OPEN-SOURCE SCRIPT

업데이트됨 [blackcat] L3 Candle Skew 3821 Trader

Level 3

Background

By modeling skew to produce long and short entry points.

Function

The concept of skew comes from physics and statistics, and is used in market technical analysis to reflect the expectation of future stock price distribution. Because the return distribution of stocks in the trend market has skew (Skew), it is reasonable to judge the trend continuity according to the historical and current skew. It is precisely because the stock price rises that there is a skew. The greater the strength of the rise, the greater the angle of inclination and the greater the skew. The degree of this upward or downward slope in the statistical distribution of stock prices is defined as skew. Through the size of skew, we can know the direction, inertia and extent of the stock's rise or fall, and find stocks with a high probability of quick profit. The technical indicator introduced today is a simplified but effective stock price skew model used to generate buying and selling points.

The principle of this technical indicator is based on the success rate test results of different moving averages corresponding to different skews as follows:

10 trading cycles profit 5% success rate (%)

5 period moving average 10 period moving average 20 period moving average 30 period moving average 60 period moving average

skew>=0 51.36 52.26 52.65 52.55 52.08

skew>=0.5 55.44 58.06 60.56 62.37 65.66

skew>=1 59.72 63.06 67.07 69.78 70.62

skew>=1.5 63.01 67.08 71.61 72.9 70.61

skew>=2 65.53 70.22 74.18 73.76 70.12

skew>=2.5 67.89 72.93 75.32 73.66 68.92

skew>=3 70.07 75.32 75.69 72.54 67.45

skew>=3.5 71.85 77.05 75.32 73.63 63.82

skew>=4 73.6 78.06 74.19 68.96 59.91

skew>=4.5 76.04 78.56 72.85 69.55 49.24

skew>=5 77.44 78.88 71.58 67.28 51.69

skew>=5.5 78.97 78.39 70.33 64.31 49.7

skew>=6 79.68 78.07 68.82 61.65 53.57

Table 1

As can be seen from the above table, with the increase of the 5-period and 10-period moving average skew values, the success rate is increasing, but after the 20- and 30-period moving average skew values increase to an upper bound, it shows a downward trend. When the skew of the 20-period and 30-period moving averages is greater than 0.5, the 10-period profit of 5% is above 60%, and when it is greater than 1.5, the success rate can reach above 70%. The larger the 5-period moving average skew, the higher the success rate, but often because the short-term skew is too large, the stock price has risen rapidly to a high level, and chasing up is risky, which is not suitable for the investment habits of most people, so prudent investors may like to do swings. Investors may wish to pay more attention to the skew of the 20-period and 30-period moving averages. Based on the above analysis, as a short-term trading enthusiast, I need to choose the 5-period and 10-period moving average skew, and consider the medium-term trend as a compromise, and I also need to consider the 20-period moving average skew. Finally, according to the principle of personal preference, I chose 3 groups of periods based on Fibonacci magic numbers: 3 periods, 8 periods, 21 periods, and skews that take into account both short-term and mid-line trends. So, I named this indicator number 3821 as a distinction.

002084 1D from TradingView

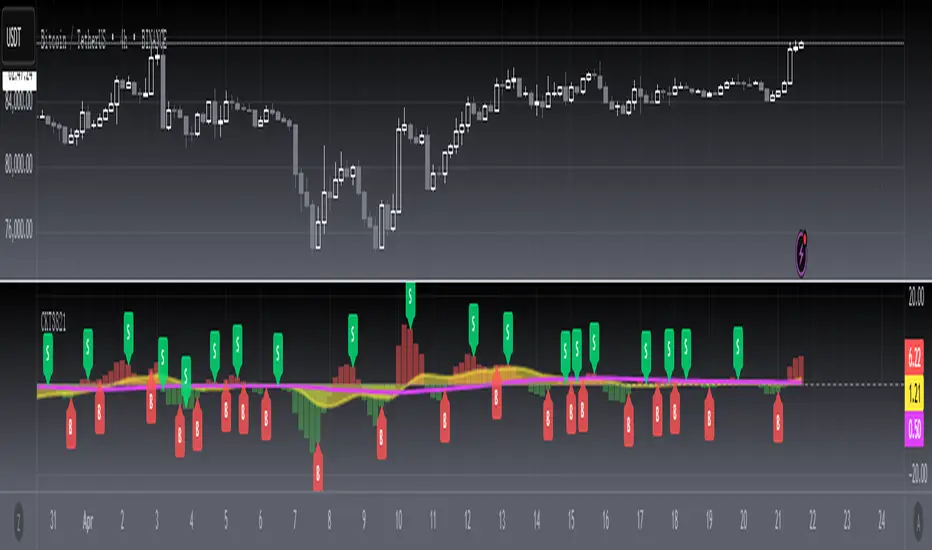

BTCUSDT 1H from TradingView

Tesla 1D from TradingView

Background

By modeling skew to produce long and short entry points.

