INVITE-ONLY SCRIPT

업데이트됨 SUPER GCOV5 MAPSCALP > MAPPING & SCALPING

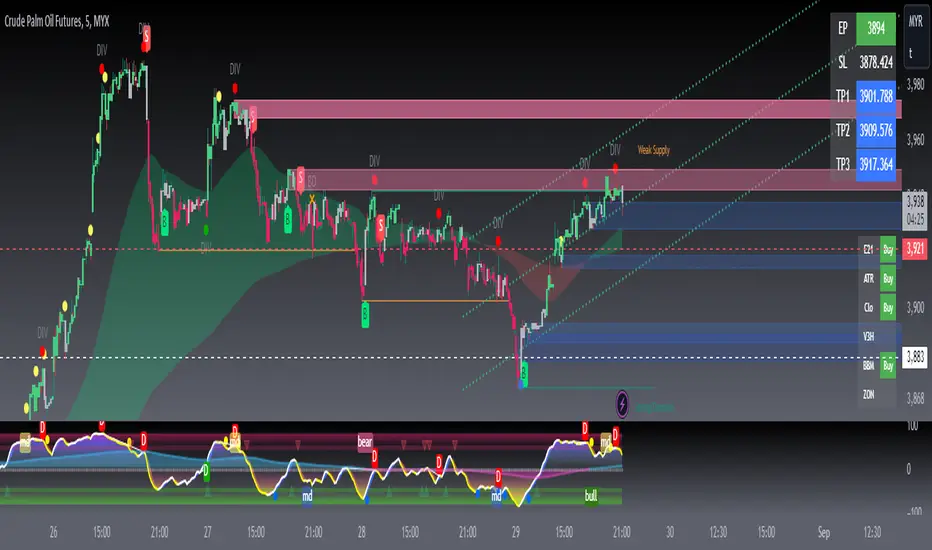

SUPER GCOV5 MAPSCALP indicator is built specifically for mapping/prediction measurement and fast trading i.e. scalping/intraday in the commodity market or cryptos market. It uses an indicator instrument consisting of ATR TRAILING STOP (ATR), EXPONENTIAL MOVING AVERAGE, PIVOT POINT, FIBONACCI KEY LEVEL, and LINEAR REGRESSION CHANNEL(LRC).

Rebuild of Instrument & Parameter

This indicator is also an upgraded instrument that is sourced from the previous indicator-FUTURES SCALPV2.This R&D of course makes trading activities more effective, and dynamic to increase the confidence of traders in current trading activities. The indicator has been upgraded in terms of parameters as well as additional instruments. Among them are;

1. ATR Trailing Stop

2. ATR BUY/SELL signal

3. Exponential Moving Average(EMA) – fastMA/slowMA Length

5. Breakout/breakdown signal

6. Pivot low/high level

7. Fibonacci extends & retracement

8. Linear Regression Channel(LRC)

9. Alert condition ( a dozen alerts )

>The best timeframe for entry is 3 minutes for FCPO and 15 minutes for other futures & cryptos.

>The best timeframe mapping/prediction is 1 hour & 4 hours.

>The candle/bars have been colored to make it easier for traders to see the price trends whether in bullish or bearish conditions.

Easier SOP of ENTRIES/POSITIONING:

1. entry by signal BUY/SELL after signal bar ( 2nd bar) for confirmation.

2. The best entries BUY at support(pivot low-Blue line) after price rebound then signal appears. The best buy also when the price is at lower

low pivot + fibo support level + lower trendline(LRC) + and the price went rebound.

3. The best entries SELL at resistance(pivot high-red line) after price pullback then signal appears.

The best buy also when the price is at a higher high pivot + fibo resistance level + upper trendline LRC + and the price went pullback.

4. Profit-taking areas are usually measured by support and resistance levels. Please refer to the bold line( support & resistance), fibo key level,

and trendline.

*To avoid false signals/wrong positions, you can use the EMA line as a guide and follow the trends, which are the buying weight when the price is above the 20/50 ema, and the selling weight when the price is below the 20/50 ema. EMA can be reset on the input setting.

