OPEN-SOURCE SCRIPT

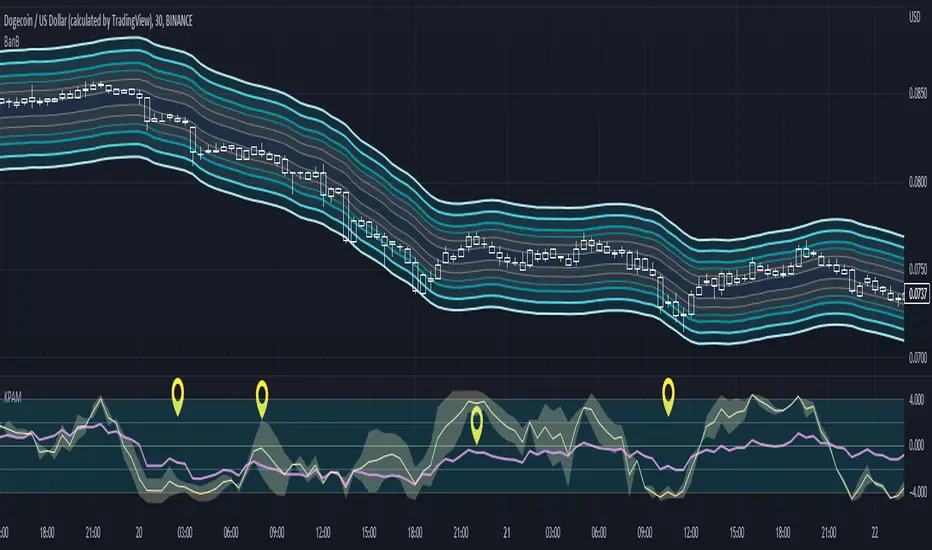

업데이트됨 Key Points of Adjoining Median (KPAM)

This indicator shows more reliable overbought & oversold levels buy combing 3 different level-indicators (i.e., indicators showing overbought/oversold levels).

A median is created by adjoining two of them and then it is assisted by a third one.

This reduces noise in calculating entries when using level indicators.

Note: The extra indicator shown is "Bands Bands (BanB)"

----- HOW TO USE IT -----

Use with price-action trading and with indicators showing the overall trend.

See notes in chart for more explanation.

The high and low levels of the RSI are within a range of 2 & -2 respectively.

The high and low levels for the median range from 4 & -4 respectively.

The Discordance shows how certain the level of the median is.

For example, if a part of the Discordance touches a low level while the median is at a higher level, then it usually indicates that the median is about to reverse.

The more Discordance that is visible, the less certain the current trend of the median is.

----- HOW THIS INDICATOR IS ORIGINAL; WHAT IT DOES AND HOW IT DOES IT -----

This indicator has an original, unique ability to reduce noise when comparing overbought and oversold levels.

It does this by first adjoining the Stochastic and the Stochastic RSI. Second, it creates a median from the two.

Third, the median is compared to the RSI on the same scale to assist in deciding where the median is at in relation to itself.

It shows whether the median lows and highs are near overbought or oversold levels.

----- VERSION -----

This is not a variant of the Stochastic, Stochastic RSI, and/or the RSI.

The focus is on the median that is created by an adjoining of the Stochastic and Stochastic RSI.

The Stochastic and Stochastic RSI are needed in order to obtain and plot the Median and the Discordance.

The RSI is plotted on the same scale to serve as the comparison needed to evaluate the Median levels with more visual accuracy.

A median is created by adjoining two of them and then it is assisted by a third one.

This reduces noise in calculating entries when using level indicators.

Note: The extra indicator shown is "Bands Bands (BanB)"

----- HOW TO USE IT -----

Use with price-action trading and with indicators showing the overall trend.

See notes in chart for more explanation.

The high and low levels of the RSI are within a range of 2 & -2 respectively.

The high and low levels for the median range from 4 & -4 respectively.

The Discordance shows how certain the level of the median is.

For example, if a part of the Discordance touches a low level while the median is at a higher level, then it usually indicates that the median is about to reverse.

The more Discordance that is visible, the less certain the current trend of the median is.

----- HOW THIS INDICATOR IS ORIGINAL; WHAT IT DOES AND HOW IT DOES IT -----

This indicator has an original, unique ability to reduce noise when comparing overbought and oversold levels.

It does this by first adjoining the Stochastic and the Stochastic RSI. Second, it creates a median from the two.

Third, the median is compared to the RSI on the same scale to assist in deciding where the median is at in relation to itself.

It shows whether the median lows and highs are near overbought or oversold levels.

----- VERSION -----

This is not a variant of the Stochastic, Stochastic RSI, and/or the RSI.

The focus is on the median that is created by an adjoining of the Stochastic and Stochastic RSI.

The Stochastic and Stochastic RSI are needed in order to obtain and plot the Median and the Discordance.

The RSI is plotted on the same scale to serve as the comparison needed to evaluate the Median levels with more visual accuracy.

릴리즈 노트

Added additional customization options for more visual clarity.릴리즈 노트

Added an EMA of the KPAM.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.