PROTECTED SOURCE SCRIPT

Statistical AMD

Overview

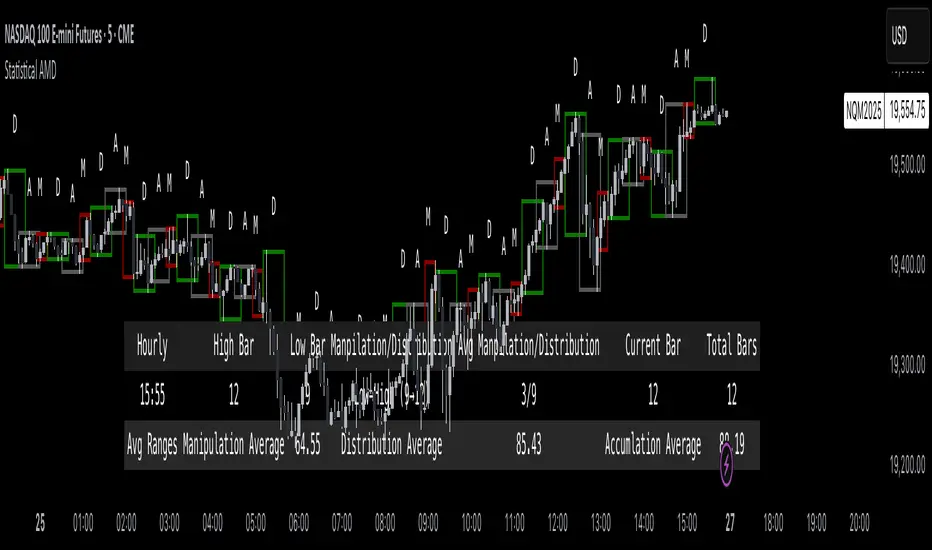

The Statistical AMD ("Accumulation, Manipulation, Distribution") is a real-time statistical analyzer and visual segmentation tool for price action.

It identifies and tracks the structure of major movements within higher timeframe candles — breaking them into three key phases:

Manipulation (M): Early-stage liquidity sweeps.

Distribution (D): Mid-phase trending moves.

Accumulation (A): Late-stage compression zones.

The tool records and visualizes where highs and lows form relative to the open of a larger candle (e.g., 1-hour) and aggregates statistical behavior across sessions.

This is not a predictive indicator — it is a segmentation and statistical probability builder for real-time and historical analysis.

What It Does

Tracks High/Low Timing:

Identifies when the high and low occur during each higher timeframe candle (like hourly).

Plots Box Structures:

Color-coded boxes for each phase:

Red = Manipulation

Green = Distribution

White = Accumulation

Displays Statistical Table:

Average timing of highs and lows

Current vs historical bar position tracking

Average ranges for each phase

Historical Aggregation:

Aggregates hundreds of candles' data to build probabilistic expectations.

Live Updates:

Boxes dynamically expand as price evolves within each phase.

Key Settings

HTF Reference:

Select the higher timeframe to analyze (Default: 1 Hour).

Manually Input Legs:

Customize leg sizes for manipulation, distribution, and no-trade zones.

Defaults:

Manipulation Leg = 3 bars

Distribution Leg = 6 bars

No Trade Zone = 6 bars

Ideal For

Liquidity and Manipulation Traders:

Those analyzing sweep behaviors, fakeouts, and structural rotations.

Time-based Statistical Analysts:

Users who build mean-reversion or breakout models based on timing patterns.

ICT, Smart Money Concept (SMC) Traders:

Traders who track sweep → displacement → compression cycles.

Scalpers and Intraday Traders:

Anyone needing microstructural framing inside large candles.

Important Notes

Higher timeframe anchoring is critical.

Make sure you align the "HTF Reference" with your intended analysis frame (e.g., if you scalp on 1-min, set HTF to 1H or 4H).

The tool doesn’t predict future moves directly — it helps build a contextual, statistically-backed map of where you are inside the cycle.

Manual input flexibility allows tailoring for different asset volatility.

Final Thought

If you're trading without understanding the internal phases of a candle — you're navigating blind.

Statistical AMD arms you with objective, historical data about how and when price tends to expand, manipulate, and compress — so you can act with probability on your side.

The Statistical AMD ("Accumulation, Manipulation, Distribution") is a real-time statistical analyzer and visual segmentation tool for price action.

It identifies and tracks the structure of major movements within higher timeframe candles — breaking them into three key phases:

Manipulation (M): Early-stage liquidity sweeps.

Distribution (D): Mid-phase trending moves.

Accumulation (A): Late-stage compression zones.

The tool records and visualizes where highs and lows form relative to the open of a larger candle (e.g., 1-hour) and aggregates statistical behavior across sessions.

This is not a predictive indicator — it is a segmentation and statistical probability builder for real-time and historical analysis.

What It Does

Tracks High/Low Timing:

Identifies when the high and low occur during each higher timeframe candle (like hourly).

Plots Box Structures:

Color-coded boxes for each phase:

Red = Manipulation

Green = Distribution

White = Accumulation

Displays Statistical Table:

Average timing of highs and lows

Current vs historical bar position tracking

Average ranges for each phase

Historical Aggregation:

Aggregates hundreds of candles' data to build probabilistic expectations.

Live Updates:

Boxes dynamically expand as price evolves within each phase.

Key Settings

HTF Reference:

Select the higher timeframe to analyze (Default: 1 Hour).

Manually Input Legs:

Customize leg sizes for manipulation, distribution, and no-trade zones.

Defaults:

Manipulation Leg = 3 bars

Distribution Leg = 6 bars

No Trade Zone = 6 bars

Ideal For

Liquidity and Manipulation Traders:

Those analyzing sweep behaviors, fakeouts, and structural rotations.

Time-based Statistical Analysts:

Users who build mean-reversion or breakout models based on timing patterns.

ICT, Smart Money Concept (SMC) Traders:

Traders who track sweep → displacement → compression cycles.

Scalpers and Intraday Traders:

Anyone needing microstructural framing inside large candles.

Important Notes

Higher timeframe anchoring is critical.

Make sure you align the "HTF Reference" with your intended analysis frame (e.g., if you scalp on 1-min, set HTF to 1H or 4H).

The tool doesn’t predict future moves directly — it helps build a contextual, statistically-backed map of where you are inside the cycle.

Manual input flexibility allows tailoring for different asset volatility.

Final Thought

If you're trading without understanding the internal phases of a candle — you're navigating blind.

Statistical AMD arms you with objective, historical data about how and when price tends to expand, manipulate, and compress — so you can act with probability on your side.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.