OPEN-SOURCE SCRIPT

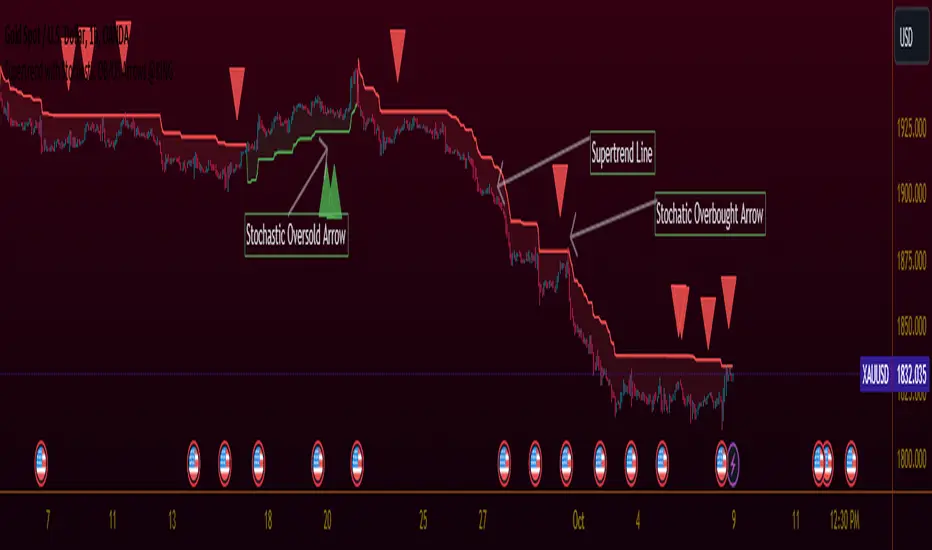

업데이트됨 Supertrend with Stochastic OB/OS Arrows @KING

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market

view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the

price.

Supertrend Display:

* The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the

oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the

overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the

insights provided by both the Supertrend indicator and Stochastic oscillator. This

combination aims to capture trend strength and potential reversal opportunities.

릴리즈 노트

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the price.

Supertrend Display:

- The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the insights provided by both the Supertrend indicator and Stochastic oscillator. This combination aims to capture trend strength and potential reversal opportunities.

---

This format uses for bold and

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.