INVITE-ONLY SCRIPT

업데이트됨 Supply and Demand Areas Responsible and Origins [PRO][keypoems]

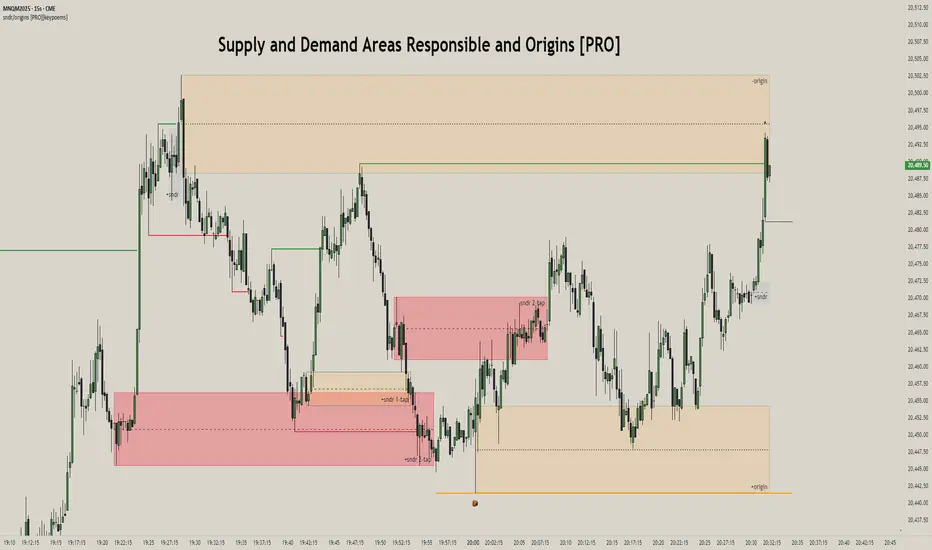

Supply and Demand Areas Responsible and Origins by Keypoems

This indicator highlights supply and demand areas responsible for breaking market structure (SNDR) and tracks how many times these have been "tapped". This is a very advanced and unique capability not present on TradingView at the moment. It also draws and track the "Origins" of breakout moves.

Using this fellow traders can to track with great precision order flow by gauging the reaction of price to these very sensitive areas.

Various powerful trading models can be built around this indicator. Here's an example on how to use it: Price Action will tend to retrace and visit ("tap") critical areas where orders are accumulated (SNDR and Origins) usually twice ("double tap") before continuing a trend. With this knowledge traders can either enter profitably a pro-trend trade after a "double tap" retracement in a responsible area or a origin or if those areas are violated, understand the change in narrative and enter a counter-trend trade.

This indicator is not a mashup of something you have already seen. It is absolutely unique: early testers and fellow traders have been very loud in requesting this to be released to the public (I love you moderators!).

SNDRs (Supply and Demand Responsible)

- Advanced Detection: Looks for the last up-move swing in a bearish zone, or the last down-move in a bullish zone. Adjust the sensitivity choosing a customizable pivot length.

- Mitigation Extension: Option to extend SNDR zones until they are fully mitigated.

- First Tap Indication: Zones change color and text upon the first tap, signaling initial mitigation.

- Second Tap Indication: Zones change color and text upon the first tap, signaling possible trade idea.

- Set pivot length for swing detection.

- Enable bullish and bearish SNDR zones separately.

- Customize texts, colors, and border colors for SNDR zones.

- Adjust line styles, widths, and display of 30%, 50%, and 70% levels within SNDR zones.

Origins

- Definition Flexibility: Mark Origins as the last down-close candle in a bullish zone, last up-close candle in a bearish zone or use the initial swing point with a customizable pivot length.

- Mitigation Extension: Extend origin zones until they are fully mitigated.

- First Tap Indication: Similar to SNDR, origin zones can change appearance upon the first tap.

- Set pivot length for swing detection.

- Enable bullish and bearish origin zones separately.

- Customize texts, colors, borders, and line styles.

- Adjust display of 30%, 50%, and 70% levels within origin zones.

