OPEN-SOURCE SCRIPT

Dominant Cycle Adaptive MACD

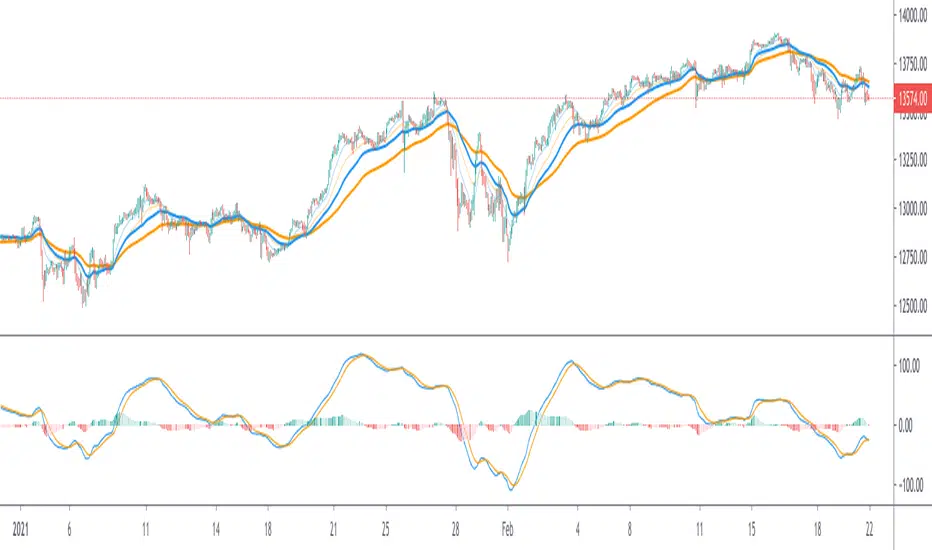

This Indicator is based on classic MACD but with an exceptional smoothing.

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

This smoothing eliminates the noise of the classic MACD as you see in the Chart

Adaptive MACD is compiled using with two adaptive moving averages, one adaptive to the dominant cycle and the other adaptive to twice the dominant cycle. As the basic behind the MACD is the difference of two moving averages we cannot find much difference between the conventional MACD (12, 26) and the adaptive MACD. However the adaptive MACD is less prone for less whipsaws and it catches the trends very well at the same time the catches the turning points in time. The Adaptive MACD is definite one notch better than the conventional MACD.

Dominant Cycle Period is calculated using Ehler's Method {Mentioned in the code}

This is how the Adaptiveness Impacts the Price Chart

1. (12, 26 EMA) VS Adaptive Dominant Cycle EMA

2. See how the Adaptive Lengths {both FastLength and SlowLength changes with time!}

Enjoy!

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.