STEPS of MAPPING/PROJECTION:

1. Use a bigger timeframe such as 4 hours or 1 hour

2. Use LRC to identify buy/sell weights when the price makes a zig-zag patent

3. Use monthly and weekly fibo levels to know support and resistance. This fibo is very important to see if the price will make an extension or

retracement based on the regression channel earlier. So here we can evaluate which area to buy/sell/take-profit/exit and the reversal of a

market price.

You can also create an ALERT CONDITION to help you get a reminder of signals and price trend changes

The original instrument has been retained but changed in terms of display & facelift features.

Hopefully, the new one will assist you in making analysis and strategy of trading activities successfully.

THIS IS NOT A BUY/SELL CALL, ONLY STUDY IDEAS AND ANALYSIS BASED ON MEASUREMENT TOOLS FOR EDUCATION AND GUIDANCE PURPOSES.PLEASE TAKE AT YOUR OWN RISK.

Rebuild of Instrument & Parameter

This indicator is also an upgraded instrument that is sourced from the previous indicator-FUTURES SCALPV2.This R&D of course makes trading activities more effective, and dynamic to increase the confidence of traders in current trading activities. The indicator has been upgraded in terms of parameters as well as additional instruments. Among them are;

1. ATR Trailing Stop

2. ATR BUY/SELL signal

3. Exponential Moving Average(EMA) – fastMA/slowMA Length

5. Breakout/breakdown signal

6. Pivot low/high level

7. Fibonacci extends & retracement

8. Linear Regression Channel(LRC)

9. Alert condition ( a dozen alerts )

>The best timeframe for entry is 3 minutes for FCPO and 15 minutes for other futures & cryptos.

>The best timeframe mapping/prediction is 1 hour & 4 hours.

>The candle/bars have been colored to make it easier for traders to see the price trends whether in bullish or bearish conditions.

Easier SOP of ENTRIES/POSITIONING:

1. entry by signal BUY/SELL after signal bar ( 2nd bar) for confirmation.

2. The best entries BUY at support(pivot low-Blue line) after price rebound then signal appears. The best buy also when the price is at lower

low pivot + fibo support level + lower trendline(LRC) + and the price went rebound.

3. The best entries SELL at resistance(pivot high-red line) after price pullback then signal appears.

The best buy also when the price is at a higher high pivot + fibo resistance level + upper trendline LRC + and the price went pullback.

4. Profit-taking areas are usually measured by support and resistance levels. Please refer to the bold line( support & resistance), fibo key level,

and trendline.

*To avoid false signals/wrong positions, you can use the EMA line as a guide and follow the trends, which are the buying weight when the price is above the 20/50 ema, and the selling weight when the price is below the 20/50 ema. EMA can be reset on the input setting.

STEPS of MAPPING/PROJECTION:

1. Use a bigger timeframe such as 4 hours or 1 hour

2. Use LRC to identify buy/sell weights when the price makes a zig-zag patent

3. Use monthly and weekly fibo levels to know support and resistance. This fibo is very important to see if the price will make an extension or

retracement based on the regression channel earlier. So here we can evaluate which area to buy/sell/take-profit/exit and the reversal of a

market price.

You can also create an ALERT CONDITION to help you get a reminder of signals and price trend changes

The original instrument has been retained but changed in terms of display & facelift features.

Hopefully, the new one will assist you in making analysis and strategy of trading activities successfully.

THIS IS NOT A BUY/SELL CALL, ONLY STUDY IDEAS AND ANALYSIS BASED ON MEASUREMENT TOOLS FOR EDUCATION AND GUIDANCE PURPOSES.PLEASE TAKE AT YOUR OWN RISK.

릴리즈 노트

Major updates;1. signal B lime & S red parameter improvements > stabilize signals if the price is in a sideways trend.

2. added VWAP longshort signals for scalping pullback during uptrend/downtrend > blue/red label.

3. technical and entry set-up for buy/sell is still the same as before, only the signal coordinate changes.

