OPEN-SOURCE SCRIPT

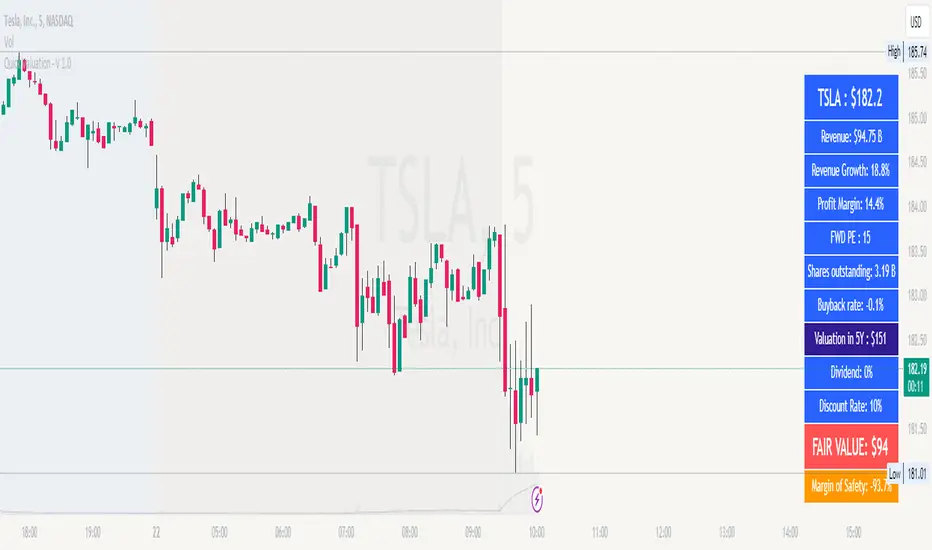

업데이트됨 Fair Value Calculator V 1.0

Fair Value Calculator V 1.0

This indicator calculates the fair value of a stock based on the revenue growth rate and net profit margin of a company, providing a quick estimate of its intrinsic worth. The calculation takes into account:

Using these inputs, the indicator estimates the fair value of the stock, providing a valuable tool for investors and traders to make informed decisions.

Note: all values can be adjusted by the user by entering the desired value and selecting the item in the setup menu.

How it works

Benefits

Note

This indicator is for informational purposes only and should not be considered as investment advice. Always do your own research and consider multiple perspectives before making investment decisions.

This indicator calculates the fair value of a stock based on the revenue growth rate and net profit margin of a company, providing a quick estimate of its intrinsic worth. The calculation takes into account:

- Current Revenue: The company's current revenue

- 5-Year Growth Rate: Expected revenue annual growth rate (CAGR) over the next 5 years

- Average PE Ratio: The average Price-to-Earnings ratio for the next 5 years

- Average Profit Margin: The average profit margin for the next 5 years

- Share Outstanding: The total number of shares outstanding

- Yearly Share Buyback Rate: The percentage of shares bought back by the company each year

- Discount Rate: The rate used to calculate the present value of the fair value

Using these inputs, the indicator estimates the fair value of the stock, providing a valuable tool for investors and traders to make informed decisions.

Note: all values can be adjusted by the user by entering the desired value and selecting the item in the setup menu.

How it works

- The indicator calculates the future revenue based on the current revenue and the expected revenue annual growth rate (CAGR).

- It then estimates the future earnings using the average profit margin.

- The future price is calculated using the exit value of the PE ratio.

- The present value of the fair value is calculated using the discount rate.

- The indicator adjusts the fair value based on the yearly share buyback rate.

Benefits

- Provides a quick but valuable estimate of a stock's fair value based on the revenue growth and the expected profit.

- Helps investors and traders identify undervalued or overvalued stocks.

- Allows users to adjust inputs to suit their own assumptions and scenarios.

Note

This indicator is for informational purposes only and should not be considered as investment advice. Always do your own research and consider multiple perspectives before making investment decisions.

릴리즈 노트

- Corrected the negative valuation issue.오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.