INVITE-ONLY SCRIPT

업데이트됨 TradeShields Strategy Builder

🛡 WHAT IS TRADESHIELDS?

This no-code strategy builder is designed for traders on TradingView, offering an intuitive platform to create, backtest, and automate trading strategies. While identifying signals is often straightforward, the real challenge in trading lies in managing risk and knowing when not to trade. It equips users with advanced tools to address this challenge, promoting disciplined decision-making and structured trading practices.

This is not just a collection of indicators but a comprehensive toolkit that helps identify high-quality opportunities while placing risk management at the core of every strategy. By integrating customizable filters, robust controls, and automation capabilities, it empowers traders to align their strategies with their unique objectives and risk tolerance.

_____________________________________

🛡 THE GOAL: SHIELD YOUR STRATEGY

The mission is simple: to shield your strategy from bad trades. Whether you're a seasoned trader or just starting, the hardest part of trading isn’t finding signals—it’s avoiding trades that can harm your account. This framework prioritizes quality over quantity, helping filter out suboptimal setups and encouraging disciplined execution.

With tools to manage risk, avoid overtrading, and adapt to changing market conditions, it protects your strategy against impulsive decisions and market volatility.

_____________________________________

🛡 HOW TO USE IT

1. Apply Higher Timeframe Filters

Begin by analyzing broader market trends using tools like the 200 EMA, Ichimoku Cloud, or Supertrend on higher timeframes (e.g., daily or 4-hour charts).

- Example: Ensure the price is above the 200 EMA on the daily chart for long trades or below it for short trades.

2. Identify the Appropriate Entry Signal

Choose an entry signal that aligns with your model and the asset you're trading. Options include:

3. Determine Take-Profit and Stop-Loss Levels

Set clear exit strategies to protect your capital and lock in profits:

4. Apply Risk Management Filters

Incorporate risk controls to ensure disciplined execution:

5. Automate and Execute

Leverage the advanced automation features to streamline execution. Alerts are tailored specifically for each supported platform, ensuring seamless integration with tools like PineConnector, 3Commas, Zapier, and more.

_____________________________________

🛡 CORE FOCUS: RISK MANAGEMENT, AUTOMATION, AND DISCIPLINED TRADING

This builder emphasizes quality over quantity, encouraging traders to approach markets with structure and control. Its innovative tools for risk management and automation help optimize performance while reducing effort, fostering consistency and long-term success.

_____________________________________

🛡 KEY FEATURES

General Settings

Time Filters

Risk Management Tools

Economic News Filters

Higher Timeframe Filters

Chart Timeframe Filters

Entry Signals

Exit Settings

Alerts and Automation

_____________________________________

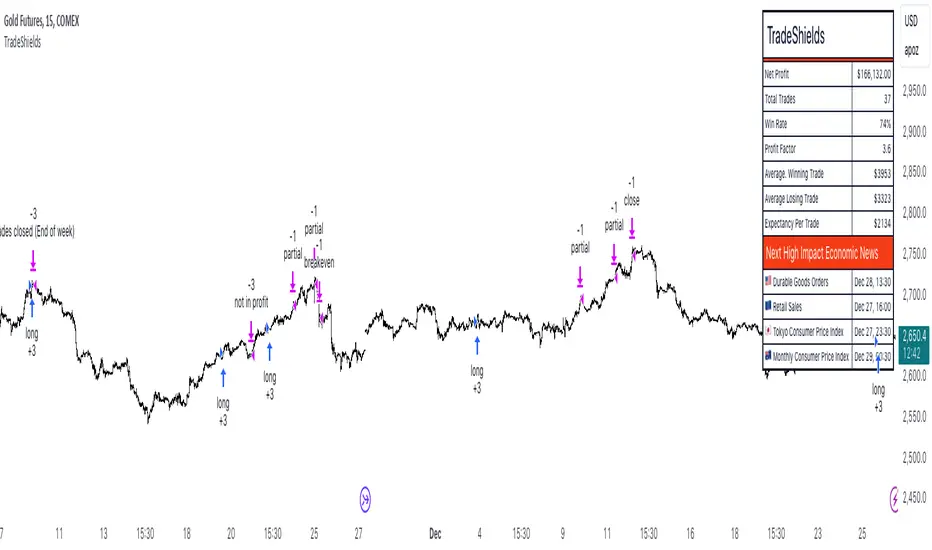

🛡 PUBLISHED CHART SETTINGS: 15m GC1!

GC1!

_____________________________________

🛡 WHY CHOOSE THIS STRATEGY BUILDER?