4. For VWAP entries set-up please refer to the image below.

*Please refresh your tradingview, or close the existing GCOV5 and reinstall / apply again

Parameter improvement & VWAP scalping signal

All of these combinations can help you make a quick decision

How does its work

VWAP entry set-up

릴리즈 노트

Re-install pivot SnR릴리즈 노트

Please turn off the current one and apply it to the chart again,1. change the multiplier & period signal for stabilization

2. added exit signal and alert for swing = Swing EX

* you can hide anyone unnecessary in your chart for a clean look in the setting inputs > inputStyle

릴리즈 노트

Major updatesGCOV5 PREMIUM- NOV23

Update list;

1. Added SUPPLY & DEMAND (SND) KEYLEVEL

2. Insert a trends cloud- easy to identify current trends

3. input divergence and reversal signals

4. trading figures – entry price, stop-loss, take profit

5. variables panel – condition and trends

BEFORE…

AFTER…

FEATURES OF INDICATOR

TRADING SET-UP

SOPs WEIGHTED POSITIONS EITHER BUY/SELL FOR ALL SIGNALS ( buy/sell scalping, Divergences, Reversal point)

SOPs entries/position

( applies to all signals- B / S, Reversal, and Divergence )

1. Position weighted based on trend cloud & SND

2. Entry only if the price is in the supply & demand zone( SND )

Buy = at demand

Sell = at supply

3. Wait for the candle to be ready and enter the close price

of the signal bar.

ENTRY TRADING – buy (B) & sell (S) signals

Time frame = 3 minutes & 5 minutes

The settings for stop loss and take profit are as follows;

SL = 0.4 % ( 15 ticks )

TP1 = 0.2 % ( 7 ticks )

TP2 = 0.4 % ( 15 ticks )

TP3 = 0.6 % ( 23 ticks )

*other markets, etc cryptos, soy, and crude oil, must reset the input of SL/TP percent( % )

because the price value difference causes the percentage value to be different.

REVERSAL & DIVERGENCE SIGNALS

a) This reversal zone is indicated by a blue circle signal for reversal-up and a

yellow signal circle for reversal-down.

b) This signal is an entry signal when this signal is in the Supply (sell) zone

and the Demand (buy) zone.

c) The SOP is to enter the position when the signal is triggered in the supply

& demand zone.

d) Signal Divergence is indicated by a green DIV circle signal for bullish

divergence and a red DIV circle for bearish divergence.

e) The SOP is the same as the reversal signal, position entry when the

signal is triggered in the supply & demand zone.

ACCURACY / WINNING RATES

This result is based on a historical algorithm test by B & S signals from the date 09 Oct - 22 Oct 2023, using a time frame of 3 minutes and 5 minutes.

Timeframe = 5 minutes

Signals = 24

Hits SL = 6

Hits TP = 18 [ TP1= 5, TP2= 4, TP3= 9 ]

% Win = 75%

Timeframe = 3 minutes

Signals = 38

Hits SL = 11

Hits TP = 27 [ TP1= 10, TP2= 3, TP3= 14 ]

% win = 71.05%

*The rate can reach up to 80-85% if we follow the position-weighted SOPs

For the complete manual and SOP please refer to the published video on my YouTube

Dear users, to apply the new update, go to “invite-only script” and click on the name of the indicator again. So that’s been done.

Hope it’s useful and have a good trade.

릴리즈 노트

fix some errors,> for some markets, the indicator cannot be analyzed when using a small time frame (eg 3m for HSI futures), so now it has been fixed (reset), and it's done.

*so far/previously this error has not happened to other markets.

only those of you who are involved please re-apply the indicator.

릴리즈 노트

Set options for trading panel label sizes;table size can be customised according to user preference > options > ‘tiny’, “small”, ‘normal’

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 TraderAsist에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Remarkable

This script is only for purchase purposes through the link provided. Please contact admin for more info.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청을 보내고 승인을 받아야 합니다. 일반적으로 결제 후에 승인이 이루어집니다. 자세한 내용은 아래 작성자의 지침을 따르거나 TraderAsist에게 직접 문의하세요.

트레이딩뷰는 스크립트 작성자를 완전히 신뢰하고 스크립트 작동 방식을 이해하지 않는 한 스크립트 비용을 지불하거나 사용하지 않는 것을 권장하지 않습니다. 무료 오픈소스 대체 스크립트는 커뮤니티 스크립트에서 찾을 수 있습니다.

작성자 지시 사항

Remarkable

This script is only for purchase purposes through the link provided. Please contact admin for more info.

면책사항

이 정보와 게시물은 TradingView에서 제공하거나 보증하는 금융, 투자, 거래 또는 기타 유형의 조언이나 권고 사항을 의미하거나 구성하지 않습니다. 자세한 내용은 이용 약관을 참고하세요.