OPEN-SOURCE SCRIPT

Supertrend Multiasset Correlation - vanAmsen

Hello traders!

I am elated to introduce the "Supertrend Multiasset Correlation", a groundbreaking fusion of the trusted Supertrend with multi-asset correlation insights. This approach offers traders a nuanced, multi-layered perspective of the market.

The Underlying Concept:

Ever pondered over the term Multiasset Correlation?

In the intricate tapestry of financial markets, assets do not operate in silos. Their movements are frequently intertwined, sometimes palpably so, and at other times more covertly. Understanding these correlations can unlock deeper insights into overarching market narratives and directional trends.

By melding the Supertrend with multi-asset correlations, we craft a holistic narrative. This allows traders to fathom not merely the trend of a lone asset but to appreciate its dynamics within a broader market tableau.

Strategy Insights:

At the core of this indicator is its strategic approach. For every asset, a signal is generated based on the Supertrend parameters you've configured. Subsequently, the correlation of daily price changes is assessed. The ultimate signal on the selected asset emerges from the average of the squared correlations, factoring in their direction. This indicator not only accounts for the asset under scrutiny (hence a correlation of 1) but also integrates 12 additional assets. By default, these span U.S. growth ETFs, value ETFs, sector ETFs, bonds, and gold.

Indicator Highlights:

The "Supertrend Multiasset Correlation" isn't your run-of-the-mill Supertrend adaptation. It's a bespoke concoction, tailored to arm traders with an all-encompassing view of market intricacies, fortified with robust correlation metrics.

Key Features:

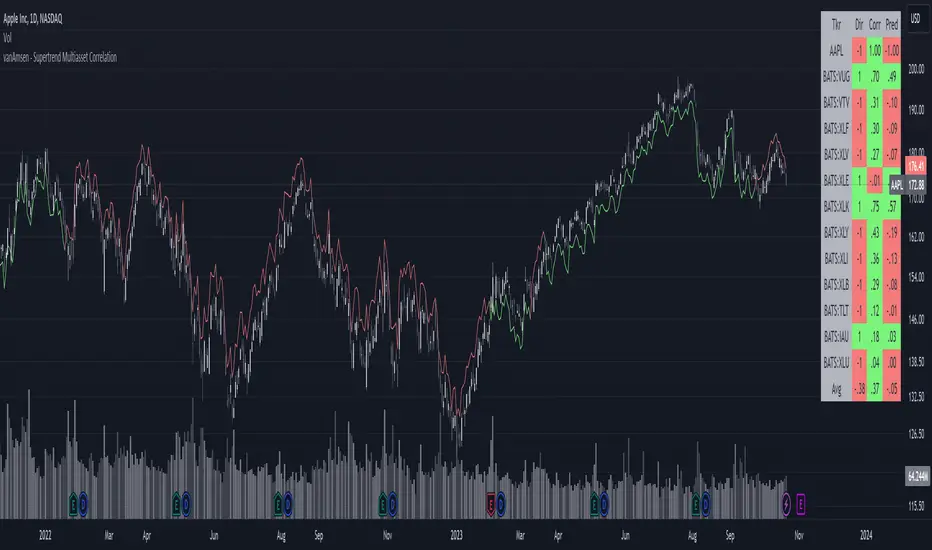

- Supertrend Line: A crystal-clear visual depiction of the prevailing market trajectory.

- Multiasset Correlation: Delve into the intricate interplay of various assets and their correlation with your primary instrument.

- Interactive Correlation Table: Nestled at the top right, this table offers a succinct overview of correlation metrics.

- Predictive Insights: Leveraging correlations to proffer predictive pointers, adding another layer of conviction to your trades.

Usage Nuances:

- The bullish Supertrend line radiates in a rejuvenating green hue, indicative of potential upward swings.

- On the flip side, the bearish trajectory stands out in a striking red, signaling possible downtrends.

- A rich suite of customization tools ensures that the chart resonates with your trading ethos.

Parting Words:

While the "Supertrend Multiasset Correlation" bestows traders with a rejuvenated perspective, it's paramount to embed it within a comprehensive trading blueprint. This would include blending it with other technical tools and adhering to stringent risk management practices. And remember, before plunging into live trades, always backtest to fine-tune your strategies.

I am elated to introduce the "Supertrend Multiasset Correlation", a groundbreaking fusion of the trusted Supertrend with multi-asset correlation insights. This approach offers traders a nuanced, multi-layered perspective of the market.

The Underlying Concept:

Ever pondered over the term Multiasset Correlation?

In the intricate tapestry of financial markets, assets do not operate in silos. Their movements are frequently intertwined, sometimes palpably so, and at other times more covertly. Understanding these correlations can unlock deeper insights into overarching market narratives and directional trends.

By melding the Supertrend with multi-asset correlations, we craft a holistic narrative. This allows traders to fathom not merely the trend of a lone asset but to appreciate its dynamics within a broader market tableau.

Strategy Insights:

At the core of this indicator is its strategic approach. For every asset, a signal is generated based on the Supertrend parameters you've configured. Subsequently, the correlation of daily price changes is assessed. The ultimate signal on the selected asset emerges from the average of the squared correlations, factoring in their direction. This indicator not only accounts for the asset under scrutiny (hence a correlation of 1) but also integrates 12 additional assets. By default, these span U.S. growth ETFs, value ETFs, sector ETFs, bonds, and gold.

Indicator Highlights:

The "Supertrend Multiasset Correlation" isn't your run-of-the-mill Supertrend adaptation. It's a bespoke concoction, tailored to arm traders with an all-encompassing view of market intricacies, fortified with robust correlation metrics.

Key Features:

- Supertrend Line: A crystal-clear visual depiction of the prevailing market trajectory.

- Multiasset Correlation: Delve into the intricate interplay of various assets and their correlation with your primary instrument.

- Interactive Correlation Table: Nestled at the top right, this table offers a succinct overview of correlation metrics.

- Predictive Insights: Leveraging correlations to proffer predictive pointers, adding another layer of conviction to your trades.

Usage Nuances:

- The bullish Supertrend line radiates in a rejuvenating green hue, indicative of potential upward swings.

- On the flip side, the bearish trajectory stands out in a striking red, signaling possible downtrends.

- A rich suite of customization tools ensures that the chart resonates with your trading ethos.

Parting Words:

While the "Supertrend Multiasset Correlation" bestows traders with a rejuvenated perspective, it's paramount to embed it within a comprehensive trading blueprint. This would include blending it with other technical tools and adhering to stringent risk management practices. And remember, before plunging into live trades, always backtest to fine-tune your strategies.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.