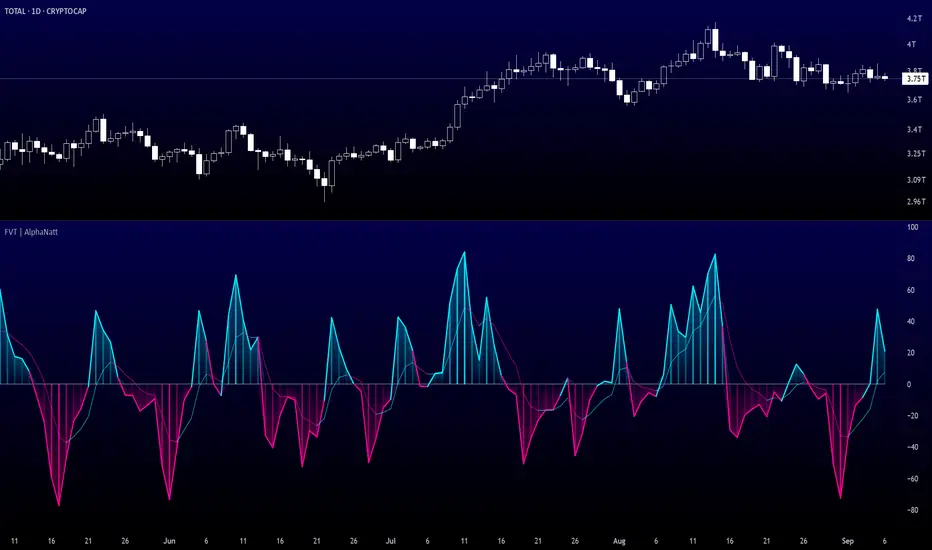

A powerful oscillator that applies the Fisher Transform - converting price into a Gaussian normal distribution - while incorporating volume weighting to identify high-probability reversal points with institutional participation.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎲 THE MATHEMATICS

Fisher Transform Formula:

The Fisher Transform converts any bounded dataset into a Gaussian distribution:

Where x is normalized price (-1 to 1 range)

Why This Matters:

Volume Integration:

Unlike standard Fisher Transform, this version weights price by relative volume:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💎 KEY ADVANTAGES

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ SETTINGS OPTIMIZATION

Fisher Period (5-30):

Volume Weight (0.1-1.0):

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TRADING SIGNALS

Primary Signals:

Visual Interpretation:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 OPTIMAL USAGE

Best Market Conditions:

Trading Strategies:

1. Extreme Reversal:

Enter when oscillator exceeds ±75 and reverses

2. Zero Line Momentum:

Trade crosses of zero line with volume confirmation

3. Signal Line Strategy:

Early entry on signal line crosses

4. Divergence Trading:

Price makes new high/low but Fisher doesn't

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Developed by AlphaNatt | Quantitative Trading Systems

Version: 1.0

Classification: Statistical Transform Oscillator

Not financial advice. Always DYOR.

A powerful oscillator that applies the Fisher Transform - converting price into a Gaussian normal distribution - while incorporating volume weighting to identify high-probability reversal points with institutional participation.

"The Fisher Transform reveals what statistics professors have known for decades: when you transform market data into a normal distribution, turning points become crystal clear."

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎲 THE MATHEMATICS

Fisher Transform Formula:

The Fisher Transform converts any bounded dataset into a Gaussian distribution:

y = 0.5 × ln((1 + x) / (1 - x))

Where x is normalized price (-1 to 1 range)

Why This Matters:

- Market extremes become statistically identifiable

- Turning points are amplified and clarified

- Removes the skew from price distributions

- Creates nearly instantaneous signals at reversals

Volume Integration:

Unlike standard Fisher Transform, this version weights price by relative volume:

- High volume moves get more weight

- Low volume moves get filtered out

- Identifies institutional participation

- Reduces false signals from retail chop

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💎 KEY ADVANTAGES

- Statistical Edge: Transforms price into normal distribution where extremes are mathematically defined

- Volume Confirmation: Only signals with volume support

- Early Reversal Detection: Fisher Transform amplifies turning points

- Clean Signals: Gaussian distribution reduces noise

- No Lag: Mathematical transformation, not averaging

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ SETTINGS OPTIMIZATION

Fisher Period (5-30):

- 5-9: Very sensitive, many signals

- 10: Default - balanced sensitivity

- 15-20: Moderate smoothing

- 25-30: Major reversals only

Volume Weight (0.1-1.0):

- 0.1-0.3: Minimal volume influence

- 0.5-0.7: Balanced price/volume

- 0.7: Default - strong volume weight

- 0.8-1.0: Volume dominant

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TRADING SIGNALS

Primary Signals:

- Zero Cross Up: Bullish momentum shift

- Zero Cross Down: Bearish momentum shift

- Signal Line Cross: Early reversal warning

- Extreme Readings (±75): Potential reversal zones

Visual Interpretation:

- Cyan zones: Bullish momentum

- Magenta zones: Bearish momentum

- Gradient intensity: Strength of move

- Histogram: Raw momentum power

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 OPTIMAL USAGE

Best Market Conditions:

- Range-bound markets (reversals clear)

- High volume periods

- Major support/resistance levels

- Divergence hunting

Trading Strategies:

1. Extreme Reversal:

Enter when oscillator exceeds ±75 and reverses

2. Zero Line Momentum:

Trade crosses of zero line with volume confirmation

3. Signal Line Strategy:

Early entry on signal line crosses

4. Divergence Trading:

Price makes new high/low but Fisher doesn't

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Developed by AlphaNatt | Quantitative Trading Systems

Version: 1.0

Classification: Statistical Transform Oscillator

Not financial advice. Always DYOR.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Free Analysis Platform 👉 alphanatt.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Free Analysis Platform 👉 alphanatt.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.