OPEN-SOURCE SCRIPT

Understanding order sizes

type: properties manipulation, no programming needed

time required: 15minutes, at least

level: medium (need to know contracts, trading pairs)

A strategy can "appear" to work or be broken depending on the pile of cash that is working on. This amount is defined in the strat properties, under "order size".

For noobs (like me) this is very confusing at first :)

A strat opens/closes positions using units, a generic measure for the chart being operated on. Thes "units" can be a fixed amount of cash, a fixed amount of contracts, or a floating amount based on the last profits made. I recommend checking my previous strat to figure the case of contracts .

So, any trading price is the amount of "things" you get for some "cash". The things are the first unit, the "cash" is the second. Some examples:

XAU/USD - 1 xau oz is worth x dollars

BTC/USD - 1 bitcoin is worth x dollars

GBP/EUR - 1 pound is worth x euros

To add to confusion, a lot of markets the "unit size" is different from what the strat thinks it is. An options contract is 100 shares(the unit), 1 xau contract is 10 oz(units), 1 eur/usd contract is 100k euros and so on... so, after figuring out how the sizes work in a strat, then the sizes must be adapted for the specific market in question.

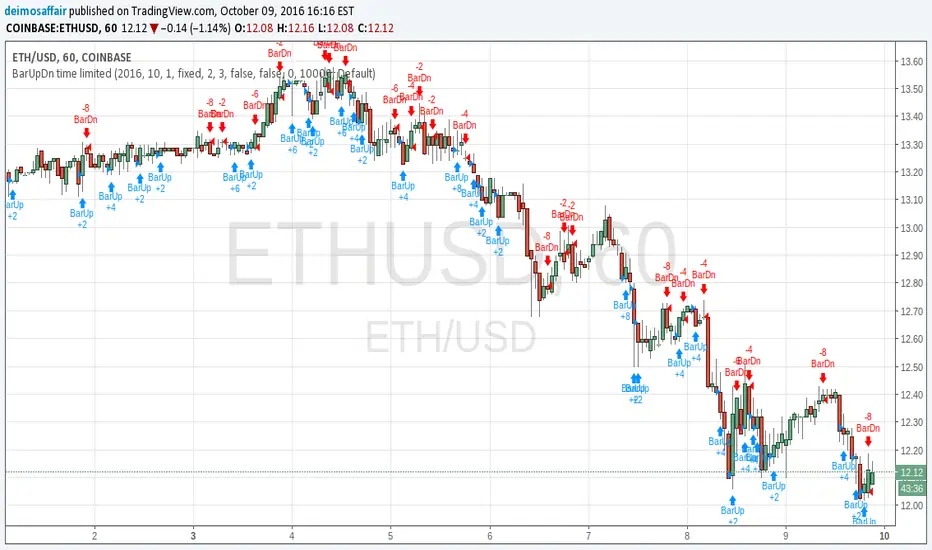

The choice os using the ETHUSD pair is because:

1 - you can buy 1eth, unlike a gold contract for example, so 1 "unit" = 1 eth, easier to get

2 - ETH is around 12 bucks, wich gives round numbers on the math, easier to wrap the brains around :)

3- is an unusual pair, so the regular contract sizes don't apply, and the brain is not conditioned to work inside the box ;)

You will have to access the script properties, to change the values. As these values are changed you will see exactly the differences in the values of the strat.

Text is too long, check the comments for all the cases

time required: 15minutes, at least

level: medium (need to know contracts, trading pairs)

A strategy can "appear" to work or be broken depending on the pile of cash that is working on. This amount is defined in the strat properties, under "order size".

For noobs (like me) this is very confusing at first :)

A strat opens/closes positions using units, a generic measure for the chart being operated on. Thes "units" can be a fixed amount of cash, a fixed amount of contracts, or a floating amount based on the last profits made. I recommend checking my previous strat to figure the case of contracts .

So, any trading price is the amount of "things" you get for some "cash". The things are the first unit, the "cash" is the second. Some examples:

XAU/USD - 1 xau oz is worth x dollars

BTC/USD - 1 bitcoin is worth x dollars

GBP/EUR - 1 pound is worth x euros

To add to confusion, a lot of markets the "unit size" is different from what the strat thinks it is. An options contract is 100 shares(the unit), 1 xau contract is 10 oz(units), 1 eur/usd contract is 100k euros and so on... so, after figuring out how the sizes work in a strat, then the sizes must be adapted for the specific market in question.

The choice os using the ETHUSD pair is because:

1 - you can buy 1eth, unlike a gold contract for example, so 1 "unit" = 1 eth, easier to get

2 - ETH is around 12 bucks, wich gives round numbers on the math, easier to wrap the brains around :)

3- is an unusual pair, so the regular contract sizes don't apply, and the brain is not conditioned to work inside the box ;)

You will have to access the script properties, to change the values. As these values are changed you will see exactly the differences in the values of the strat.

Text is too long, check the comments for all the cases

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.