PROTECTED SOURCE SCRIPT

업데이트됨 AlgosPoint G&M

Point Breaking 2025 (MB&GB Breaking Point Pro)

What It Does:

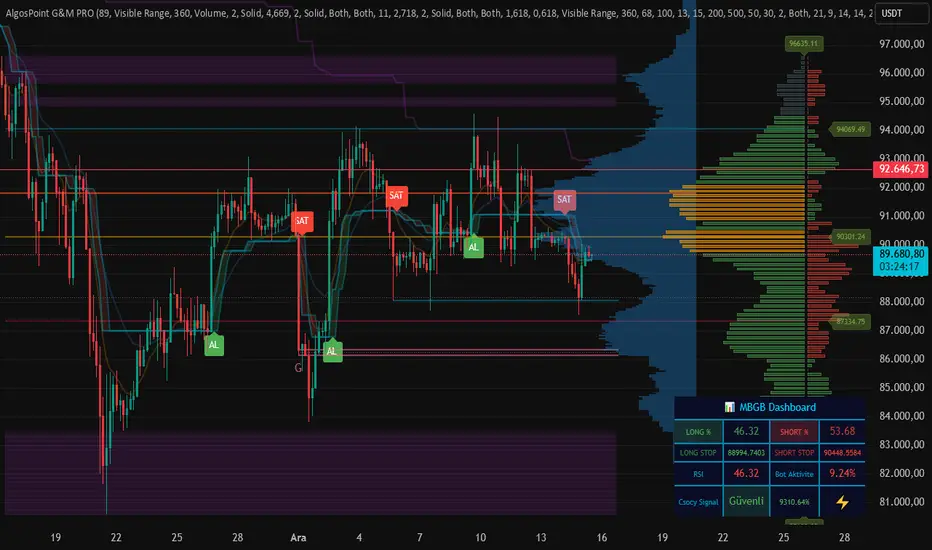

A comprehensive TradingView indicator that combines multiple technical analysis tools to identify key market breakout points, support/resistance levels, and trading opportunities. It integrates Volume Profile analysis, AlphaTrend signals, and custom risk assessment metrics.

Key Features:

Volume Profile Analysis: Displays Point of Control (POC), Value Area High/Low (VAH/VAL), and volume distribution

Support & Resistance Detection: Automatically identifies key price levels based on volume or price action

AlphaTrend Signals: Generates BUY/SELL signals with visual labels on chart

Volume Spike Detection: Highlights unusual volume activity indicating potential exhaustion or breakout

High Volatility Alerts: Marks periods of increased market volatility using ATR

Risk Assessment Dashboard: Real-time panel showing:

Long/Short percentages (RSI-based)

Stop levels for both directions

Bot activity percentage

Csocy Signal status (Safe/Undecided/Risky)

How to Use:

Add to Chart: Apply indicator to any timeframe (works best on 15m-4H)

Configure Settings: Adjust parameters in grouped sections:

📊 General Settings (lookback periods)

🎯 Support & Resistance (line styles/colors)

💥 Volume Spike (threshold sensitivity)

⚡ High Volatility (ATR multiplier)

📈 Volume Profile (display options)

🔥 AlphaTrend (signal sensitivity)

Read Signals:

BUY label = Potential long entry when AlphaTrend crosses up

SELL label = Potential short entry when AlphaTrend crosses down

Dashboard colors: Green = bullish, Red = bearish, Yellow = neutral

Set Alerts: Built-in alerts for price crosses, volume spikes, and signal confirmations

Risk Management: Use displayed stop levels and Csocy Signal status to manage position sizing

Best For:

Day traders and swing traders

Crypto, Forex, and Stock markets

Identifying high-probability breakout zones

Volume-based trading strategies

What It Does:

A comprehensive TradingView indicator that combines multiple technical analysis tools to identify key market breakout points, support/resistance levels, and trading opportunities. It integrates Volume Profile analysis, AlphaTrend signals, and custom risk assessment metrics.

Key Features:

Volume Profile Analysis: Displays Point of Control (POC), Value Area High/Low (VAH/VAL), and volume distribution

Support & Resistance Detection: Automatically identifies key price levels based on volume or price action

AlphaTrend Signals: Generates BUY/SELL signals with visual labels on chart

Volume Spike Detection: Highlights unusual volume activity indicating potential exhaustion or breakout

High Volatility Alerts: Marks periods of increased market volatility using ATR

Risk Assessment Dashboard: Real-time panel showing:

Long/Short percentages (RSI-based)

Stop levels for both directions

Bot activity percentage

Csocy Signal status (Safe/Undecided/Risky)

How to Use:

Add to Chart: Apply indicator to any timeframe (works best on 15m-4H)

Configure Settings: Adjust parameters in grouped sections:

📊 General Settings (lookback periods)

🎯 Support & Resistance (line styles/colors)

💥 Volume Spike (threshold sensitivity)

⚡ High Volatility (ATR multiplier)

📈 Volume Profile (display options)

🔥 AlphaTrend (signal sensitivity)

Read Signals:

BUY label = Potential long entry when AlphaTrend crosses up

SELL label = Potential short entry when AlphaTrend crosses down

Dashboard colors: Green = bullish, Red = bearish, Yellow = neutral

Set Alerts: Built-in alerts for price crosses, volume spikes, and signal confirmations

Risk Management: Use displayed stop levels and Csocy Signal status to manage position sizing

Best For:

Day traders and swing traders

Crypto, Forex, and Stock markets

Identifying high-probability breakout zones

Volume-based trading strategies

릴리즈 노트

set Point 보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.