OPEN-SOURCE SCRIPT

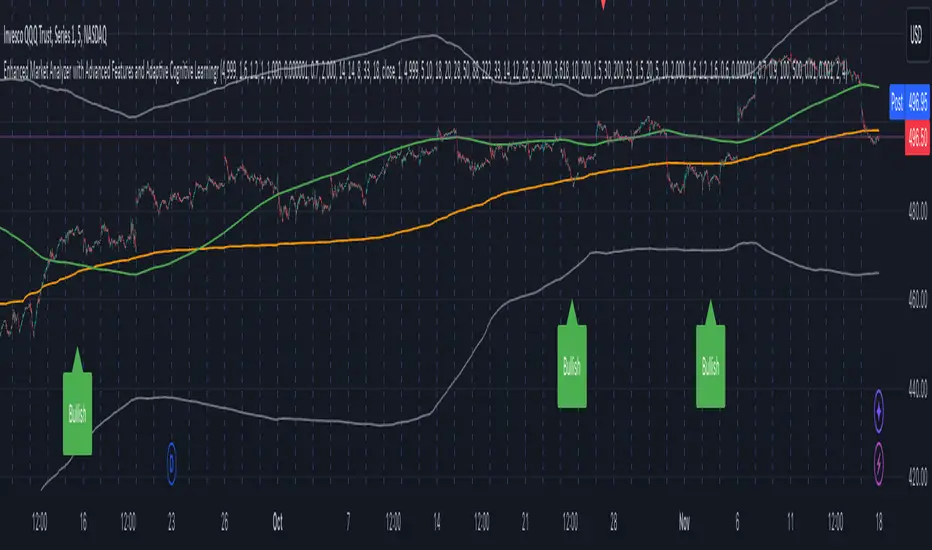

업데이트됨 Enhanced Market Analyzer with Adaptive Cognitive Learning

The "Enhanced Market Analyzer with Advanced Features and Adaptive Cognitive Learning" is an advanced, multi-dimensional trading indicator that leverages sophisticated algorithms to analyze market trends and generate predictive trading signals. This indicator is designed to merge traditional technical analysis with modern machine learning techniques, incorporating features such as adaptive learning, Monte Carlo simulations, and probabilistic modeling. It is ideal for traders who seek deeper market insights, adaptive strategies, and reliable buy/sell signals.

Key Features:

Adaptive Cognitive Learning:

Utilizes Monte Carlo simulations, reinforcement learning, and memory feedback to adapt to changing market conditions.

Adjusts the weighting and learning rate of signals dynamically to optimize predictions based on historical and real-time data.

Hybrid Technical Indicators:

Custom RSI Calculation: An RSI that adapts its length based on recursive learning and error adjustments, making it responsive to varying market conditions.

VIDYA with CMO Smoothing: An advanced moving average that incorporates Chander Momentum Oscillator for adaptive smoothing.

Hamming Windowed VWMA: A volume-weighted moving average that applies a Hamming window for smoother calculations.

FRAMA: A fractal adaptive moving average that responds dynamically to price movements.

Advanced Statistical Analysis:

Skewness and Kurtosis: Provides insights into the distribution and potential risk of market trends.

Z-Score Calculations: Identifies extreme market conditions and adjusts trading thresholds dynamically.

Probabilistic Monte Carlo Simulation:

Runs thousands of simulations to assess potential price movements based on momentum, volatility, and volume factors.

Integrates the results into a probabilistic signal that informs trading decisions.

Feature Extraction:

Calculates a variety of market metrics, including price change, momentum, volatility, volume change, and ATR.

Normalizes and adapts these features for use in machine learning algorithms, enhancing signal accuracy.

Ensemble Learning:

Combines signals from different technical indicators, such as RSI, MACD, Bollinger Bands, Stochastic Oscillator, and statistical features.

Weights each signal based on cumulative performance and learning feedback to create a robust ensemble signal.

Recursive Memory and Feedback:

Stores and averages past RSI calculations in a memory array to provide historical context and improve future predictions.

Adaptive memory factor adjusts the influence of past data based on current market conditions.

Multi-Factor Dynamic Length Calculation:

Determines the length of moving averages based on volume, volatility, momentum, and rate of change (ROC).

Adapts to various market conditions, ensuring that the indicator is responsive to both high and low volatility environments.

Adaptive Learning Rate:

The learning rate can be adjusted based on market volatility, allowing the system to adapt its speed of learning and sensitivity to changes.

Enhances the system's ability to react to different market regimes.

Monte Carlo Simulation Engine:

Simulates thousands of random outcomes to model potential future price movements.

Weights and aggregates these simulations to produce a final probabilistic signal, providing a comprehensive risk assessment.

RSI with Dynamic Adjustments:

The initial RSI length is adjusted recursively based on calculated errors between true RSI and predicted RSI.

The adaptive RSI calculation ensures that the indicator remains effective across various market phases.