Zones

To be able to draw SNDRs (which are internal counter-trend areas in a zone) the indicator needs to track market structure zones. So the indicator can also draw those zones if needed. The indicator can also extend the current price zones until the 50% of the zone is mitigated.

Info Box

Displays a box with detailed information about the last identified zone, including risk and range size.

- Risk Management: Set the risk amount to calculate contract sizes or position sizing.

- Visibility Options: Adjust the labels' size within the info box for better readability.

- Set the risk amount for calculations.

This indicator highlights supply and demand areas responsible for breaking market structure (SNDR) and tracks how many times these have been "tapped". This is a very advanced and unique capability not present on TradingView at the moment. It also draws and track the "Origins" of breakout moves.

Using this fellow traders can to track with great precision order flow by gauging the reaction of price to these very sensitive areas.

Various powerful trading models can be built around this indicator. Here's an example on how to use it: Price Action will tend to retrace and visit ("tap") critical areas where orders are accumulated (SNDR and Origins) usually twice ("double tap") before continuing a trend. With this knowledge traders can either enter profitably a pro-trend trade after a "double tap" retracement in a responsible area or a origin or if those areas are violated, understand the change in narrative and enter a counter-trend trade.

This indicator is not a mashup of something you have already seen. It is absolutely unique: early testers and fellow traders have been very loud in requesting this to be released to the public (I love you moderators!).

SNDRs (Supply and Demand Responsible)

- Advanced Detection: Looks for the last up-move swing in a bearish zone, or the last down-move in a bullish zone. Adjust the sensitivity choosing a customizable pivot length.

- Mitigation Extension: Option to extend SNDR zones until they are fully mitigated.

- First Tap Indication: Zones change color and text upon the first tap, signaling initial mitigation.

- Second Tap Indication: Zones change color and text upon the first tap, signaling possible trade idea.

- Set pivot length for swing detection.

- Enable bullish and bearish SNDR zones separately.

- Customize texts, colors, and border colors for SNDR zones.

- Adjust line styles, widths, and display of 30%, 50%, and 70% levels within SNDR zones.

Origins

- Definition Flexibility: Mark Origins as the last down-close candle in a bullish zone, last up-close candle in a bearish zone or use the initial swing point with a customizable pivot length.

- Mitigation Extension: Extend origin zones until they are fully mitigated.

- First Tap Indication: Similar to SNDR, origin zones can change appearance upon the first tap.

- Set pivot length for swing detection.

- Enable bullish and bearish origin zones separately.

- Customize texts, colors, borders, and line styles.

- Adjust display of 30%, 50%, and 70% levels within origin zones.

Zones

To be able to draw SNDRs (which are internal counter-trend areas in a zone) the indicator needs to track market structure zones. So the indicator can also draw those zones if needed. The indicator can also extend the current price zones until the 50% of the zone is mitigated.

Info Box

Displays a box with detailed information about the last identified zone, including risk and range size.

- Risk Management: Set the risk amount to calculate contract sizes or position sizing.

- Visibility Options: Adjust the labels' size within the info box for better readability.

- Set the risk amount for calculations.

릴리즈 노트

Changelog up to version v1.1.0- option to customise 1-tap text or icon for sndrs and origins

- option to color 2-taps for sndrs

- update settings to reflect publish image

- improve sndr double tap detection and current bar following

- implement double tap detection and check on origins, option to color origins on 2-tap

- fix wick based zones that wick multiple times a zone low before continuing (major fix)

- keep debugging wick based zones wick continuation, this is hard work.

- clean up continuation labels

- some final label cleanups

- settings readibility SNDRs

- fix bearish origins taps/double taps not working

- first tap level is now configurable (default 50% of zone)

- option to show origin size in points

릴리즈 노트

Changelog:- v1.1.0 Option to show origin size in points

- v1.1.1 Clean up logic of sndr swings (and origins)

- Clean up origin swing code

- v1.1.2 Option (default true) to draw zones from the very beginning of zone not protected level

- v1.2.0 Draw lines for tap and double taps into origins at a specific "mitigation" level

- v1.2.1 Fix origin based on swing points to use pivots

- v1.2.2 Mega debugging session to nail swing based origins, should work now.

