OPEN-SOURCE SCRIPT

업데이트됨 TechniTrend: Dynamic Local Fibonacci Levels

TechniTrend: Dynamic Local Fibonacci Levels

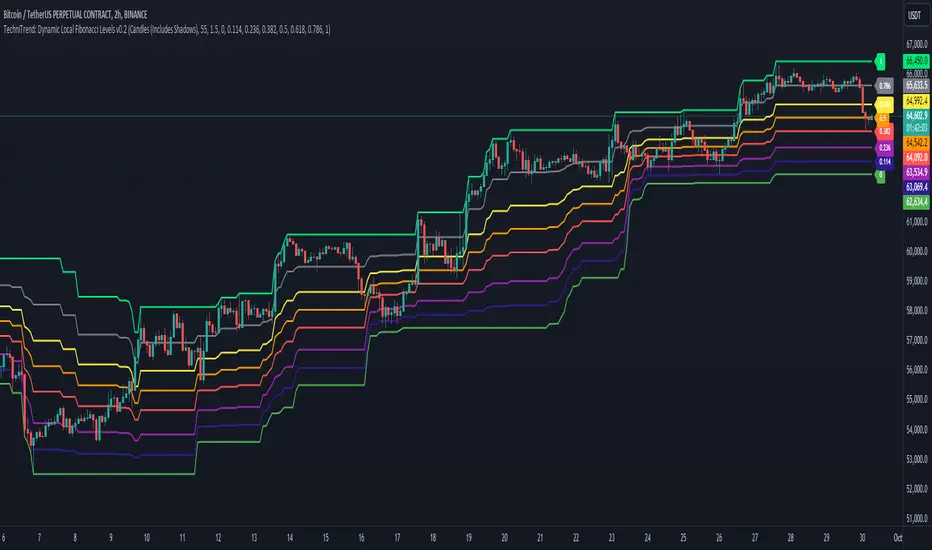

Description: The "Dynamic Local Fibonacci Levels" indicator dynamically displays Fibonacci levels only when the market is experiencing significant volatility. By detecting volatile price movements, this tool helps traders focus on Fibonacci retracement levels that are most relevant during high market activity, reducing noise from calm market periods.

Key Features:

Adaptive Fibonacci Levels: The indicator calculates and plots Fibonacci levels (from 0 to 1) only during periods of high volatility. This helps traders focus on actionable levels during significant price swings.

Customizable Chart Type: Users can choose between Candlestick charts (including shadows) or Line charts (excluding shadows) to determine the high and low price points for Fibonacci level calculations.

Volatility-Based Detection: The Average True Range (ATR) is used to detect significant volatility. Traders can adjust the ATR multiplier to fine-tune the sensitivity of the indicator to price movements.

Fully Customizable Fibonacci Levels: Traders can modify the default Fibonacci levels according to their preferences or trading strategies.

Real-Time Volatility Confirmation: Fibonacci levels are displayed only if the price range between the local high and low exceeds a user-defined volatility threshold, ensuring that these levels are only plotted when the market is truly volatile.

Customization Options:

Chart Type: Select between "Candles (Includes Shadows)" and "Line (Excludes Shadows)" for detecting price highs and lows.

Length for High/Low Detection: Choose the period for detecting the highest and lowest price in the given time frame.

ATR Multiplier for Volatility Detection: Adjust the sensitivity of the volatility threshold by setting the ATR multiplier.

Fibonacci Levels: Customize the specific Fibonacci levels to be displayed, from 0 to 1.

Usage Tips:

Focus on Key Levels During Volatility: This indicator is best suited for periods of high volatility. It can help traders identify potential support and resistance levels that may be more significant in turbulent markets.

Adjust ATR Multiplier: Depending on the asset you're trading, you might want to fine-tune the ATR multiplier to better suit the market conditions and volatility.

Recommended Settings:

ATR Multiplier: 1.5

Fibonacci Levels: Default levels set to 0.00, 0.114, 0.236, 0.382, 0.5, 0.618, 0.786, and 1.0

Length for High/Low Detection: 55

Use this indicator to detect key Fibonacci retracement levels in volatile market conditions and make more informed trading decisions based on price dynamics and volatility.

Description: The "Dynamic Local Fibonacci Levels" indicator dynamically displays Fibonacci levels only when the market is experiencing significant volatility. By detecting volatile price movements, this tool helps traders focus on Fibonacci retracement levels that are most relevant during high market activity, reducing noise from calm market periods.

