OPEN-SOURCE SCRIPT

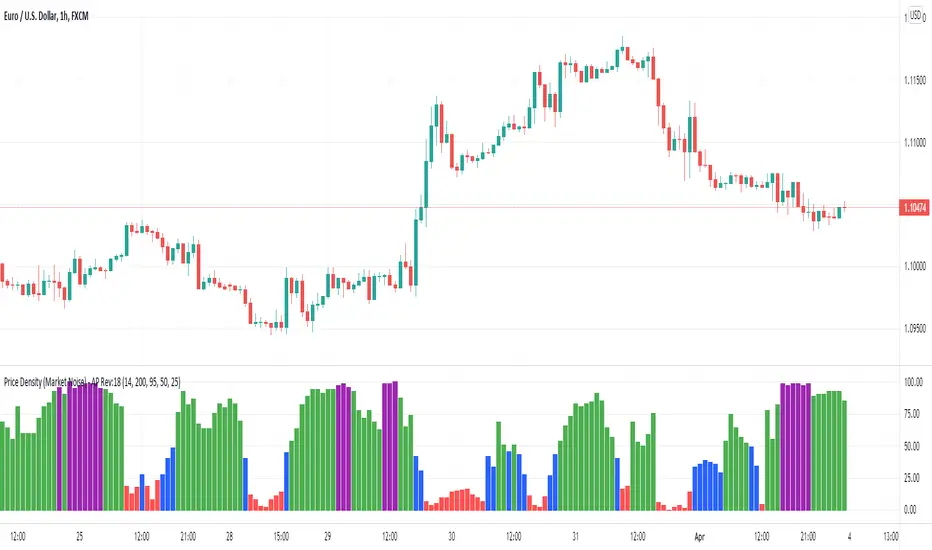

업데이트됨 Price Density (Market Noise) by Alejandro P

This is an indicator based on the Price Density concept. Price Density is a quantifiable method of measuring market noise for a certain period of candles.

This indicator also has the option to use relative percentile values which transforms the indicator from an absolute value measure to a percentile based measure so it can be more easily compared across vastly different assets.

We can use Price Density to set rules and only trade particular systems when noise is at an appropriate level. For example, if noise is high then we would want to avoid trend following strategies and instead trade mean-reversion strategies, and vice-versa when the opposite is true. Price Density can also be used to match assets to strategies. Some assets will be naturally more noisy than others and therefore we might have a principle where we only trade those noisy assets with our mean reversion strategies and the more quiet assets with trend following strategies.

Price Density can be used by looking at indicator and seeing how efficiently the indicator line moves from one side to the other. Is it in a straight line? Or are there lots of zigs and zags? The straighter the line, the less market noise there is.

Calculations:

Price Density = Sum(ATR(1), Length) / (Max(High) - Min(Low))

The numerator on top looks at the high of each of the bars, the low of a bar, calculates the difference and then sums up all of those values for the time period. This gives us an idea of the fluctuation of the individual price moves. Next, the denominator uses the maximum value from all of the highs of those bars and subtracts the minimum low out of all of the bars. This gives us the range or the height of the box and so if there's a lot of price fluctuation compared to the actual range this means we'll have a high value which gives the indication that we have high levels of noise. If however those individual fluctuations are small compared to the range this means we'll get a low value for the price density and therefore have low levels of noise.

This indicator also has the option to use relative percentile values which transforms the indicator from an absolute value measure to a percentile based measure so it can be more easily compared across vastly different assets.

We can use Price Density to set rules and only trade particular systems when noise is at an appropriate level. For example, if noise is high then we would want to avoid trend following strategies and instead trade mean-reversion strategies, and vice-versa when the opposite is true. Price Density can also be used to match assets to strategies. Some assets will be naturally more noisy than others and therefore we might have a principle where we only trade those noisy assets with our mean reversion strategies and the more quiet assets with trend following strategies.

Price Density can be used by looking at indicator and seeing how efficiently the indicator line moves from one side to the other. Is it in a straight line? Or are there lots of zigs and zags? The straighter the line, the less market noise there is.

Calculations:

Price Density = Sum(ATR(1), Length) / (Max(High) - Min(Low))

The numerator on top looks at the high of each of the bars, the low of a bar, calculates the difference and then sums up all of those values for the time period. This gives us an idea of the fluctuation of the individual price moves. Next, the denominator uses the maximum value from all of the highs of those bars and subtracts the minimum low out of all of the bars. This gives us the range or the height of the box and so if there's a lot of price fluctuation compared to the actual range this means we'll have a high value which gives the indication that we have high levels of noise. If however those individual fluctuations are small compared to the range this means we'll get a low value for the price density and therefore have low levels of noise.

릴리즈 노트

Updated to pinescript V5오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.