This tool transforms trading from reactive to proactive, focusing on risk management and automation as the foundation of every strategy. By helping users avoid unnecessary trades, implement robust controls, and automate execution, it fosters disciplined trading.

This no-code strategy builder is designed for traders on TradingView, offering an intuitive platform to create, backtest, and automate trading strategies. While identifying signals is often straightforward, the real challenge in trading lies in managing risk and knowing when not to trade. It equips users with advanced tools to address this challenge, promoting disciplined decision-making and structured trading practices.

This is not just a collection of indicators but a comprehensive toolkit that helps identify high-quality opportunities while placing risk management at the core of every strategy. By integrating customizable filters, robust controls, and automation capabilities, it empowers traders to align their strategies with their unique objectives and risk tolerance.

_____________________________________

🛡 THE GOAL: SHIELD YOUR STRATEGY

The mission is simple: to shield your strategy from bad trades. Whether you're a seasoned trader or just starting, the hardest part of trading isn’t finding signals—it’s avoiding trades that can harm your account. This framework prioritizes quality over quantity, helping filter out suboptimal setups and encouraging disciplined execution.

With tools to manage risk, avoid overtrading, and adapt to changing market conditions, it protects your strategy against impulsive decisions and market volatility.

_____________________________________

🛡 HOW TO USE IT

1. Apply Higher Timeframe Filters

Begin by analyzing broader market trends using tools like the 200 EMA, Ichimoku Cloud, or Supertrend on higher timeframes (e.g., daily or 4-hour charts).

- Example: Ensure the price is above the 200 EMA on the daily chart for long trades or below it for short trades.

2. Identify the Appropriate Entry Signal

Choose an entry signal that aligns with your model and the asset you're trading. Options include:

- Supertrend changes for trend reversals.

- Bollinger Band touches for mean-reversion trades.

- RSI strength/weakness for overbought or oversold conditions.

- Breakouts of key levels (e.g., daily or weekly highs/lows) for momentum trades.

- MACD and TSI flips.

3. Determine Take-Profit and Stop-Loss Levels

Set clear exit strategies to protect your capital and lock in profits:

- Use single, dual, or triple take-profit levels based on percentages or price levels.

- Choose a stop-loss type, such as fixed percentage, ATR-based, or trailing stops.

- Optionally, set breakeven adjustments after hitting your first take-profit target.

4. Apply Risk Management Filters

Incorporate risk controls to ensure disciplined execution:

- Limit the number of trades per day, week, or month to avoid overtrading.

- Use time-based filters to trade during specific sessions or custom windows.

- Avoid trading around high-impact news events with region-specific filters.

5. Automate and Execute

Leverage the advanced automation features to streamline execution. Alerts are tailored specifically for each supported platform, ensuring seamless integration with tools like PineConnector, 3Commas, Zapier, and more.

_____________________________________

🛡 CORE FOCUS: RISK MANAGEMENT, AUTOMATION, AND DISCIPLINED TRADING

This builder emphasizes quality over quantity, encouraging traders to approach markets with structure and control. Its innovative tools for risk management and automation help optimize performance while reducing effort, fostering consistency and long-term success.

_____________________________________

🛡 KEY FEATURES

General Settings

- Theme Customization: Light and dark themes for a tailored interface.

- Timezone Adjustment: Align session times and news schedules with your local timezone.

- Position Sizing: Define lot sizes to manage risk effectively.

- Directional Control: Choose between long-only, short-only, or both directions for trading.

Time Filters

- Day-of-Week Selection: Enable or disable trading on specific days.

- Session-Based Trading: Restrict trades to major market sessions (Asia, London, New York) or custom windows.

- Custom Time Windows: Precisely control the timeframes for trade execution.

Risk Management Tools

- Trade Limits: Maximum trades per day, week, or month to avoid overtrading.

- Automatic Trade Closures: End-of-session, end-of-day, or end-of-week options.

- Duration-Based Filters: Close trades if take-profit isn’t reached within a set timeframe or if they remain unprofitable beyond a specific duration.

- Stop-Loss and Take-Profit Options: Fixed percentage or ATR-based stop-losses, single/dual/triple take-profit levels, and breakeven stop adjustments.

Economic News Filters

- Region-Specific Filters: Exclude trades around major news events in regions like the USA, UK, Europe, Asia, or Oceania.

- News Avoidance Windows: Pause trades before and after high-impact events or automatically close trades ahead of scheduled news releases.