Key Features:

Adaptive Fibonacci Levels: The indicator calculates and plots Fibonacci levels (from 0 to 1) only during periods of high volatility. This helps traders focus on actionable levels during significant price swings.

Customizable Chart Type: Users can choose between Candlestick charts (including shadows) or Line charts (excluding shadows) to determine the high and low price points for Fibonacci level calculations.

Volatility-Based Detection: The Average True Range (ATR) is used to detect significant volatility. Traders can adjust the ATR multiplier to fine-tune the sensitivity of the indicator to price movements.

Fully Customizable Fibonacci Levels: Traders can modify the default Fibonacci levels according to their preferences or trading strategies.

Real-Time Volatility Confirmation: Fibonacci levels are displayed only if the price range between the local high and low exceeds a user-defined volatility threshold, ensuring that these levels are only plotted when the market is truly volatile.

Customization Options:

Chart Type: Select between "Candles (Includes Shadows)" and "Line (Excludes Shadows)" for detecting price highs and lows.

Length for High/Low Detection: Choose the period for detecting the highest and lowest price in the given time frame.

ATR Multiplier for Volatility Detection: Adjust the sensitivity of the volatility threshold by setting the ATR multiplier.

Fibonacci Levels: Customize the specific Fibonacci levels to be displayed, from 0 to 1.

Usage Tips:

Focus on Key Levels During Volatility: This indicator is best suited for periods of high volatility. It can help traders identify potential support and resistance levels that may be more significant in turbulent markets.

Adjust ATR Multiplier: Depending on the asset you're trading, you might want to fine-tune the ATR multiplier to better suit the market conditions and volatility.

Recommended Settings:

ATR Multiplier: 1.5

Fibonacci Levels: Default levels set to 0.00, 0.114, 0.236, 0.382, 0.5, 0.618, 0.786, and 1.0

Length for High/Low Detection: 55

Use this indicator to detect key Fibonacci retracement levels in volatile market conditions and make more informed trading decisions based on price dynamics and volatility.

릴리즈 노트

In this update, labels of Fibonacci levels are displayed next to them.릴리즈 노트

Release Notes - TechniTrend: Dynamic Local Fibonacci Levels v2 + ToolkitIn this update, we’re introducing a Candle Alignment Toolkit with new filtering options designed to make Fibonacci-level analysis even more precise and relevant for traders. These features bring added flexibility, letting you focus on critical price actions that align closely with Fibonacci levels during periods of volatility.

What’s New:

Candle Alignment Toolkit

Our new toolkit helps you with candles that closely interact with Fibonacci levels, giving a clearer picture of potential support and resistance. Here’s how it works:

Positioning Options: You can now set the indicator to look for candles in specific Fibonacci levels:

Above: Detects candles that close above a Fibonacci level, hinting at possible resistance.

Below: Detects candles that close below a Fibonacci level, potentially marking support.

Both: Captures candles positioned right around a Fibonacci level, which can signal indecision or a pivotal moment for the market.

Body-to-Range Ratio Filtering

This feature allows you to focus on stronger price moves by filtering candles based on the proportion of their body (open-close range) relative to the entire candle range (high-low).

Body-to-Range Ratio: Set a ratio to determine the minimum portion of the candle range that must be covered by the body. For instance, setting a body-to-range ratio of 0.5 will only show candles where at least half of the candle’s range is filled by the body, filtering out minor price movements and helping to spot decisive trends.

Shadow-to-Range Ratio Filtering

This setting lets you filter candles based on the shadow’s size relative to the full range, which is particularly useful for spotting candles with long wicks that often indicate potential reversals.

Shadow-to-Range Ratio: Set a ratio to capture candles with significant wicks. For example, a shadow-to-range ratio of 0.3 will highlight candles where shadows make up at least 30% of the total range, helping you identify key price rejections or reversals at Fibonacci levels.

How This Update Helps:

These alignment options and ratio filters make it easier to focus on Fibonacci levels that are backed by meaningful price action, filtering out noise from weaker movements. This way, you can concentrate on Fibonacci retracement zones that align with strong, decisive candles during volatile periods.

With this update, TechniTrend: Dynamic Local Fibonacci Levels is now even more versatile, letting you customize your analysis to highlight support and resistance levels that truly matter in dynamic market conditions.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.