OPEN-SOURCE SCRIPT

Elliott Wave [BigBeluga]

🔵 OVERVIEW

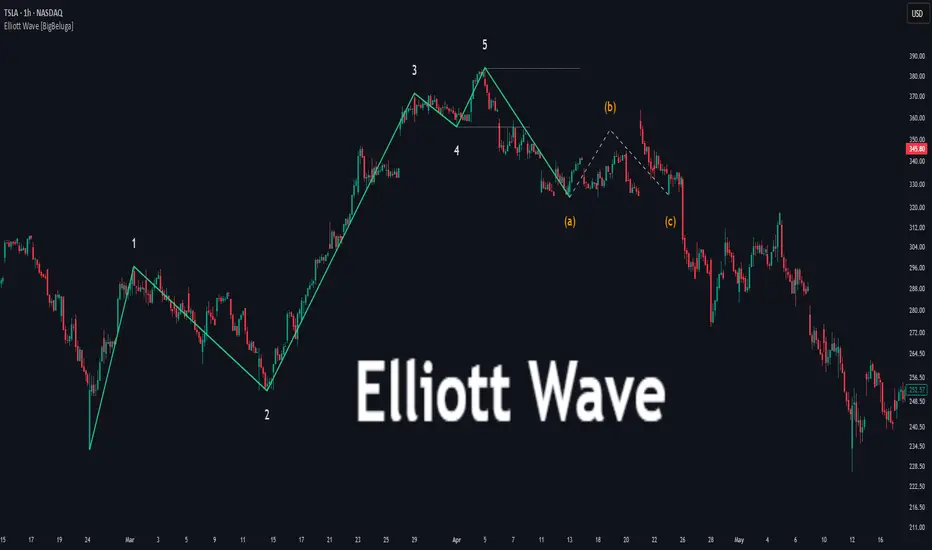

Elliott Wave [BigBeluga] automatically finds and draws an Elliott-style 5-wave impulse and a dashed projection for a potential -(a)→(b)→(c) correction. It detects six sequential reversal points from rolling highs/lows — 1, 2, 3, 4, 5, (a) — validates their relative placement, and then renders the wave with labels and horizontal reference lines. If price invalidates the structure by closing back through the Wave-5 level inside a 100-bar window, the pattern is cleared (optionally kept as “broken”) while key dotted levels remain for context.

🔵 CONCEPTS

🔵 FEATURES

🔵 HOW TO USE

🔵 CONCLUSION

Elliott Wave [BigBeluga] systematizes discretionary wave analysis: it detects and labels the 5-wave impulse, projects a plausible (a)-(b)-(c) path, and self-cleans on invalidation. With clear labels, dotted reference levels, and a practical breaker rule, it gives traders an objective framework for scenario planning, invalidation, and timing.

Elliott Wave [BigBeluga] automatically finds and draws an Elliott-style 5-wave impulse and a dashed projection for a potential -(a)→(b)→(c) correction. It detects six sequential reversal points from rolling highs/lows — 1, 2, 3, 4, 5, (a) — validates their relative placement, and then renders the wave with labels and horizontal reference lines. If price invalidates the structure by closing back through the Wave-5 level inside a 100-bar window, the pattern is cleared (optionally kept as “broken”) while key dotted levels remain for context.

🔵 CONCEPTS

- Reversal harvesting from extremes: The script scans highest/lowest values over a user-set Length and stores swing points with their bar indices.

- Six-point validation: A pattern requires six pivots (1…5 and (a)). Their vertical/temporal order must satisfy Elliott-style constraints before drawing.

- Impulse + projection: After confirming 1→5, the tool plots a curved polyline through the pivots and a dashed forward path from (a) toward (b) (midpoint of 5 and (a)) and back to (c).

- Risk line (invalidator): The Wave-5 price is tracked; a close back through it within 100 bars marks the structure as broken.

- Minimal persistence: When broken, the wave drawing is removed to avoid noise, while dotted horizontals for waves 5 and 4 remain as reference.

🔵 FEATURES

- Automatic pivot collection from rolling highs/lows (user-controlled Length).

- Wave labeling: Points 1–5 are printed; the last collected swing is marked b

. Projected i

& i

are shown with a dashed polyline. - Breaker line & cleanup: If price closes above Wave-5 (opposite for bears) within 100 bars, the pattern is removed; only dotted levels of 5 and 4 stay.

- Styling controls:

Length (pivot sensitivity)

Text Size for labels (tiny/small/normal/large)

Wave color input

Show Broken toggle to keep invalidated patterns visible - Lightweight memory: Keeps a compact buffer of recent pivots/draws to stay responsive.

🔵 HOW TO USE

- Set sensitivity: Increase Length on noisy charts for cleaner pivots; decrease to catch earlier/shorter structures.

- Wait for confirmation: Once 1→5 is printed and (a) appears, use the Wave-5 line as your invalidation. A close back through it within ~100 bars removes the active wave (unless Show Broken is on).

- Plan with the dashed path: The (a)→(b)→(c) projection offers a scenario for potential corrective movement and risk placement.

- Work MTF: Identify cleaner waves on higher TFs; refine execution on lower TFs near the breaker or during the move toward (b).

- Seek confluence: Align with structure (S/R), volume/Delta, or your trend filter to avoid counter-context trades.

🔵 CONCLUSION

Elliott Wave [BigBeluga] systematizes discretionary wave analysis: it detects and labels the 5-wave impulse, projects a plausible (a)-(b)-(c) path, and self-cleans on invalidation. With clear labels, dotted reference levels, and a practical breaker rule, it gives traders an objective framework for scenario planning, invalidation, and timing.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.