OPEN-SOURCE SCRIPT

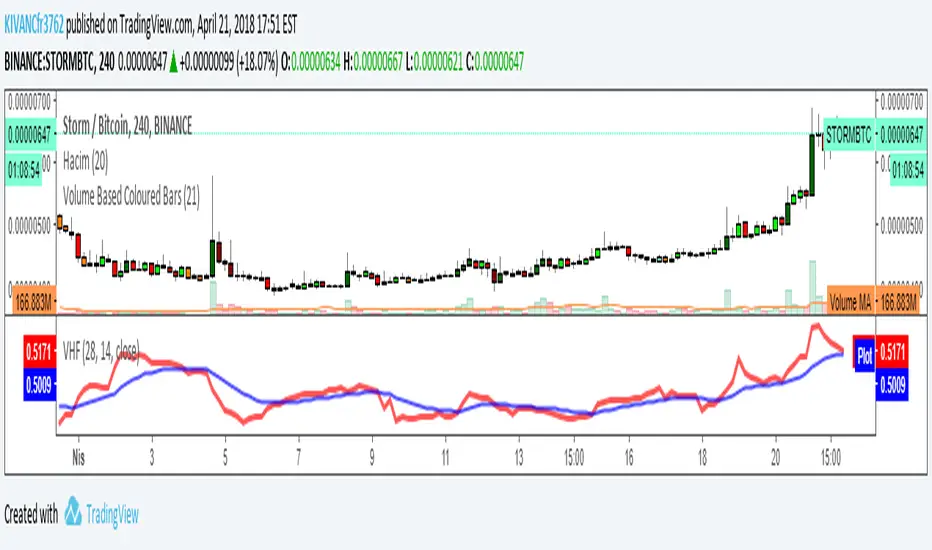

Vertical Horizontal Filter VHF by KIVANÇ fr3762

Vertical Horizontal Filter

Vertical Horizontal Filter (VHF) was created by Adam White to identify trending and ranging markets. VHF measures the level of trend activity, similar to ADX in the Directional Movement System. Trend indicators can then be employed in trending markets and momentum indicators in ranging markets.

Vary the number of periods in the Vertical Horizontal Filter to suit different time frames. White originally recommended 28 days but now prefers an 18-day window smoothed with a 6-day moving average.

Trading Signals

Vertical Horizontal Filter does not, itself, generate trading signals, but determines whether signals are taken from trend or momentum indicators.

Rising values indicate a trend.

Falling values indicate a ranging market.

High values precede the end of a trend.

Low values precede a trend start.

I have added an option to plot a deafult value of 14 bar EMA too, to clarify the signals.

Formula

To calculate the Vertical Horizontal Filter:

Select the number of periods (n) to include in the indicator. This should be based on the length of the cycle that you are analyzing. The most popular is 28 days (for intermediate cycles).

Determine the highest closing price ( HCP ) in n periods.

Determine the lowest closing price (LCP) in n periods.

Calculate the range of closing prices in n periods:

HCP - LCP

Next, calculate the movement in closing price for each period:

Closing price - Closing price

Add up all price movements for n periods, disregarding whether they are up or down:

Sum of absolute values of ( Close - Close ) for n periods

Divide Step 4 by Step 6:

VHF = ( HCP - LCP) / (Sum of absolute values for n periods)

created by Adam White

Vertical Horizontal Filter (VHF) was created by Adam White to identify trending and ranging markets. VHF measures the level of trend activity, similar to ADX in the Directional Movement System. Trend indicators can then be employed in trending markets and momentum indicators in ranging markets.

Vary the number of periods in the Vertical Horizontal Filter to suit different time frames. White originally recommended 28 days but now prefers an 18-day window smoothed with a 6-day moving average.

Trading Signals

Vertical Horizontal Filter does not, itself, generate trading signals, but determines whether signals are taken from trend or momentum indicators.

Rising values indicate a trend.

Falling values indicate a ranging market.

High values precede the end of a trend.

Low values precede a trend start.

I have added an option to plot a deafult value of 14 bar EMA too, to clarify the signals.

Formula

To calculate the Vertical Horizontal Filter:

Select the number of periods (n) to include in the indicator. This should be based on the length of the cycle that you are analyzing. The most popular is 28 days (for intermediate cycles).

Determine the highest closing price ( HCP ) in n periods.

Determine the lowest closing price (LCP) in n periods.

Calculate the range of closing prices in n periods:

HCP - LCP

Next, calculate the movement in closing price for each period:

Closing price - Closing price

Add up all price movements for n periods, disregarding whether they are up or down:

Sum of absolute values of ( Close - Close ) for n periods

Divide Step 4 by Step 6:

VHF = ( HCP - LCP) / (Sum of absolute values for n periods)

created by Adam White

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.