OPEN-SOURCE SCRIPT

Engulfing [TradingFinder] Bullish & Bearish CandleStick Pattern

🔵Introduction

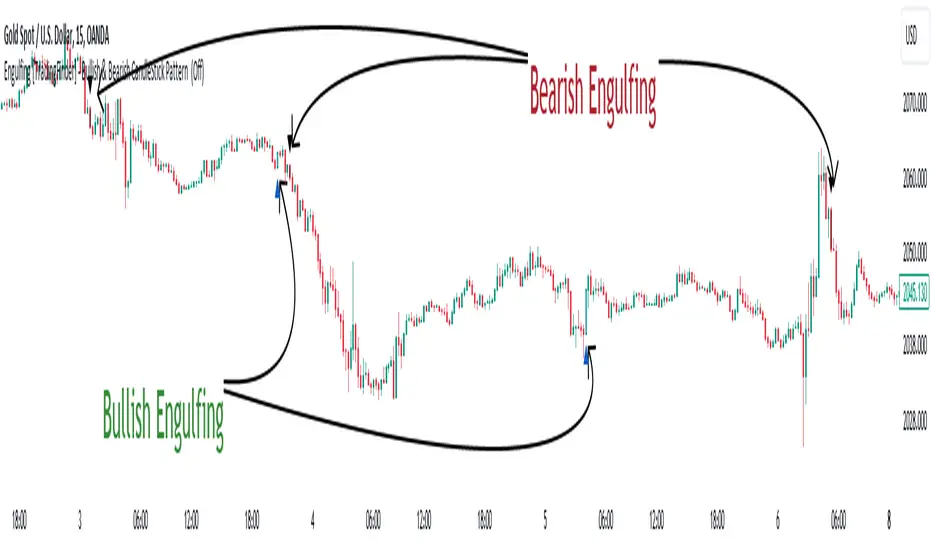

The candlestick engulfing pattern is important pattern in technical analysis that can be observed in candlestick charts. This pattern occurs when a complete candle engulfs or "engulfs" the body of a previous candle, meaning that the body of the new candle completely covers the body of the previous candle.

The candlestick engulfing pattern has two types: the bullish engulfing pattern and the bearish engulfing pattern.

• Bullish Engulfing Pattern: This pattern occurs when a market candle opens with a larger and higher body than the previous market candle and completely covers the body of the previous candle. This pattern may indicate the presence of strong buying pressure and a potential change in price direction upwards.

• Bearish Engulfing Pattern: This pattern occurs when a market candle opens with a larger and lower body than the previous market candle and completely covers the body of the previous candle. This pattern may indicate the presence of strong selling pressure and a potential change in price direction downwards.

The candlestick engulfing pattern is usually used as a valid signal for a change in price direction in the market and can enhance a combination of crossover investments and technical analysis. However, it should always be evaluated alongside other indicators and market factors, and counter decisions should be made accordingly.

🔵Recognition Method

Correct, the candlestick engulfing pattern is one of the important patterns in technical analysis that is typically used as a strong signal for a valid change in price direction in the market. This pattern occurs when a candle (usually in the market) opens with a larger and higher (for bullish engulfing pattern) or lower (for bearish engulfing pattern) body than a previous market candle and completely covers the body of the previous candle.

Example of Bullish Engulfing Pattern:

• First Candle: A bearish (downward) candle with a small red body.

• Second Candle: A bullish (upward) candle with a larger body that completely covers the body of the previous candle.

This pattern may indicate a change in price direction from downward to upward.

Example of Bearish Engulfing Pattern:

• First Candle: A bullish (upward) candle with a small green body.

• Second Candle: A bearish (downward) candle with a larger body that completely covers the body of the previous candle.

This pattern may indicate a change in price direction from upward to downward.

The most important point is that the candlestick engulfing pattern should be carefully considered and always evaluated alongside other market indicators and overall conditions. For example, the engulfing pattern near important support or resistance levels, during significant market command changes, or accompanied by other technical signals can have greater signaling power.

🟣"Bullish Engulfing" Candle

• The first candle is bullish and the second candle is bearish.

• At the end of a downtrend.

• The closing of the first candle is above the opening of the second candle.

• The high of the first candle is higher than the high of the second candle.

Optimal Condition:

• The closing of the first candle is higher than the high of the second candle.

• More than 80% of the first candle is bullish.

🟣"Bearish Engulfing" Candle

• The first candle is bearish and the second candle is bullish.