Function

The concept of skew comes from physics and statistics, and is used in market technical analysis to reflect the expectation of future stock price distribution. Because the return distribution of stocks in the trend market has skew (Skew), it is reasonable to judge the trend continuity according to the historical and current skew. It is precisely because the stock price rises that there is a skew. The greater the strength of the rise, the greater the angle of inclination and the greater the skew. The degree of this upward or downward slope in the statistical distribution of stock prices is defined as skew. Through the size of skew, we can know the direction, inertia and extent of the stock's rise or fall, and find stocks with a high probability of quick profit. The technical indicator introduced today is a simplified but effective stock price skew model used to generate buying and selling points.

The principle of this technical indicator is based on the success rate test results of different moving averages corresponding to different skews as follows:

10 trading cycles profit 5% success rate (%)

5 period moving average 10 period moving average 20 period moving average 30 period moving average 60 period moving average

skew>=0 51.36 52.26 52.65 52.55 52.08

skew>=0.5 55.44 58.06 60.56 62.37 65.66

skew>=1 59.72 63.06 67.07 69.78 70.62

skew>=1.5 63.01 67.08 71.61 72.9 70.61

skew>=2 65.53 70.22 74.18 73.76 70.12

skew>=2.5 67.89 72.93 75.32 73.66 68.92

skew>=3 70.07 75.32 75.69 72.54 67.45

skew>=3.5 71.85 77.05 75.32 73.63 63.82

skew>=4 73.6 78.06 74.19 68.96 59.91

skew>=4.5 76.04 78.56 72.85 69.55 49.24

skew>=5 77.44 78.88 71.58 67.28 51.69

skew>=5.5 78.97 78.39 70.33 64.31 49.7

skew>=6 79.68 78.07 68.82 61.65 53.57

Table 1

As can be seen from the above table, with the increase of the 5-period and 10-period moving average skew values, the success rate is increasing, but after the 20- and 30-period moving average skew values increase to an upper bound, it shows a downward trend. When the skew of the 20-period and 30-period moving averages is greater than 0.5, the 10-period profit of 5% is above 60%, and when it is greater than 1.5, the success rate can reach above 70%. The larger the 5-period moving average skew, the higher the success rate, but often because the short-term skew is too large, the stock price has risen rapidly to a high level, and chasing up is risky, which is not suitable for the investment habits of most people, so prudent investors may like to do swings. Investors may wish to pay more attention to the skew of the 20-period and 30-period moving averages. Based on the above analysis, as a short-term trading enthusiast, I need to choose the 5-period and 10-period moving average skew, and consider the medium-term trend as a compromise, and I also need to consider the 20-period moving average skew. Finally, according to the principle of personal preference, I chose 3 groups of periods based on Fibonacci magic numbers: 3 periods, 8 periods, 21 periods, and skews that take into account both short-term and mid-line trends. So, I named this indicator number 3821 as a distinction.

002084 1D from TradingView

BTCUSDT 1H from TradingView

Tesla 1D from TradingView

릴리즈 노트

OVERVIEWThis Pine Script is designed to implement the "[blackcat] L3 Candle Skew 3821 Trader" strategy on TradingView. It uses multiple exponential moving averages and their slopes to generate buy/sell signals displayed as labels on the chart.

FEATURES

* Calculates three EMAs: short-term (3 periods), medium-term (8 periods), and long-term (21 periods).

* Determines the rate of change (slope) for each EMA using lagged values.

* Plots the slopes on separate panels:

+ Short-term slope as red/green columns

+ Medium-term slope as yellow area plot

+ Long-term slope as magenta line

* Generates buy/sell signals based on crossover conditions between different timeframes.

* Displays "B" (buy) and "S" (sell) labels at signal points.

* Provides alert conditions for both long and short signals.

HOW TO USE

1. Add this script to your TradingView chart.

2. Observe the colored plots representing slope changes across different timeframes.

3. Look for "B" and "S" labels indicating potential entry/exit points.

4. Set up alerts for automatic notifications when new signals are generated.

LIMITATIONS

* The script may produce false signals during choppy market conditions.

* Optimal parameters might vary depending on the asset being traded.

* Backtesting results should be verified before relying solely on the indicators.

NOTES

* The custom functions `xrf` and `bton` are used internally for value retrieval and binary conversion respectively.

* The indicator can handle up to 5000 bars back due to the specified `max_bars_back`.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

오픈 소스 스크립트

트레이딩뷰의 진정한 정신에 따라, 이 스크립트의 작성자는 이를 오픈소스로 공개하여 트레이더들이 기능을 검토하고 검증할 수 있도록 했습니다. 작성자에게 찬사를 보냅니다! 이 코드는 무료로 사용할 수 있지만, 코드를 재게시하는 경우 하우스 룰이 적용된다는 점을 기억하세요.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.