INVITE-ONLY SCRIPT

업데이트됨 Market Volatility Momentum + Trend Filter Pro @MaxMaserati

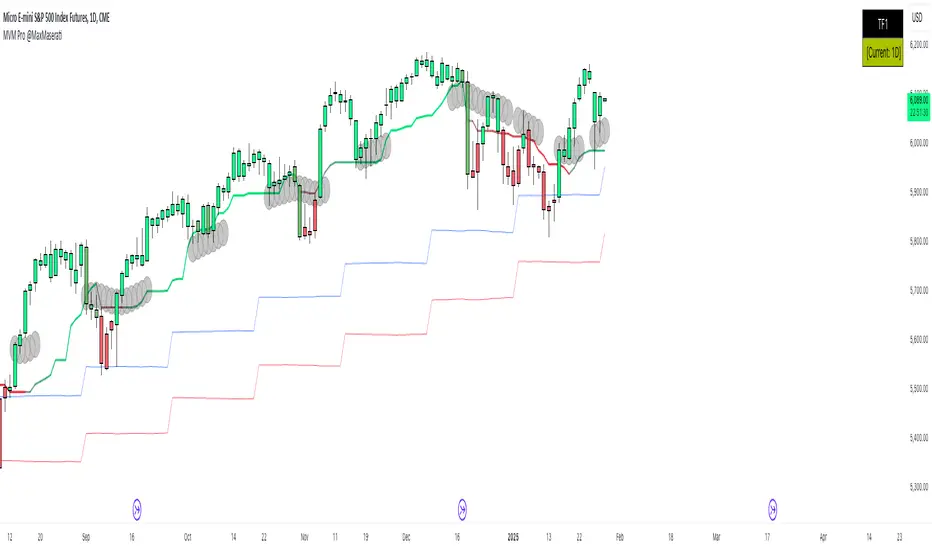

# 📊 Market Volatility Momentum + Trend Filter Pro

## 🎯 Overview

An enhanced version of the Market Momentum Indicator, combining the power of momentum analysis with adaptive volatility bands and trend filtering. This professional tool helps traders identify market direction and potential momentum shifts with greater precision.

## 🔄 Core Momentum Components

### 📈 Momentum Line

- Calculated using the midpoint between highest and lowest prices over 14 periods

- Provides a clear reference for price direction

- Acts as a dynamic support/resistance level

### 📉 Momentum Signal

- Offset from the Momentum Line by 0.25 tick size

- Creates a precise visual guide for momentum shifts

- Standard increment compatible with most markets

## 💫 Enhanced Features

### 🌊 Trend Filter

- Dynamic color-coding system showing trend strength

- Customizable length and damping parameters

- Visual identification of neutral market conditions

### 📊 Volatility Bands

- Adaptive bands that expand and contract with market volatility

- Choice between short-term and long-term trend adaptation

- Provides additional confirmation of trend strength

## 📝 Trading Signals

### 📈 Bullish Momentum

- Both momentum lines below price

- Enhanced by trend filter color confirmation

- Supported by volatility band positioning

### 📉 Bearish Momentum

- Both momentum lines above price

- Confirmed by trend filter color signals

- Reinforced by volatility band context

### ⚖️ Consolidation

- Momentum lines within price range

- Neutral trend indication with deep blue area

- Potential breakout preparation phase

## ⚙️ Multi-Timeframe Analysis

- Dual timeframe capability for comprehensive market view

- Custom timeframe selection with current chart reference

- Real-time timeframe display in top-right corner

## 🎨 Visual Features

- Dynamic bar coloring system reflecting trend strength

- Clear trend visualization through color gradients

- Optional line smoothing for reduced noise

- Customizable color schemes

## 💡 Tips for Usage

1. Monitor the position of price relative to momentum lines

2. Use trend filter colors for confirmation

3. Watch for convergence with volatility bands

4. Pay attention to neutral market signals

5. Utilize multi-timeframe analysis for better context

## ⚠️ Important Notes

- Originally designed without smoothing (smoothing optional)

- Best used with multiple timeframe analysis

- Provides clearest signals in trending markets

- Works effectively across all tradable assets

Note: Past performance doesn't guarantee future results. Always practice proper risk management and develop your trading plan.

## 🎯 Overview

An enhanced version of the Market Momentum Indicator, combining the power of momentum analysis with adaptive volatility bands and trend filtering. This professional tool helps traders identify market direction and potential momentum shifts with greater precision.

## 🔄 Core Momentum Components

### 📈 Momentum Line

- Calculated using the midpoint between highest and lowest prices over 14 periods

- Provides a clear reference for price direction

- Acts as a dynamic support/resistance level

### 📉 Momentum Signal

- Offset from the Momentum Line by 0.25 tick size

- Creates a precise visual guide for momentum shifts

- Standard increment compatible with most markets

## 💫 Enhanced Features

### 🌊 Trend Filter

- Dynamic color-coding system showing trend strength

- Customizable length and damping parameters

- Visual identification of neutral market conditions

### 📊 Volatility Bands

- Adaptive bands that expand and contract with market volatility

- Choice between short-term and long-term trend adaptation

- Provides additional confirmation of trend strength

## 📝 Trading Signals

### 📈 Bullish Momentum

- Both momentum lines below price

- Enhanced by trend filter color confirmation

- Supported by volatility band positioning

### 📉 Bearish Momentum

- Both momentum lines above price

- Confirmed by trend filter color signals

- Reinforced by volatility band context

### ⚖️ Consolidation

- Momentum lines within price range

- Neutral trend indication with deep blue area

- Potential breakout preparation phase

## ⚙️ Multi-Timeframe Analysis

- Dual timeframe capability for comprehensive market view

- Custom timeframe selection with current chart reference

- Real-time timeframe display in top-right corner

## 🎨 Visual Features

- Dynamic bar coloring system reflecting trend strength

- Clear trend visualization through color gradients

- Optional line smoothing for reduced noise

- Customizable color schemes

## 💡 Tips for Usage

1. Monitor the position of price relative to momentum lines

2. Use trend filter colors for confirmation

3. Watch for convergence with volatility bands

4. Pay attention to neutral market signals

5. Utilize multi-timeframe analysis for better context

## ⚠️ Important Notes

- Originally designed without smoothing (smoothing optional)

- Best used with multiple timeframe analysis

- Provides clearest signals in trending markets

- Works effectively across all tradable assets

Note: Past performance doesn't guarantee future results. Always practice proper risk management and develop your trading plan.

릴리즈 노트

- Bugs fix초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 MaxMaserati에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access: https://whop.com/max-maserati/

MMM : No body close (PO4), No Trade.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 MaxMaserati에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Access: https://whop.com/max-maserati/

MMM : No body close (PO4), No Trade.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.