Hybrid Moving Averages:

Short-Term and Long-Term Averages: Combines FRAMA, VIDYA, and Hamming VWMA with specific weights for a unique hybrid moving average.

Weighted Gradient: Applies a color gradient to indicate trend strength and direction, improving visual clarity.

Signal Generation:

Generates buy and sell signals based on the ensemble model and multi-factor analysis.

Uses percentile-based thresholds to determine overbought and oversold conditions, factoring in historical data for context.

Optional settings to enable adaptation to volume and volatility, ensuring the indicator remains effective under different market conditions.

Monte Carlo and Learning Parameters:

Users can customize the number of Monte Carlo simulations, learning rate, memory factor, and reward decay for tailored performance.

Applications:

Scalping and Day Trading:

The fast response of the adaptive RSI and ensemble learning model makes this indicator suitable for short-term trading strategies.

Swing Trading:

The combination of long-term moving averages and probabilistic models provides reliable signals for medium-term trends.

Volatility Analysis:

The ATR, Bollinger Bands, and adaptive moving averages offer insights into market volatility, helping traders adjust their strategies accordingly.

Key Features:

Adaptive Cognitive Learning:

Utilizes Monte Carlo simulations, reinforcement learning, and memory feedback to adapt to changing market conditions.

Adjusts the weighting and learning rate of signals dynamically to optimize predictions based on historical and real-time data.

Hybrid Technical Indicators:

Custom RSI Calculation: An RSI that adapts its length based on recursive learning and error adjustments, making it responsive to varying market conditions.

VIDYA with CMO Smoothing: An advanced moving average that incorporates Chander Momentum Oscillator for adaptive smoothing.

Hamming Windowed VWMA: A volume-weighted moving average that applies a Hamming window for smoother calculations.

FRAMA: A fractal adaptive moving average that responds dynamically to price movements.

Advanced Statistical Analysis:

Skewness and Kurtosis: Provides insights into the distribution and potential risk of market trends.

Z-Score Calculations: Identifies extreme market conditions and adjusts trading thresholds dynamically.

Probabilistic Monte Carlo Simulation:

Runs thousands of simulations to assess potential price movements based on momentum, volatility, and volume factors.

Integrates the results into a probabilistic signal that informs trading decisions.

Feature Extraction:

Calculates a variety of market metrics, including price change, momentum, volatility, volume change, and ATR.

Normalizes and adapts these features for use in machine learning algorithms, enhancing signal accuracy.

Ensemble Learning:

Combines signals from different technical indicators, such as RSI, MACD, Bollinger Bands, Stochastic Oscillator, and statistical features.

Weights each signal based on cumulative performance and learning feedback to create a robust ensemble signal.

Recursive Memory and Feedback:

Stores and averages past RSI calculations in a memory array to provide historical context and improve future predictions.

Adaptive memory factor adjusts the influence of past data based on current market conditions.

Multi-Factor Dynamic Length Calculation:

Determines the length of moving averages based on volume, volatility, momentum, and rate of change (ROC).

Adapts to various market conditions, ensuring that the indicator is responsive to both high and low volatility environments.

Adaptive Learning Rate:

The learning rate can be adjusted based on market volatility, allowing the system to adapt its speed of learning and sensitivity to changes.

Enhances the system's ability to react to different market regimes.

Monte Carlo Simulation Engine:

Simulates thousands of random outcomes to model potential future price movements.

Weights and aggregates these simulations to produce a final probabilistic signal, providing a comprehensive risk assessment.

RSI with Dynamic Adjustments:

The initial RSI length is adjusted recursively based on calculated errors between true RSI and predicted RSI.

The adaptive RSI calculation ensures that the indicator remains effective across various market phases.

Hybrid Moving Averages:

Short-Term and Long-Term Averages: Combines FRAMA, VIDYA, and Hamming VWMA with specific weights for a unique hybrid moving average.

Weighted Gradient: Applies a color gradient to indicate trend strength and direction, improving visual clarity.

Signal Generation:

Generates buy and sell signals based on the ensemble model and multi-factor analysis.

Uses percentile-based thresholds to determine overbought and oversold conditions, factoring in historical data for context.

Optional settings to enable adaptation to volume and volatility, ensuring the indicator remains effective under different market conditions.

Monte Carlo and Learning Parameters:

Users can customize the number of Monte Carlo simulations, learning rate, memory factor, and reward decay for tailored performance.

Applications:

Scalping and Day Trading:

The fast response of the adaptive RSI and ensemble learning model makes this indicator suitable for short-term trading strategies.

Swing Trading:

The combination of long-term moving averages and probabilistic models provides reliable signals for medium-term trends.

Volatility Analysis:

The ATR, Bollinger Bands, and adaptive moving averages offer insights into market volatility, helping traders adjust their strategies accordingly.

