OPEN-SOURCE SCRIPT

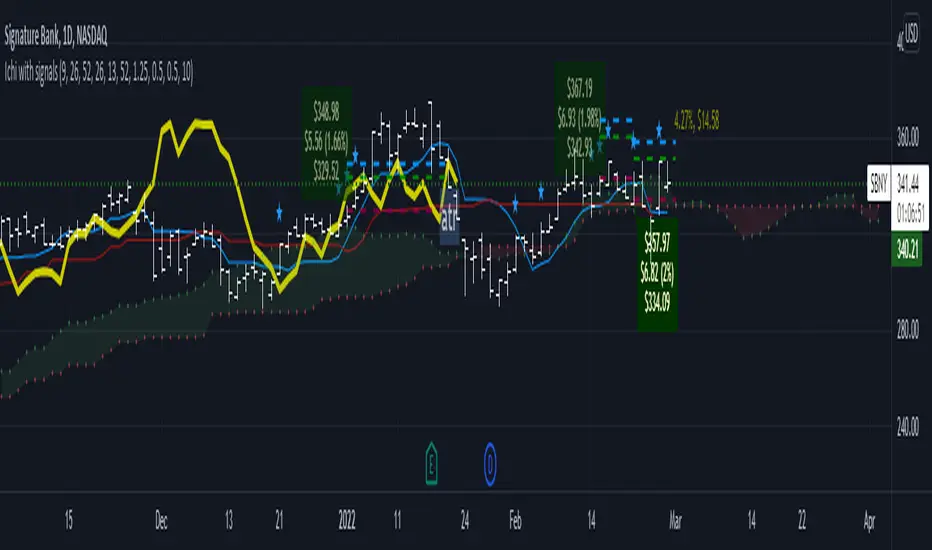

업데이트됨 Ichimoku Cloud LONG and SHORT indicators

This simple script uses 4 rules from Ichimoku Cloud indicator to marks position entry points.

The idea is that by entering a long position just when these 4 criteria are met, you can capture a 2-3% plus move within the next few days:

1. The conversion line is above the base line

2. The price is above the clouds

3. The lagging span is above the clouds

4. The rightmost cloud is green

The same 4 criteria but inverted will indicate a short entry.

In order to avoid 'stale' entries which can lead to chasing, we want the price and conversion line crossovers to be recent, within the past few days. Ideally we want to enter before close on the day the entry signal is given so that we can capture any potential gap up (or down if short). Often the price will make a nice move the next day or day after. If any of the criteria become invalidated, or if after 4-5 days there hasn't been significant movement, then it was a false alarm.

This script will show the basic Ichimoku Cloud indicators, plus labels for bearish and bullish price and conversion line crossovers as well as LONG and SHOT indicators to show when the entry criteria have been met.

The idea is that by entering a long position just when these 4 criteria are met, you can capture a 2-3% plus move within the next few days:

1. The conversion line is above the base line

2. The price is above the clouds

3. The lagging span is above the clouds

4. The rightmost cloud is green

The same 4 criteria but inverted will indicate a short entry.

In order to avoid 'stale' entries which can lead to chasing, we want the price and conversion line crossovers to be recent, within the past few days. Ideally we want to enter before close on the day the entry signal is given so that we can capture any potential gap up (or down if short). Often the price will make a nice move the next day or day after. If any of the criteria become invalidated, or if after 4-5 days there hasn't been significant movement, then it was a false alarm.

This script will show the basic Ichimoku Cloud indicators, plus labels for bearish and bullish price and conversion line crossovers as well as LONG and SHOT indicators to show when the entry criteria have been met.

릴리즈 노트

This update makes the indicators respect any changes in the displacement value in the Inputs.릴리즈 노트

Pretty significant update:added visual indicators to facilitate an exit strategy described below

removed price/cloud crossover labels as they are not very useful and this chart has more than enough clutter as is

the exit strategy is also documented in the code, but here it is:

1: set STOP LOSS at 1 std. dev. below close (RED DASHED LINE)

2: activate TRAILING STOP when price hits 1/2 std. dev. above close (BLUE DASHED LINE)

3: use 1/4 std. dev. as the TRAILING STOP value (GREEN DASHED LINE shows minimum expected profit in cases where blue line is reached)

4: after 5 more bars, exit trade if price is still between red and blue lines (no visual indicator for this at this time)

릴리즈 노트

The main point of this update is to fix an edge case caused by the crossover function counting touches as crossovers. I've also removed the SHORT callouts until such time as I have enough data to indicate this is a viable strategy.

Additionally I've updated the default plotting styles to reflect my preferences.

릴리즈 노트

Some incremental improvements:*updated initial defaults to reflect current strategy

*added ability to limit signals to long only

*added ability to display the standard deviation over the selected number of periods as a percentage of current price

릴리즈 노트

now considering touches as crosses for determining entry eligibility for the cloud and the conversion/base pair릴리즈 노트

using ATR instead of stdDev, tweaking initial paramaters, tweaking colors for better visibiliity오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.