INVITE-ONLY SCRIPT

Double Fractal Entry

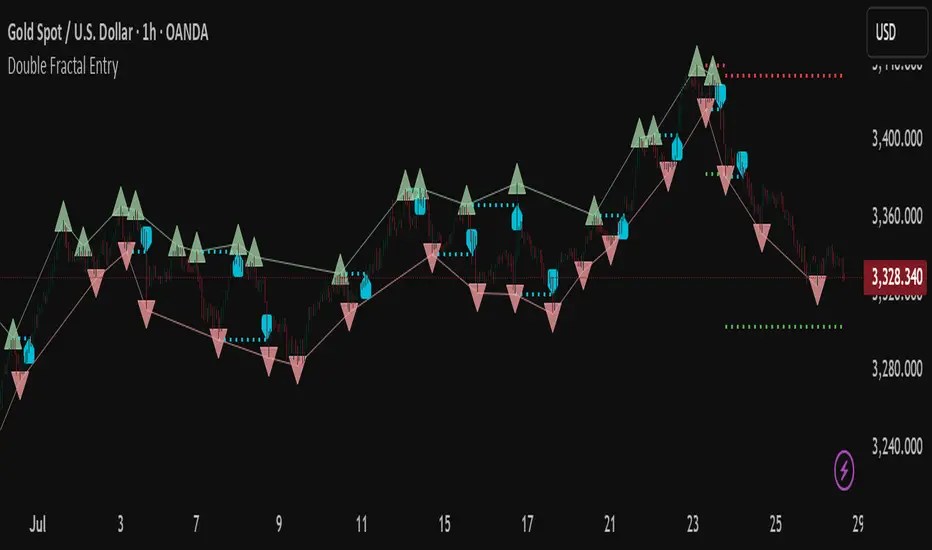

📘 Double Fractal Entry – Original Structure-Based Entry System

Double Fractal Entry is a proprietary indicator that uses dynamic fractal structure to generate actionable buy/sell signals, with automatic Stop-Loss and Take-Profit placement. Unlike classic fractal tools or ZigZag-based visuals, this script constructs real-time structural channels from price extremes and offers precise entry points based on breakout or rejection behavior.

It is designed for traders who want a clear, structured approach to trading price action — without repainting, lagging indicators, or built-in oscillators.

🧠 Core Logic

This script combines three custom-built modules:

1. Fractal Detection and Channel Construction

- Fractals are detected using a configurable number of left/right bars (sensitivity).

- Confirmed upper/lower fractals are connected into two continuous channels.

- These channels represent real-time structure zones that evolve with price.

2. Entry Signal Logic

You can choose between two signal types:

- Breakout Mode – Triggers when price breaks above the upper fractal structure (for buys) or below the lower one (for sells).

- Rebound Mode – Triggers when price approaches a fractal channel and then rejects it (forms a reversal setup).

Each signal includes:

- Entry arrow on the chart

- Horizontal entry line

- Stop-Loss and Take-Profit lines

3. SL/TP Calculation

Unlike tools that use ATR or fixed values, SL and TP are dynamically set using the fractal range — the distance between the most recent upper and lower fractals. This makes the risk model adaptive to market volatility and structure.

📊 Visuals on the Chart

- 🔺 Green/Red triangle markers = confirmed fractals

- 📈 Lime/Red channel lines = evolving upper/lower structure

- 🔵 Blue arrow = signal direction (buy/sell)

- 📉 SL/TP lines = dynamically drawn based on fractal spacing

- 🔁 Signal history = optional, toggleable for backtesting

⚙️ Settings and Customization

- Fractal sensitivity (bars left/right)

- Entry mode: Breakout or Rebound

- SL and TP multiplier (based on fractal range)

- Visibility settings (signal history, lines, colors, etc.)

💡 What Makes It Unique

This is not just a variation of standard fractals or a ZigZag wrapper.

Double Fractal Entry was built entirely from scratch and includes:

- ✅ A dual-channel system that shows the live market structure

- ✅ Entry signals based on price behavior around key zones

- ✅ Volatility-adaptive SL/TP levels for realistic trade management

- ✅ Clean, non-repainting logic for both manual and automated use

The goal is to simplify structure trading and provide precise, repeatable entries in any market condition.