릴리즈 노트

Removed unused code fragments 릴리즈 노트

1. Lookback Period (lookback)Impact: The lookback period controls how much historical data is included in calculations for momentum, volatility, and feedback loops. A longer lookback makes the indicator less reactive to short-term changes, smoothing out the signal output, and focusing on long-term trends.

Short Lookback: Makes the indicator highly responsive to recent price moves, suitable for fast-paced markets or scalping.

Long Lookback: Reduces noise by averaging over a larger dataset, ideal for capturing significant trends in swing trading or longer-term analysis.

2. Momentum and Volatility Weights (momentumWeight & volatilityWeight)

Momentum Weight:

High Momentum Weight: Emphasizes strong price trends, amplifying the indicator's response when price direction is clear. This adjustment makes the indicator favor momentum-based entries, resulting in quicker entries and exits in trending markets.

Low Momentum Weight: Reduces the impact of momentum, allowing the indicator to respond more evenly to price movements, even during minor fluctuations.

Volatility Weight:

High Volatility Weight: Makes the indicator more sensitive to volatile conditions, leading to quicker responses when volatility spikes. This setting will adapt RSI and other indicators more aggressively in response to volatility, making signals more reactive and potentially less reliable in choppy markets.

Low Volatility Weight: Decreases the indicator's reactivity to volatility, filtering out noisy price movements and creating smoother signal output. This adjustment is suitable for low-volatility, trending markets, where extreme reactivity could lead to whipsaws.

3. Learning Rate and Adaptive Learning Rate (learning_rate & adaptive_learning_rate)

Learning Rate:

High Learning Rate: Enables faster adaptations to recent price movements, leading to quicker, but potentially noisier, signal changes. Useful in volatile or fast-moving markets.

Low Learning Rate: Slows down the rate of adaptation, reducing noise and making the indicator more stable. This setting is ideal for markets with sustained trends, where rapid adaptation isn’t as critical.

Adaptive Learning Rate:

Enabled: The script adjusts the learning rate based on market volatility, increasing it in high-volatility conditions and reducing it in stable markets. This setting makes the indicator more versatile, automatically balancing sensitivity and stability according to current market conditions.

Disabled: Keeps the learning rate constant, making the indicator respond in a fixed manner across different market environments.

4. Memory Factor (memory_factor)

High Memory Factor (e.g., 0.8 - 1): Increases the influence of past values on the current signal, creating a smoother output by retaining historical context. A high memory factor helps reduce noise in trending markets, stabilizing the signal.

Low Memory Factor (e.g., 0.2 - 0.5): Reduces the influence of past data, making the indicator more reactive to current conditions. This adjustment makes the output more sensitive, ideal for capturing rapid reversals or momentum shifts but may lead to false signals in quiet or sideways markets.

5. Monte Carlo Simulations (simulations)

High Simulation Count: Increases the number of possible price paths generated, creating a more reliable probabilistic signal but also making the indicator less sensitive to small changes. This adjustment helps filter out false signals but can slow down real-time calculations.

Low Simulation Count: Reduces the accuracy of probabilistic forecasting, making the indicator more sensitive to recent price action. Suitable for fast-moving markets where a quicker reaction is desired, but with an increased risk of false signals.

6. Minimum and Maximum RSI Lengths (min_rsi_length & max_rsi_length)

Minimum RSI Length:

Low Minimum (e.g., 1-5): Allows the RSI length to adjust to very short periods, making it highly responsive to price changes. This is useful for detecting rapid, short-term reversals but can introduce noise.

Higher Minimum (e.g., 10-20): Keeps the RSI length within a more conservative range, reducing its ability to capture quick movements and focusing instead on stronger, sustained trends.

Maximum RSI Length:

High Maximum (e.g., 1000): Allows for long RSI periods, useful for smoothing out the signal in quiet or sideways markets and focusing on significant trend shifts.

Low Maximum (e.g., 100): Restricts RSI length, maintaining moderate responsiveness across market conditions.

7. Signal Sensitivity (sensitivity)

High Sensitivity: Makes thresholds for signal generation more stringent, reducing the number of signals and focusing on high-confidence situations. This adjustment reduces noise and prevents false signals, especially in choppy or sideways markets.

Low Sensitivity: Lowers the threshold for signal generation, creating more frequent signals, which can be useful in volatile markets. However, this setting increases the likelihood of false positives.

8. Weighting Adjustments for Indicators (Machine Learning Parameters)

Momentum, Volatility, and Volume Weights (ml_momentumWeight, ml_volatilityWeight, ml_volumeWeight):

These weights control the influence of each factor (momentum, volatility, volume) on the machine learning model's output.

High Weights: Increase the influence of each factor on the final signal, making the indicator more responsive to strong price moves or volatility spikes.

Balanced Weights: Provide a holistic view of the market, incorporating all factors without overemphasis on one, giving a more stable, adaptive signal.

릴리즈 노트

Updated configs오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.