Higher Timeframe Filters

- Multi-Timeframe Tools: Leverage EMAs, Supertrend, or Ichimoku Cloud on higher timeframes (Daily, 4-hour, etc.) for trend alignment.

Chart Timeframe Filters

- Precision Filtering: Apply EMA or ADX-based conditions to refine trade setups on current chart timeframes.

Entry Signals

- Customizable Options: Choose from signals like Supertrend, Bollinger Bands, RSI, MACD, Ichimoku Cloud, or EMA pullbacks.

- Indicator Parameter Overrides: Fine-tune default settings for specific signals.

Exit Settings

- Flexible Take-Profit Targets: Single, dual, or triple targets. Exit at significant levels like daily/weekly highs or lows.

- Stop-Loss Variability: Fixed, ATR-based, or trailing stop-loss options.

Alerts and Automation

- Third-Party Integrations: Seamlessly connect with platforms like PineConnector, 3Commas, Zapier, and Capitalise.ai.

- Precision-Formatted Alerts: Alerts are tailored specifically for each platform, ensuring seamless execution. For example:

- PineConnector alerts include risk-per-trade parameters.

- 3Commas alerts contain bot-specific configurations.

_____________________________________

🛡 PUBLISHED CHART SETTINGS: 15m

- Time Filters: Trades are enabled from Tuesday to Friday, as Mondays often lack sufficient data coming off the weekend, and weekends are excluded due to market closures. Custom time sessions are turned off by default, allowing trades throughout the day.

- Risk Filters: Risk is tightly controlled by limiting trades to a maximum of 2 per day and enabling a mechanism to close trades if they remain open too long and are unprofitable. Weekly trade closures ensure that no positions are carried over unnecessarily.

- Economic News Filters: By default, trades are allowed during economic news periods, giving traders flexibility to decide how to handle volatility manually. It is recommended to enable these filters if you are creating strategies on lower timeframes.

- Higher Timeframe Filters: The setup incorporates confluence from higher timeframe indicators. For example, the 200 EMA on the daily timeframe is used to establish trend direction, while the Ichimoku cloud on the 30-minute timeframe adds additional confirmation.

- Entry Signals: The strategy triggers trades based on changes in the Supertrend indicator.

- Exit Settings: Trades are configured to take partial profits at three levels (1%, 2%, and 3%) and use a fixed stop loss of 2%. Stops are moved to breakeven after reaching the first take profit level.

_____________________________________

🛡 WHY CHOOSE THIS STRATEGY BUILDER?

This tool transforms trading from reactive to proactive, focusing on risk management and automation as the foundation of every strategy. By helping users avoid unnecessary trades, implement robust controls, and automate execution, it fosters disciplined trading.

릴리즈 노트

The economic calendar has been refreshed with the latest data for Q1 2025, ensuring users have access to up-to-date events for strategy filtering and optimization.릴리즈 노트

Resolved an issue with handling end-of-week market closures to ensure accurate strategy execution during weekly transitions.릴리즈 노트

You can now connect your custom indicators as external entry signals! 🎯릴리즈 노트

Expand alerts to support manual trading.릴리즈 노트

Additional features added for external indicators as entry signals 🎯릴리즈 노트

Now includes ATR-based trailing stops, allowing for dynamic stop-loss adjustments based on market volatility. This enhancement helps optimize trade exits by maintaining flexibility in both trending and fluctuating market conditions.릴리즈 노트

Now supports order pyramiding, allowing traders to scale into positions with greater flexibility and precision!릴리즈 노트

Bug fix: Ensure alerts are triggered for trailing stops.릴리즈 노트

Disabled use_bar_magnifier

릴리즈 노트

Bar Magnifier feature can now be enabled/disabled from the Properties tab.릴리즈 노트

The economic calendar has been refreshed with the latest data for Q2 2025, ensuring users have access to up-to-date events for strategy filtering and optimization.릴리즈 노트

Economic news filters are now smarter and faster, only checking relevant regions when needed.릴리즈 노트

Smarter handling of multiple profit targets and partial exits for better trade management.릴리즈 노트

Bug fix.초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 tradeshields에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM for a free trial.

TradeShields | Risk-Focused Automation for TradingView

Automate Your Trading Strategies with Advanced Risk Controls 🚀

Automate Your Trading Strategies with Advanced Risk Controls 🚀

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 tradeshields에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

DM for a free trial.

TradeShields | Risk-Focused Automation for TradingView

Automate Your Trading Strategies with Advanced Risk Controls 🚀

Automate Your Trading Strategies with Advanced Risk Controls 🚀

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.