INVITE-ONLY SCRIPT

Institutional VWAPs

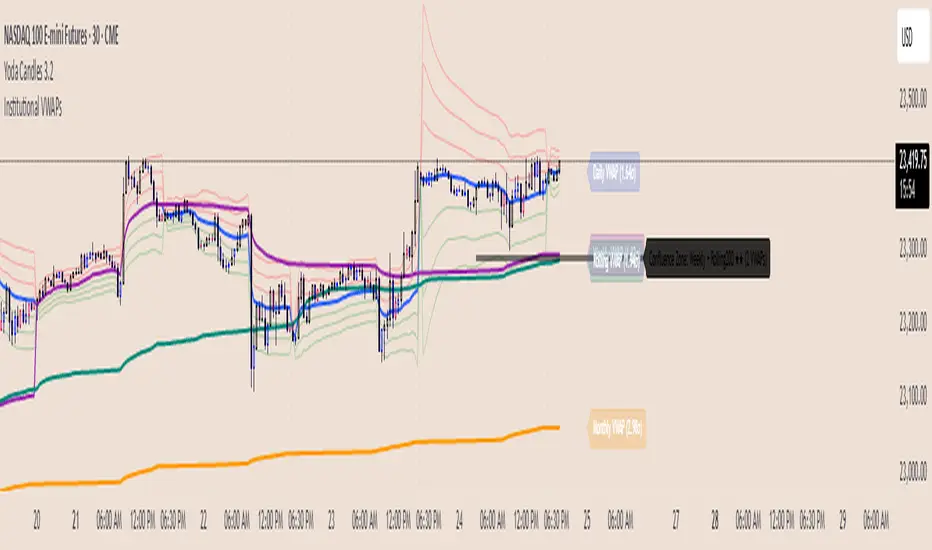

📊 Institutional VWAPs - Multi-Timeframe Confluence Detection

Track the VWAP levels that institutions are watching. This comprehensive indicator identifies high-probability reversal zones by detecting confluences between multiple timeframe VWAPs.

✨ Key Features:

4 Customizable VWAPs - Mix Daily, Weekly, Monthly, Quarterly, Yearly, RTH, or Rolling anchors

Institutional Rolling VWAP - Default 200-period used by algorithms and smart money

Automatic Confluence Detection - Highlights zones where multiple VWAPs converge

Standard Deviation Bands - 1, 2, and 3 sigma levels for mean reversion trades

Real-time Distance Tracking - Shows current price position in standard deviations

Clean Visual Design - Professional appearance with customizable colors and styles

🎯 Perfect For:

Day traders seeking institutional support/resistance levels

Swing traders identifying high-probability reversal zones

Scalpers trading mean reversion from deviation bands

Anyone wanting to see where algorithms are positioned

💡 How It Works:

The indicator monitors up to 4 VWAPs simultaneously and automatically detects when they converge within your specified threshold. These confluence zones act as powerful magnets for price action, often marking significant reversals.

🔧 Smart Defaults:

VWAP 1: Daily (Primary intraday anchor)

VWAP 2: RTH (Regular Trading Hours)

Rolling: 200-period (Institutional standard)

Confluence threshold: 0.2% (Optimal for most instruments)

Stop guessing where institutions are positioned. See exactly where the smart money is watching.

Track the VWAP levels that institutions are watching. This comprehensive indicator identifies high-probability reversal zones by detecting confluences between multiple timeframe VWAPs.

✨ Key Features:

4 Customizable VWAPs - Mix Daily, Weekly, Monthly, Quarterly, Yearly, RTH, or Rolling anchors

Institutional Rolling VWAP - Default 200-period used by algorithms and smart money

Automatic Confluence Detection - Highlights zones where multiple VWAPs converge

Standard Deviation Bands - 1, 2, and 3 sigma levels for mean reversion trades

Real-time Distance Tracking - Shows current price position in standard deviations

Clean Visual Design - Professional appearance with customizable colors and styles

🎯 Perfect For:

Day traders seeking institutional support/resistance levels

Swing traders identifying high-probability reversal zones

Scalpers trading mean reversion from deviation bands

Anyone wanting to see where algorithms are positioned

💡 How It Works:

The indicator monitors up to 4 VWAPs simultaneously and automatically detects when they converge within your specified threshold. These confluence zones act as powerful magnets for price action, often marking significant reversals.

🔧 Smart Defaults:

VWAP 1: Daily (Primary intraday anchor)

VWAP 2: RTH (Regular Trading Hours)

Rolling: 200-period (Institutional standard)

Confluence threshold: 0.2% (Optimal for most instruments)

Stop guessing where institutions are positioned. See exactly where the smart money is watching.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Anth0nyy에게 직접 문의하세요.

이 프라이빗, 인바이트-온리 스크립트는 스크립트 관리자가 리뷰하지 않았으며 하우스 룰 준수 여부가 결정되지 않았습니다. 트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 Anth0nyy에게 직접 문의하세요.

이 프라이빗, 인바이트-온리 스크립트는 스크립트 관리자가 리뷰하지 않았으며 하우스 룰 준수 여부가 결정되지 않았습니다. 트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

경고: 액세스를 요청하기 앞서 초대 전용 스크립트에 대한 가이드를 읽어주세요.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.