PROTECTED SOURCE SCRIPT

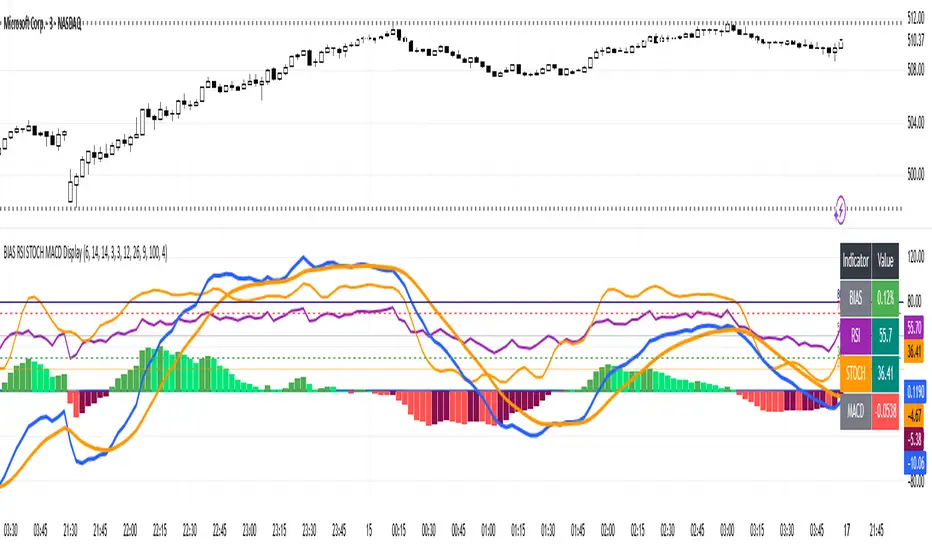

업데이트됨 BIAS RSI STOCH MACD Display

simple but effective to prevent chart clutter.

Hi Traders! Today I’m showing you a **custom indicator** that combines **BIAS, RSI, Stochastic, and MACD** in one easy-to-read panel. Let’s break it down:

1️⃣ **BIAS** – Shows how far the price is from its moving average.

* Positive BIAS → price is above the average.

* Negative BIAS → price is below the average.

2️⃣ **RSI (Relative Strength Index)** – Measures momentum.

* Above 70 → overbought

* Below 30 → oversold

* **50 line added** → midpoint for trend direction

3️⃣ **Stochastic (STOCH)** – Confirms momentum like RSI.

* Above 80 → overbought

* Below 20 → oversold

4️⃣ **MACD (Moving Average Convergence Divergence)** – Shows trend and momentum.

* Histogram colors indicate strength

* Lines show trend direction

5️⃣ **Visual Table** – On the top right, you can see all current indicator values at a glance, with color coding for easy interpretation.

6️⃣ **Plots & Levels** –

* BIAS, RSI, Stoch are plotted clearly

* RSI has **midline at 50** for trend reference

* Standard overbought/oversold levels highlighted

✅ **How to Use:**

* Look for RSI or Stoch crossing midline or extreme levels for potential entries.

* Check MACD histogram and lines for confirmation of trend strength.

* Use BIAS to see if price is stretched from the moving average.

This indicator is perfect for **momentum, trend, and mean-reversion traders**, giving multiple signals in one pane without clutter.

---

Hi Traders! Today I’m showing you a **custom indicator** that combines **BIAS, RSI, Stochastic, and MACD** in one easy-to-read panel. Let’s break it down:

1️⃣ **BIAS** – Shows how far the price is from its moving average.

* Positive BIAS → price is above the average.

* Negative BIAS → price is below the average.

2️⃣ **RSI (Relative Strength Index)** – Measures momentum.

* Above 70 → overbought

* Below 30 → oversold

* **50 line added** → midpoint for trend direction

3️⃣ **Stochastic (STOCH)** – Confirms momentum like RSI.

* Above 80 → overbought

* Below 20 → oversold

4️⃣ **MACD (Moving Average Convergence Divergence)** – Shows trend and momentum.

* Histogram colors indicate strength

* Lines show trend direction

5️⃣ **Visual Table** – On the top right, you can see all current indicator values at a glance, with color coding for easy interpretation.

6️⃣ **Plots & Levels** –

* BIAS, RSI, Stoch are plotted clearly

* RSI has **midline at 50** for trend reference

* Standard overbought/oversold levels highlighted

✅ **How to Use:**

* Look for RSI or Stoch crossing midline or extreme levels for potential entries.

* Check MACD histogram and lines for confirmation of trend strength.

* Use BIAS to see if price is stretched from the moving average.

This indicator is perfect for **momentum, trend, and mean-reversion traders**, giving multiple signals in one pane without clutter.

---

릴리즈 노트

uypdate보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.