🧪 Use Cases

- Breakout mode – Ideal for trend continuation and momentum entries

- Rebound mode – Great for reversals, pullbacks, and range-bound markets

- Can be used standalone or combined with volume/trend filters

🔒 Invite-Only Notice

This is an invite-only script with a fully closed source.

All logic is original and developed by the author. It does not use or copy public open-source scripts, built-in indicators (RSI, MA, etc.), or repainting tricks. The entire entry and risk system is based on custom structural logic built from real-time price action.

⚠️ Disclaimer

This tool is intended for technical analysis and educational use. It does not predict future market direction and should be used with proper risk management and strategy confirmation.

Double Fractal Entry is a proprietary indicator that uses dynamic fractal structure to generate actionable buy/sell signals, with automatic Stop-Loss and Take-Profit placement. Unlike classic fractal tools or ZigZag-based visuals, this script constructs real-time structural channels from price extremes and offers precise entry points based on breakout or rejection behavior.

It is designed for traders who want a clear, structured approach to trading price action — without repainting, lagging indicators, or built-in oscillators.

🧠 Core Logic

This script combines three custom-built modules:

1. Fractal Detection and Channel Construction

- Fractals are detected using a configurable number of left/right bars (sensitivity).

- Confirmed upper/lower fractals are connected into two continuous channels.

- These channels represent real-time structure zones that evolve with price.

2. Entry Signal Logic

You can choose between two signal types:

- Breakout Mode – Triggers when price breaks above the upper fractal structure (for buys) or below the lower one (for sells).

- Rebound Mode – Triggers when price approaches a fractal channel and then rejects it (forms a reversal setup).

Each signal includes:

- Entry arrow on the chart

- Horizontal entry line

- Stop-Loss and Take-Profit lines

3. SL/TP Calculation

Unlike tools that use ATR or fixed values, SL and TP are dynamically set using the fractal range — the distance between the most recent upper and lower fractals. This makes the risk model adaptive to market volatility and structure.

📊 Visuals on the Chart

- 🔺 Green/Red triangle markers = confirmed fractals

- 📈 Lime/Red channel lines = evolving upper/lower structure

- 🔵 Blue arrow = signal direction (buy/sell)

- 📉 SL/TP lines = dynamically drawn based on fractal spacing

- 🔁 Signal history = optional, toggleable for backtesting

⚙️ Settings and Customization

- Fractal sensitivity (bars left/right)

- Entry mode: Breakout or Rebound

- SL and TP multiplier (based on fractal range)

- Visibility settings (signal history, lines, colors, etc.)

💡 What Makes It Unique

This is not just a variation of standard fractals or a ZigZag wrapper.

Double Fractal Entry was built entirely from scratch and includes:

- ✅ A dual-channel system that shows the live market structure

- ✅ Entry signals based on price behavior around key zones

- ✅ Volatility-adaptive SL/TP levels for realistic trade management

- ✅ Clean, non-repainting logic for both manual and automated use

The goal is to simplify structure trading and provide precise, repeatable entries in any market condition.

🧪 Use Cases

- Breakout mode – Ideal for trend continuation and momentum entries

- Rebound mode – Great for reversals, pullbacks, and range-bound markets

- Can be used standalone or combined with volume/trend filters

🔒 Invite-Only Notice

This is an invite-only script with a fully closed source.

All logic is original and developed by the author. It does not use or copy public open-source scripts, built-in indicators (RSI, MA, etc.), or repainting tricks. The entire entry and risk system is based on custom structural logic built from real-time price action.

⚠️ Disclaimer

This tool is intended for technical analysis and educational use. It does not predict future market direction and should be used with proper risk management and strategy confirmation.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 trdngclbsmn에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please send me a message to get access.

Algotrader at TRADINGCLUBS.COM

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 trdngclbsmn에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Please send me a message to get access.

Algotrader at TRADINGCLUBS.COM

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.