PROTECTED SOURCE SCRIPT

TONYLASUERTE

Indicator Description

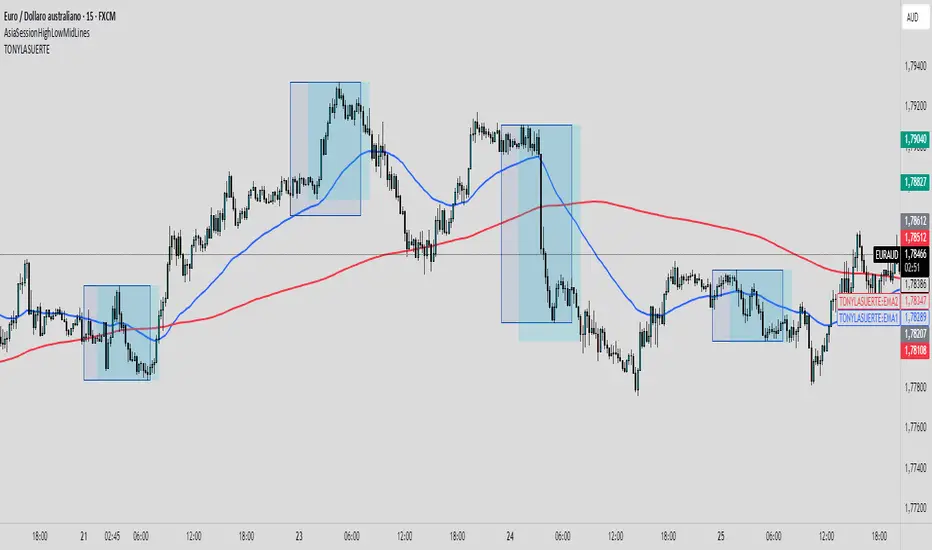

This indicator is designed to provide a clear market reading by combining trend analysis, low-activity zones, and potential reaction signals:

- Moving Averages (50 and 200 periods): the 50-period (blue) and 200-period (red) moving averages help define the overall market trend while also acting as dynamic support and resistance levels. Their alignment or crossover serves as a key signal for assessing market strength.

- Asian Session Highlighting: the indicator marks rectangles over the Asian session ranges, a phase typically characterized by low volatility and tight ranges. This helps avoid trading in low-interest conditions and focus on more liquid phases.

- Post-Asia Reactions: the imbalance occurring after the Asian session is highlighted, making it easier to spot potential breakout points and the start of directional moves.

- Divergent Candles (visual signals): divergence candles are highlighted with different colors. When combined with the moving averages and the post-Asia imbalance, they can anticipate possible reversals or confirm trend continuation.

📌 Indicator Objective: filter out low-quality trading phases, highlight key reaction zones, and improve entry timing by leveraging the interaction between trend (moving averages), divergences, and post-Asian session dynamics.

This indicator is designed to provide a clear market reading by combining trend analysis, low-activity zones, and potential reaction signals:

- Moving Averages (50 and 200 periods): the 50-period (blue) and 200-period (red) moving averages help define the overall market trend while also acting as dynamic support and resistance levels. Their alignment or crossover serves as a key signal for assessing market strength.

- Asian Session Highlighting: the indicator marks rectangles over the Asian session ranges, a phase typically characterized by low volatility and tight ranges. This helps avoid trading in low-interest conditions and focus on more liquid phases.

- Post-Asia Reactions: the imbalance occurring after the Asian session is highlighted, making it easier to spot potential breakout points and the start of directional moves.

- Divergent Candles (visual signals): divergence candles are highlighted with different colors. When combined with the moving averages and the post-Asia imbalance, they can anticipate possible reversals or confirm trend continuation.

📌 Indicator Objective: filter out low-quality trading phases, highlight key reaction zones, and improve entry timing by leveraging the interaction between trend (moving averages), divergences, and post-Asian session dynamics.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.