- v1.2.3 Major bugfix that should solve the chart being sometimes left empty (because of no immediate pullback at start time)

- v1.2.3a Remove comments unused code

릴리즈 노트

Changelog:- v1.2.2b Critical fix, reset and initialization was broken and kept the chart empty.

릴리즈 노트

Changelog:- v1.2.3b/c solve some initialization issues

릴리즈 노트

Changelog:- v1.2.3d Bearish origins were temporarily drawn as bullish

- v1.2.4 Fix bug on MSS for wick based zones where the protected levels were lost

- v1.2.5 Swing based origins that extend the whole zone are just not drawn, change pivot to see smaller swings

- v1.2.5b Fix bearish origins extension, 1-tap, 2-tap

릴리즈 노트

Changelog v1.3.0:- Robustness fixes that avoid indicator to go blank when it can't calculate the max_bars_back

- Work around 500 labels limit that would bug out and lose protected levels

- Tweak code so that proper protected levels are deleted.

- Persist continuation high/lows externally to labels (which max out at 500).

릴리즈 노트

No major new features in this release but a lot of stability and maintainability fixes. Indicator looks the same but runs smoother and with less hiccups. Options screen has been streamlined and looks much better.Changelog v2.0.0:

- Major cut of code to start rewrite

- Remove ph/pl labels

- Candidate high/lows are moved off labels

- Draw only one candidate high/low

- Major resolution of continuation high/lows simplified structures

- Options clean up

- Tiny bug to draw continuation high wick based

- Rework options ordering

릴리즈 노트

Changelog v2.2.4- Separate 30/50/70% lines settings: color, width and style can be configured independently.

- 50% level can be now hidden via flag too.

릴리즈 노트

Everyone can get access now!Changelog: v2.2.5

- Bump for launch and general availability

- Moved default start date

- Stability improvements

릴리즈 노트

Changelog: v2.3.2 New Features

- Color candles based on Orderflow. This feature has never been released fully and now it's ready for your eyes. Very very useful to gauge the current state of order flow. Video on this soon.

Bugfixes

- Stability improvements. Out of bounds errors for many categories of situations should be gone now and the default lookback has been bumped to 5,000 candles (was 800). You can still chose a manual start time in the settings if you want to see internal structure or start fresh from a specific date/time.

-Fixes and improvements to Alerts. Because alerts are only triggered on a live chart I did not have the chance to do heavy testing but I applied several fixes and the results are promising. Check if the alerts trigger for you now.

Defaults Rework

The indicator will show by default immediately SNDRs. Additionally:

- Change default color of zones to 7% Green/Red

- Turn on SNDR with pivot 3 and prune by default

- Change default Origin colors to match SNDR colors.

- Change text from +/-Org to +/- origin

- Hide origin 50% lines (turn it back on in settings)

릴리즈 노트

Changelog: 21 August 2025This indicator is now in "LEGACY" mode. It has been superseded by a 100% rewritten engine and features.

You can find the improved and maintained version in my published scripts with name "Market Structure [PRO] - 100% rewritten engine".

This legacy indicator will still be available for people that feel attached to it.

Right now the major feature missing in the new indicator is support for "Origins" but that will come soon.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 keypoems에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Indicator is still available via web shop at: https://whop.com/keypoems/?a=keypoems but it has been superseded but much improved version (which is also in the same bundle)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

초대 전용 스크립트

이 스크립트는 작성자가 승인한 사용자만 접근할 수 있습니다. 사용하려면 요청 후 승인을 받아야 하며, 일반적으로 결제 후에 허가가 부여됩니다. 자세한 내용은 아래 작성자의 안내를 따르거나 keypoems에게 직접 문의하세요.

트레이딩뷰는 스크립트의 작동 방식을 충분히 이해하고 작성자를 완전히 신뢰하지 않는 이상, 해당 스크립트에 비용을 지불하거나 사용하는 것을 권장하지 않습니다. 커뮤니티 스크립트에서 무료 오픈소스 대안을 찾아보실 수도 있습니다.

작성자 지시 사항

Indicator is still available via web shop at: https://whop.com/keypoems/?a=keypoems but it has been superseded but much improved version (which is also in the same bundle)

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.