• At the end of an uptrend.

• The closing of the first candle is below the opening of the second candle.

• The low of the first candle is lower than the low of the second candle.

Optimal Condition:

• The closing of the first candle is below the opening of the second candle.

• More than 80% of the first candle is bearish.

🔵Settings

The "Engulf Filter" option allows the "Optimal Condition" to be executed and will show fewer candlesticks.

🔵Status

Off: Default mode, showing more identifications.

• Green color indicates optimal "Bullish Engulfing" candles.

• Red color indicates optimal "Bearish Engulfing" candles.

On: By changing the default to "On," the number of identifications decreases and the optimal condition [80% body candle] is applied.

• Blue color indicates "Bullish Engulfing" candles.

• Black color indicates "Bearish Engulfing" candles.

🟣Important Note

"Engulfing" candles are very useful signals in the direction of the overall trend, but we do not expect a suitable movement from "Engulfing" candles against the trend.

The candlestick engulfing pattern is important pattern in technical analysis that can be observed in candlestick charts. This pattern occurs when a complete candle engulfs or "engulfs" the body of a previous candle, meaning that the body of the new candle completely covers the body of the previous candle.

The candlestick engulfing pattern has two types: the bullish engulfing pattern and the bearish engulfing pattern.

• Bullish Engulfing Pattern: This pattern occurs when a market candle opens with a larger and higher body than the previous market candle and completely covers the body of the previous candle. This pattern may indicate the presence of strong buying pressure and a potential change in price direction upwards.

• Bearish Engulfing Pattern: This pattern occurs when a market candle opens with a larger and lower body than the previous market candle and completely covers the body of the previous candle. This pattern may indicate the presence of strong selling pressure and a potential change in price direction downwards.

The candlestick engulfing pattern is usually used as a valid signal for a change in price direction in the market and can enhance a combination of crossover investments and technical analysis. However, it should always be evaluated alongside other indicators and market factors, and counter decisions should be made accordingly.

🔵Recognition Method

Correct, the candlestick engulfing pattern is one of the important patterns in technical analysis that is typically used as a strong signal for a valid change in price direction in the market. This pattern occurs when a candle (usually in the market) opens with a larger and higher (for bullish engulfing pattern) or lower (for bearish engulfing pattern) body than a previous market candle and completely covers the body of the previous candle.

Example of Bullish Engulfing Pattern:

• First Candle: A bearish (downward) candle with a small red body.

• Second Candle: A bullish (upward) candle with a larger body that completely covers the body of the previous candle.

This pattern may indicate a change in price direction from downward to upward.

Example of Bearish Engulfing Pattern:

• First Candle: A bullish (upward) candle with a small green body.

• Second Candle: A bearish (downward) candle with a larger body that completely covers the body of the previous candle.

This pattern may indicate a change in price direction from upward to downward.

The most important point is that the candlestick engulfing pattern should be carefully considered and always evaluated alongside other market indicators and overall conditions. For example, the engulfing pattern near important support or resistance levels, during significant market command changes, or accompanied by other technical signals can have greater signaling power.

🟣"Bullish Engulfing" Candle

• The first candle is bullish and the second candle is bearish.

• At the end of a downtrend.

• The closing of the first candle is above the opening of the second candle.

• The high of the first candle is higher than the high of the second candle.

Optimal Condition:

• The closing of the first candle is higher than the high of the second candle.

• More than 80% of the first candle is bullish.

🟣"Bearish Engulfing" Candle

• The first candle is bearish and the second candle is bullish.

• At the end of an uptrend.

• The closing of the first candle is below the opening of the second candle.

• The low of the first candle is lower than the low of the second candle.

Optimal Condition:

• The closing of the first candle is below the opening of the second candle.

• More than 80% of the first candle is bearish.

🔵Settings

The "Engulf Filter" option allows the "Optimal Condition" to be executed and will show fewer candlesticks.

🔵Status

Off: Default mode, showing more identifications.

• Green color indicates optimal "Bullish Engulfing" candles.

• Red color indicates optimal "Bearish Engulfing" candles.

On: By changing the default to "On," the number of identifications decreases and the optimal condition [80% body candle] is applied.

• Blue color indicates "Bullish Engulfing" candles.

• Black color indicates "Bearish Engulfing" candles.

🟣Important Note

"Engulfing" candles are very useful signals in the direction of the overall trend, but we do not expect a suitable movement from "Engulfing" candles against the trend.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.